Last Wednesday, Facebook Inc topped Wall Street estimates both for second-quarter earnings and revenue. However, shares went south as much as 5% in extended trading due to guidance of slowing revenue growth.

Figure-wise, adjusted earnings amounted to $3.61 per share, exceeding $3.03 per share expected by Refinitiv-gathered analysts. Revenue grew by 56% YoY to $29.08 billion, also exceeding $27.89 billion, accelerating from a 48% increase in the prior quarter. It is Facebook's fastest growth since 2016.

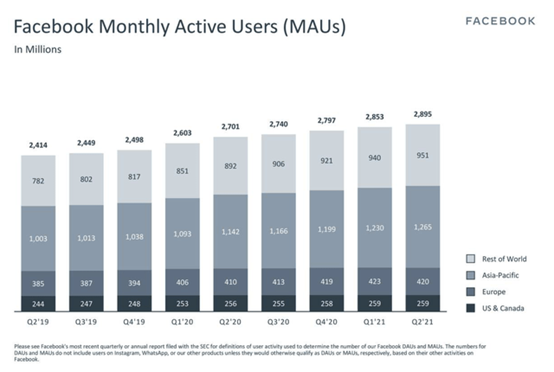

In the first financial period to really reflect a return to quasi-economic normalcy after a very online pandemic year, Facebook met user growth expectations. At the end of March, Facebook boasted 2.85 billion monthly active users across its network of apps. At the end of its second quarter, Facebook reported 2.9 billion monthly active users, roughly what was expected.

In spite of a strong quarter, Facebook is warning of change ahead — namely impacts to its massive ad business, which generated $28.5 billion out of the company’s $29 billion this quarter. The company specifically named privacy-focused updates to Apple’s mobile operating system as a threat to its business.

“We continue to expect increased ad targeting headwinds in 2021 from regulatory and platform changes, notably the recent iOS updates, which we expect to have a greater impact in the third quarter compared to the second quarter,” the company stated its investor report outlook.

Q2 user growth disappoints

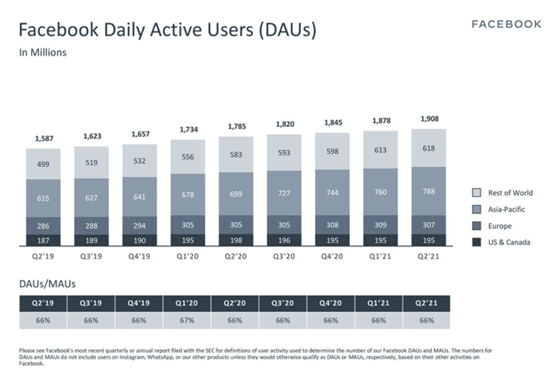

Let's start with the key highlights from Q2 that turned investor sentiment south. For the past several quarters, now, Facebook has been dealing with a slowdown in user growth in the post-pandemic era. That trend played out even more strongly in Q2. Take a look at the DAU and MAU charts below:

A summary of the above:

- DAUs at 1.908 billion, growing 1.6% sequentially and 6.9% y/y

- MAUs at 2.895 billion, growing 1.5% sequentially and 7.2% y/y

We note that the y/y growth rates in MAUs were significantly compressed from Q1's pace of 9.6% y/y MAU growth.

These trends are telling us something we already knew instinctively: Facebook benefited tremendously in 2020 due to the pandemic. DAUs, in particular, and average time spent on the app per user (not a metric that Facebook reports, but something that drives ARPU) jolted upward as users had little alternatives in the lockdown world to compete with digital entertainment and distraction.

But picking apart at the geo-levels trends highlights additional concerns. Facebook has simply stopped growing in the U.S. and Canada. Its DAU and MAU counts in its home region have frozen at 185 million and 259 million, respectively. A North America user generates ~5x the ARPU of the worldwide index of Facebook users - so this slowdown will in particular hurt future growth.

It's an even worse story in Europe, where DAU counts declined by 2 million sequentially and MAU counts declined by 3 million. Europe has been a little laxer in reopenings than the U.S., with many tourist hotspots reopening (especially for inter-EU travel), and we saw the effects of a more opened Europe summer season on Facebook's Q2 user counts in the region (potentially a harbinger of what will happen in the U.S. when it reopens more broadly). Seeing as Europe is Facebook's second-most lucrative region after North America, this is another concern.

In Q2, Facebook generated 56% y/y revenue growth to $29.08 billion, beating Wall Street's expectations of $27.89 billion (+49% y/y) by a respectable seven-point margin. Yet the majority of this revenue growth was driven by ARPU growth, and in particular ad pricing. As investors who were active in tech stocks last year will recall, internet giants reported particular softness in ad pricing last year (Q2 and Q3 especially) as consumer brands pulled back on their marketing spend to conserve cash. This year, as pent-up consumer demand is racing to buy everything from cars to Peloton ad spend is up furiously. Globally, Facebook's ARPU is up 43%5 y/y to $10.12; in the U.S., ARPU is up an even stronger 45% y/y to $53.01:

Yet this to be a temporary growth driver, as ad pricing can't continue expanding indefinitely. We note as well that declining amounts of time spent in the Facebook family of apps will also cause downward pressure on ARPU.

Over the long run, Facebook must continue growing its core U.S. user base or start getting its Asia-Pacific and Rest of World users to a higher ARPU. Yet given that, for example, Asia users' $4.16 ARPU is already less than a tenth of the U.S. and also growing slower at 39% y/y in Q2, this may take a long time to equalize (if it ever will at all).

Metaverse

Mark Zuckerberg spent much of the company's earnings call revealing his vision for the company's transformation from social media to a metaverse: a digital world that Facebook is investing billions of dollars to create.

The metaverse was first coined in the 1992 science fiction novel "Snow Crash" by Neal Stephenson. The term represents a meeting of the physical world with augmented and virtual reality.

Zuckerberg called the metaverse the “next generation of the internet and next chapter for us as a company,” one that he said will create “entirely new experiences and economic opportunities.”

He believes the metaverse will be the successor to the mobile internet, and creating this product group is the next step in Facebook's journey. He describes it as "an embodied internet where instead of just viewing content -- you are in it." Facebook has invested heavily in virtual reality, spending $2 billion on acquiring Oculus, which develops its VR products and continues spending billions each year in R&D.

Zuckerberg thinks that many focus on the gaming side of things for the metaverse and highlights the growing entertainment sector of the market. Ultimately, Zuckerberg sees the metaverse as a hybrid of existing social platforms we have today — with the difference being the environment.