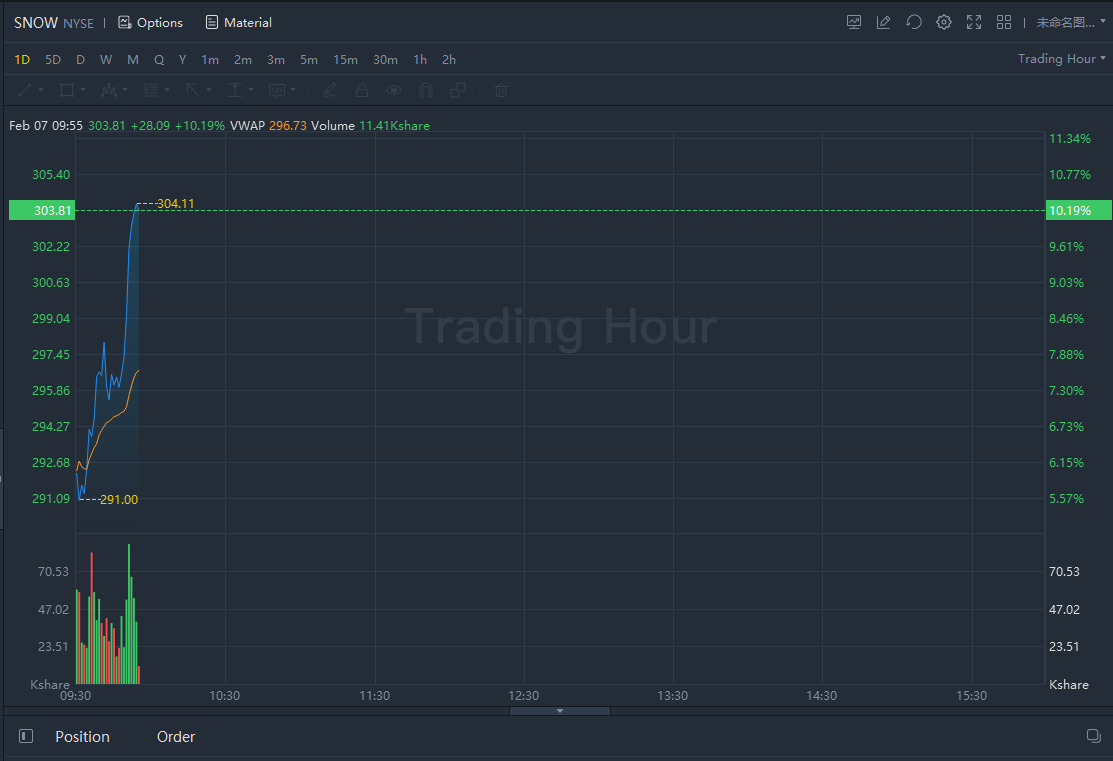

Snowflake stock soared over 10% on upgrade to overweight at Morgan Stanley.

Analyst Keith Weiss, who raised his rate to overweight and has a $390 price target, noted that the company is executing "ahead of plan" and the recent 8% decline over the past month provides investors with an opportunity.

"Leveraging the elasticity, scalability and performance of the public cloud, Snowflake’s cloud data platform enables its customers to eliminate data silos, while reducing overhead, complexity and infrastructure management costs, thereby allowing them to focus on driving and sharing insights from their data," Weiss wrote in a note to clients.

In addition, Weiss added that Snowflake's value for its customers is resonating better than it did when the company went public 16 months ago, citing better fundamentals, better traction to expand its total addressable market and better acceptance as a "broad data platform."

"Given a 172% net-dollar expansion rate, our current base case CY22 revenue growth forecast of 77% YoY appears conservative – our bull case suggesting 91% growth appears increasingly probable and suggests 18.5% upside from consensus estimates," Weiss added. "Further, growth from expansion of existing customers (as measured in the DBNER) should carry robust incremental margins and drive a faster ramp in [free cash flow]."

Last month, Snowflake was upgraded at Loup Capital, with the investment firm citing the significant pullback that the stock experienced since mid-November.