Despite having outperformed the S&P 500 so far in 2022, Apple share price continues to zigzag. Could this be yet another opportunity to buy the dip?

The rally has stalled out for now. After climbing an encouraging 18% in the last several days of Q1, Apple stock has dropped around 5% from the recent peak of March 29.

Is this an opportunity to buy a small dip or a sign that AAPL may have lost momentum? Today, the Apple Maven tries to answer this question.

AAPL: the 2022 zigzag

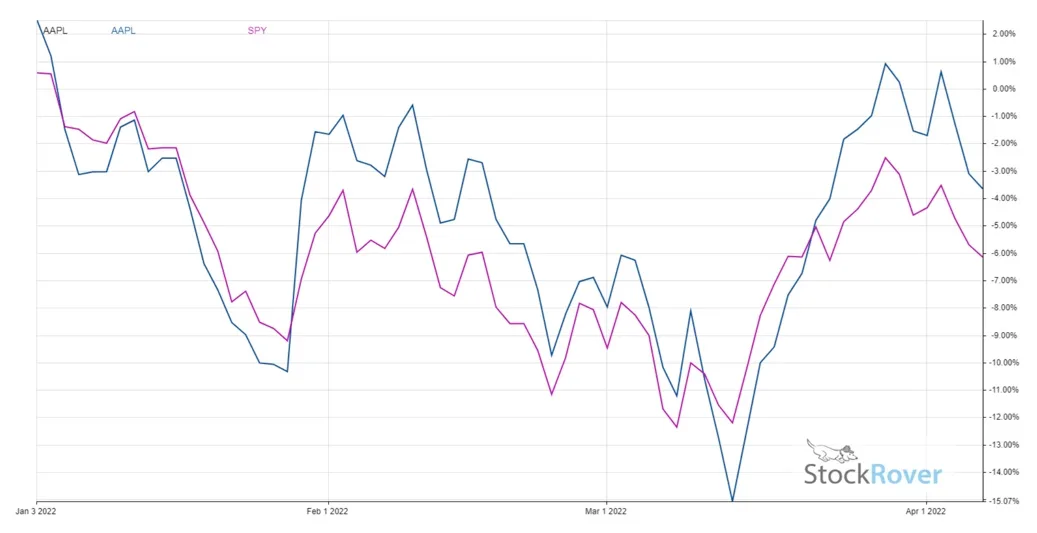

The equities market has been soft so far this year, as the tech-rich Nasdaq remains in correction territory. Apple stock, on the other hand, has declined a much tamer 5% YTD.

But make no mistake: Apple’s path to outperformance in 2022 has not been without ups and downs. The chart below shows that the stock dipped as much as 15% by mid-March (blue line), trailing the returns of the S&P 500 at times. However, AAPL has consistently recovered more strongly.

After flirting with the $3 trillion market cap once again, Apple share price declined from nearly $180 to an intraday low of $170 in a matter of few days.

Buy the dip?

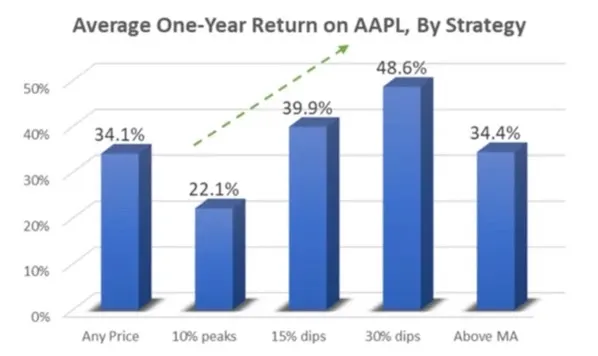

Historically, Apple stock has been a better buy after pullbacks. Therefore, the recent decline in share price could be seen as an opportunity for new investors to own shares at early December 2021 prices.

But there are a couple of caveats to the buy-on-weakness approach. First, the strategy does not always work in the short term. In fact, Apple stock often trends over a period of days or weeks, suggesting that the recent decline could extend further.

Second, the most recent 5% pullback puts AAPL stock at a drawdown of only 6% from the all-time high of only about three months ago. The chart below shows that corrections of at least 15% are the ones that tend to produce the best one-year gains for dip-buyers.

Think longer term

Therefore, I do not think that short-term traders or buy-the-dip fans should get too excited about the recent softness in AAPL price. This is more likely to be market noise than a rare opportunity to own Apple on the cheap.

Instead, I believe that those who are considering buying Apple stock at current levels should be willing to think longer term. Fundamentally, is AAPL a good name to buy and tuck away inside a diversified stock portfolio over the next several years?

From that perspective, I find it hard not to like Apple stock, even at current prices that are not too far from the historical peak.

I could present my own business-specific arguments for owning AAPL, but I will quote Wall Street experts instead. According toTipRanks, not a single analyst believes that Apple stock is a sell. About four out of five think that AAPL is a buy, while one in five maintains a hold rating.

The most bullish of analysts sees AAPL climbing to $215 for upside potential of around 25% in the foreseeable future. Wamsi Mohan, from Bank of America, has cited decreased trade-in prices to support his thesis of strong demand for the iPhone in 2022.

Mr. Mohan also does not seem too concerned about supply chain issues. Despite plant shutdowns in Asia, the analyst points out that Apple has sourcing flexibility.

Strength in the iPhone business is only part of the bullish thesis — albeit a very important one. Morgan Stanley’s Katy Huberty, for example,saysthat hardware subscriptions across Apple’s different devices can be highly supportive of user spending, and potentially a source of upside to consensus expectations.