Stocks edged higher on Wednesday as Wall Street struggled to extend its rally despite another strong batch of corporate earnings.

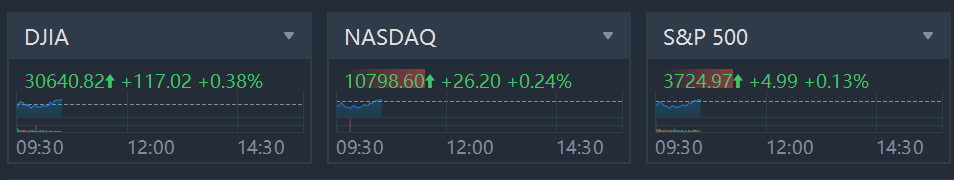

The Dow Jones Industrial Average added 117 points, or 0.38%. The S&P 500 and Nasdaq ticked up 0.1% and 0.2% respectively.

The tepid moves came even as Netflix shares rallied 15% after the streaming giantposted earnings and revenue that beat estimates as well as strong subscriber growth for the third quarter. United Airlines climbed more than 7% after it also beat estimates on the top and bottom lines.

The solid start to earnings season comes as many on Wall Street have been resetting their earnings projections lower and investors are worried about a recession. Even though equities have rallied in the first two days of the week, Treasury yields remain high and rose on Wednesday, suggesting that recession fears are still intact.

The 10-year Treasury yield jumped to 4.073% on Wednesday.

“On the plus side, corporate earnings season may help investor confidence somewhat, just given current oversold conditions and reduced expectations. That should help equities keep their footing, but until we see 2-year and 10-year yields start to decline we think traders and investors should remain wary of expecting too much from this rally,” said Nick Colas of DataTrek Research.

Among the biggest loses in the Nasdaq was Chinese tech stock JD.com, falling more than 4%. Abbott Labs was one of the worst performers in the S&P 500, falling over 7% despite beating third-quarter expectations.

Tech earnings will be in full swing next week, but IBM and Tesla are on deck to report Wednesday. Social media firm Snap will report later in the week.

In economic data, investors are looking forward to housing starts on Wednesday. The Federal Reserve’s so-called Beige Book, the central bank’s report on the current state of economic conditions, will come out as well.

Wednesday’s moves came after another strong day for stocks, with the Dow rallying about 337 points Tuesday and the S&P 500 gaining 1.1%.