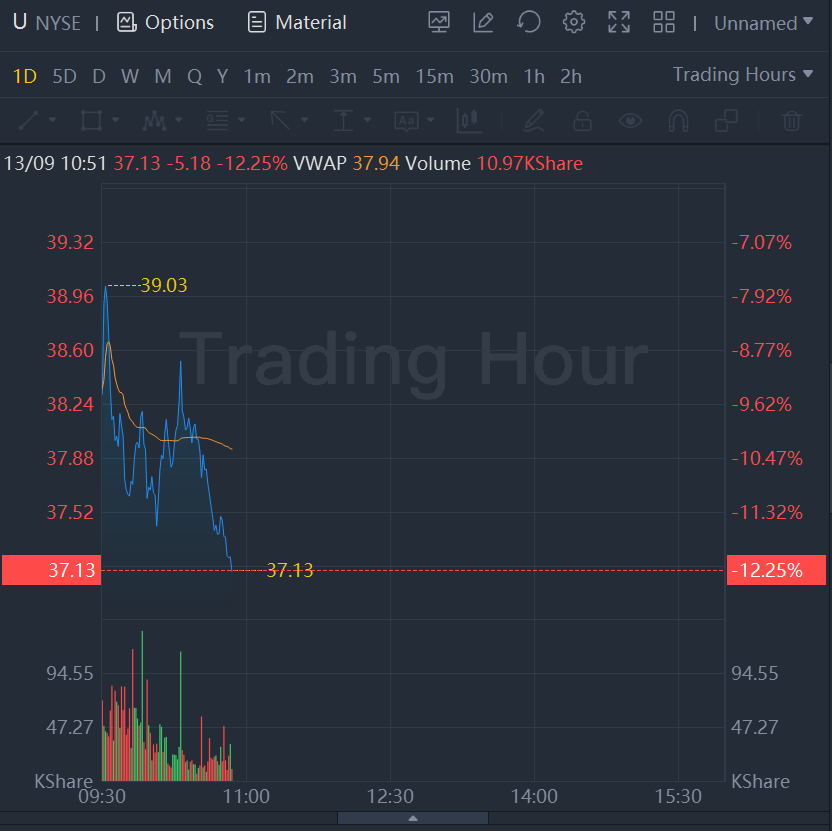

Sept 13 (Reuters) - Shares of Unity Software Inc(U.N)fell 12% on Tuesday after AppLovin Corp(APP.O)withdrew its buyout offer for the gaming software maker, cementing Unity's planned purchase of ironSource Ltd

AppLovin, whose services compete with ironSource in helping developers grow and monetize their apps, said late on Monday it would not table a higher bid and had pulled its initial offer.

Shares of AppLovin and ironSource were down 5% and 4%, respectively, amid broader market weakness after surprisingly strong inflation data.

An acquisition would have helped AppLovin build machine-learning capabilities using Unity's platform that has been used for games such as "Pokemon Go". AppLovin now plans to focus on fast-growing categories such as connected TV and offerings for manufacturers.

Analysts, however, expect AppLovin to face strong competition from Unity and ironSouce's merger deal alongside a weakening mobile ad market.

"Without AppLovin's further involvement, Unity's merger with ironSource is likely to close, creating a stronger competitor to AppLovin soon," said Oppenheimer analyst Martin Yang.