After major U.S. stock indexes closed over 1% higher on Tuesday, U.S. stocks had strong performance in January. The S&P 500 tallied its first January increase since 2019, gaining 6.18%, while the tech-heavy Nasdaq jumped 10.68% for the month - its biggest January percentage rise since 2001.

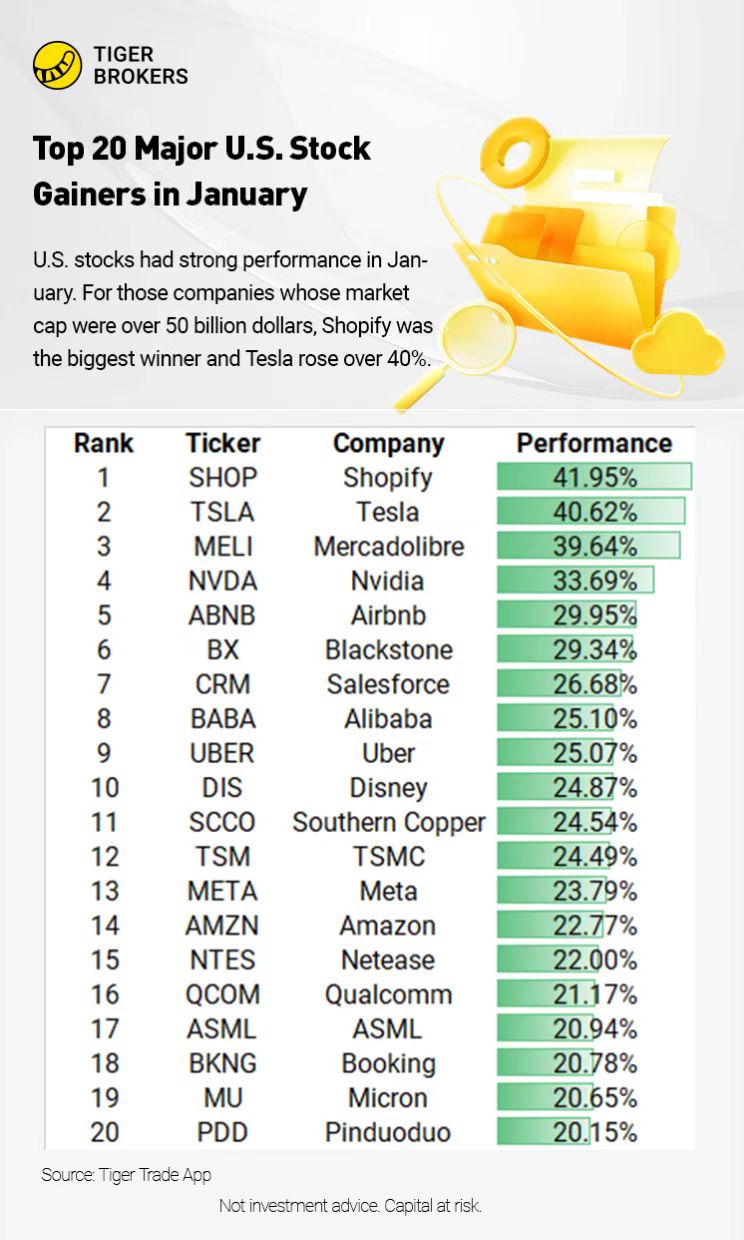

For those companies whose market cap were over 50 billion dollars, Shopify was the biggest winner and Tesla rose over 40%. Meanwhile, Alibaba led the Chinese ADRs like Netease and Pinduoduo flying higher.

Shopify Surged 41.95% for Its New Pricing Plan

Shopify’s Basic plan will cost $39 a month, up from $29; its Shopify plan will rise to $105 from $79; and its Advanced plan will jump to $399 from $299. Merchants who already use Shopify won’t be affected for three months.

Oppenheimer analysts, led by Ken Wong, believe the changes will spark growth in fiscal 2023. He said investors will have to take account of the likelihood that some companies will stop using Shopify, but he noted that competitors including WIX.com (WIX) and Squarespace (SQSP) have increased their prices with “minimal impact on retention.” And with competitors charging more, users are less likely to move their business elsewhere, he said. He has an Outperform rating on the stock with a target of $45 for the price.

Another thing to mention is that Baillie Gifford increased its holdings by 12.3% to 72.45 million.

Tesla Soared 40.62% After Posting Its Financial Results

Tesla beat Wall Street targets for Q4 revenue and profit despite a sharp decline in vehicle profit margins, and it sought to reassure investors that it can cut costs and continue to generate cash as competition intensifies in the year ahead.

It forecasted a 37% rise in car volume for the year, to 1.8 million vehicles, slowing the pace of growth from last year even as it made aggressive price cuts.

The 37 analysts offering 12-month price forecasts for Tesla Inc have a median target of 195.00, with a high estimate of 338.00 and a low estimate of 24.33. The median estimate represents a 12.91% increase from the last price of 172.71.

Alibaba Jumped 25.1% for Ant Group’s News and the Economic Recovery

The China Banking and Insurance Regulatory Commission said it approved Ant Group’s request to increase the amount of registered capital for the company’s consumer unit, to 18.5 billion yuan from 8 billion yuan.

Morgan Stanley analyst Gary Yu said investors have underappreciated Alibaba's leverage to a consumption recovery in China" due to its retail strength in areas like consumer products. Yu also said that he expects Alibaba's cloud business revenue to begin growing again in the first quarter of 2024 due mostly to non-Internet industries. Also,any potentially positive regulatory event regarding Ant such as restructuring, licensing or a resumption of Ant's potential IPO could be a significant positive catalyst for Alibaba. Yu currently holds an outperform rating and a $150-a-share price target on it.