- U.S. stock futures traded mostly lower in early pre-market trade.

- 10-year Treasury yield surges to 14-month high of 1.74%, 30-year rate tops 2.5%.

- Dollar General, Signet Jewelers, Petco & more making the biggest moves in the premarket trading.

(March 18) Inflation concerns are rattling investors once again, fueling a selloff in U.S. bonds and sending Nasdaq futures sharply lower in early trading.

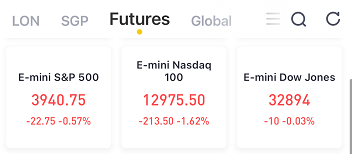

At 7:50 a.m. ET, Futures for the Dow Jones Industrial Average fell 10 points to 32,894.00, while the Standard & Poor’s 500 index futures skidded 22.75 points at 3,940.75. Futures for the Nasdaq 100 index skidded 213.50 points to 12,975.50.

The 10-year U.S. Treasury yield jumped above 1.7% on Thursday despite reassurance from the Federal Reserve that it had no plans to hike interest rates anytime soon, nor taper its bond-buying program.

The yield on the benchmark10-year Treasury notewas up 9 basis points to 1.737% by 7:10 a.m. ET. The yield on the30-year Treasury bondclimbed 5 basis points to 2.502%. Yields move inversely to prices. (1 basis point equals 0.01%).

The 10-year broke above 1.4% earlier in the session, marking its highest level since Jan. 24, 2020, when it topped out at 1.762%. This is also the first time the 30-year has traded above 2.5% since August 2019.

Stocks making the biggest moves in the premarket:

1) Dollar General(DG) – Dollar General shares tumbled 6.1% in premarket action after the discount retailer missed estimates by 10 cents a share, with quarterly earnings of $2.62 per share. The company exceeded revenue estimates as comparable-store sales increased more than expected.

2) Signet Jewelers(SIG) – The jewelry retailer’s stock jumped 5.7% in premarket trading following an upbeat quarterly report. Signet earned $4.15 per share, compared to a consensus estimate of $3.54 a share. Revenue came in above estimates as well amid strong comparable-store sales.

3) Petco(WOOF) – In its first report since going public in January, the pet supplies retailer reported quarterly profit of 17 cents per share, 6 cents a share above estimates. Revenue also came in above Wall Street forecasts, with comparable-store sales up 17%. Shares gained 3.2% in the premarket.

4) Accenture(ACN) – The consulting firm reported quarterly profit of $2.23 per share, beating the consensus estimate of $1.90 a share. Revenue topped forecasts as well. Accenture also raised its earnings forecast, as more companies utilize its services to move to cloud-based operations. Accenture added 2.2% in premarket trading.

5) Apple(AAPL) – Apple is planning to launch a new line of iPads as early as next month, according to a Bloomberg report. iPad sales have been boosted over the past year, as more people worked and attended school remotely due to the pandemic. Apple fell 1% in premarket action.

6) Five Below(FIVE) – The discount retailer beat estimates by 9 cents a share, with quarterly profit of $2.20 per share. Revenue was above Wall Street forecasts as well, boosted by a 14% jump in comparable-store sales. Shares rallied 5.7% in premarket trading.

7) Coherent(COHR) – The bidding battle for the laser products maker continues, with a new offer from optical components makerII-VI(IIVI) worth about $7 billion in cash and stock. Coherent originally agreed to be acquired by telecom equipment makerLumentum(LITE) in January, but then became the target of a three-way contest between II-VI, Lumentum andMKS Instruments(MKSI) that has now resulted in a total of 9 bids. Coherent added 3.4% in the premarket, while II-VI fell 1.6%.

8) Williams-Sonoma(WSM) – Williams-Sonoma reported quarterly earnings of $3.95 per share compared to a consensus estimate of $3.39 a share. The housewares retailer’s revenue beat estimates as well, helped by people spending more time at home amid the pandemic. The company also announced an 11% dividend hike and authorized a $1 billion share repurchase program. Williams-Sonoma surged 11.1% in premarket action.

9) PagerDuty(PD) – PagerDuty lost 7 cents per share for its latest quarter, less than the 11 cents a share that Wall Street analysts were anticipating. The operations software company’s revenue beat forecasts, but is expecting a wider full-year loss than analysts have been forecasting. Shares fell 4.4% in the premarket.

10) Nikola(NKLA) – Nikola said South Korean stakeholder Hanwha plans to sell up to half its stake in the electric truck maker this year, reducing its 5.65% stake. Nikola added that the maker of optoelectronic components remains an “Important strategic partner.” Its shares lost 3.6% in premarket action.

11) Lordstown Motors(RIDE) – Shares fell 4.2% in premarket trading after Lordstown said it had received a Securities and Exchange Commission request for information regarding accusations made in a report by short-seller Hindenburg Research. The report accused the electric vehicle maker of misleading consumers and investors, but Lordstown has said the report was full of “lies and half-truths.”

12) Sundial Growers(SNDL) – Shares of the Canada-based cannabis producer rose 8.4% in premarket trading after it reported better-than-expected revenue for its latest quarter. The company also said it successfully restructured the company during 2020, positioning it for future success. The stock surged 7.8% in the premarket.

13) National Grid(NGG) – National Grid is buying the United Kingdom distribution grid unit of Pennsylvania-basedPPL Corp.(PPL) for $10.9 billion. At the same time, the multinational power company is selling Rhode Island-based Narragansett Electric Company to PPL for $3.8 billion. PPL added 1.7% in premarket trading.

14) Peloton(PTON) – Peloton CEO John Foley told Bloomberg news that the fitness equipment maker has expanded its production capacity by 700% over the past year, and that its supply of exercise bicycles is now close to meeting demand. Peloton fell 1.7% in the premarket.

These are some key events this week:

Bank of England rate decision Thursday. BOE is expected to leave monetary policy unchanged.Bank of Japan monetary policy decision and Governor Haruhiko Kuroda briefing Friday.

These are the main moves in markets:

Currencies

The Bloomberg Dollar Spot Index rose 0.2%.The euro dipped 0.3% to $1.1939.The British pound dipped 0.1% to $1.3958.The onshore yuan was little changed at 6.503 per dollar.The Japanese yen weakened 0.2% to 109.04 per dollar.

Bonds

The yield on 10-year Treasuries jumped eight basis points to 1.72%.The yield on two-year Treasuries gained one basis point to 0.14%.Germany’s 10-year yield gained two basis points to -0.27%.Japan’s 10-year yield increased one basis point to 0.114%.Britain’s 10-year yield rose four basis points to 0.868%.

Commodities

West Texas Intermediate crude dipped 0.5% to $64.30 a barrel.Brent crude decreased 0.4% to $67.71 a barrel.Gold weakened 0.5% to $1,736.11 an ounce.