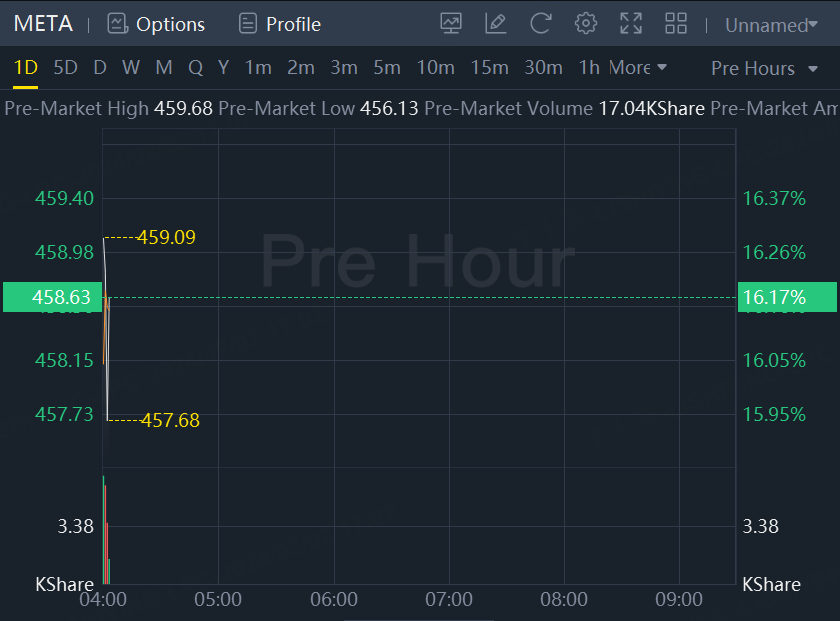

Meta will reward shareholders with its first-ever dividend and an additional $50bn in share buybacks as bumper fourth-quarter results sent its shares up by more than 16 per cent in premarket trading Friday.

The parent of Facebook and Instagram said the quarterly dividend of 50 cents per share was payable on March 26, in a sign of its continued recovery in growth after getting hit by an advertising slump in late 2022 and 2023. The jump in share price added more than $140bn in market capitalisation to Meta, whose value recently soared past $1tn.

The promised payout for investors came as chief executive Mark Zuckerberg outlined longer-term plans to increase investment in artificial intelligence, the metaverse and the costly infrastructure needed to support the technology.

“This was a pivotal year for our company,” said Susan Li, Meta’s chief financial officer, citing increased operating discipline and improved advertising performance.

“We will look to build on our priorities in each of those areas in 2024 while advancing our ambitious, longer-term efforts in AI” as well as Reality Labs, its augmented and virtual reality arm, Li said.

Zuckerberg had declared a “year of efficiency” in 2023, in which he slashed jobs and costs in order to rescue the company from a period of sluggish growth and respond to investor ire over his as-yet unprofitable bet on the metaverse.

However, on Thursday he signalled his intention to double down on plans to introduce generative AI to the platform — joining Microsoft and Google in telling investors to expect large costs to develop cutting-edge AI products. Meta is working on rolling out “AI assistants” for users, content creators and advertisers across the platform, and also wielding AI to improve advertising performance.

“We don’t expect our Gen AI products to be a meaningful 2024 driver of revenue,” Li said, but added that “the most near-term monetisation opportunity is with our ad creative tools”.

Meta on Thursday estimated full-year 2024 capital expenditures in the range of $30bn-$37bn, a $2bn increase on the high end of its prior range of guidance, citing investment in AI and non-AI servers, as well as data centres.

Zuckerberg was also at pains to emphasise that his ambition to build a digital avatar-filled metaverse, first announced in 2021, had not been dropped but rather morphed to include more AI. Where Meta had initially prioritised developing immersive virtual reality technology and holograms as part of its metaverse initiatives, Zuckerberg said that now “it seems quite possible that smart glasses that have AI assistants built in will be the killer app”.

The company said that it expected operating losses at Reality Labs to “increase meaningfully” year over year as it scales that part of the business. Full-year 2024 total expenses are expected in the range of $94bn to $99bn, it said, unchanged from the prior outlook.

Revenues at Meta rose 25 per cent in the fourth quarter to $40.1bn, it said, beating analyst expectations of a rise to $39.1bn. Net income jumped 201 per cent to $14bn, beating consensus estimates of $13bn compiled by S&P Capital IQ.

The increases came even after Meta warned in October that macroeconomic uncertainty and lower advertising demand in response to conflict in the Middle East had made for a rockier start to the quarter.

Meta expects first-quarter revenues between $34.5bn-$37bn, above analysts’ consensus of a rise to $33.9bn.

Meta’s strong first-quarter guidance “should take some of the AI pressure off Meta that we’ve seen with Google and Microsoft so far this week”, said Debra Aho Williamson, an independent tech analyst. But she added: “Eventually investors will need to know more about when Meta is going to start generating revenue from AI.”

Meta is still facing a challenging legal and political landscape. Earlier this week Zuckerberg was singled out and repeatedly berated by irate US senators at a judiciary committee hearing on the topic of protecting children from harmful content. He was accused of failing to adequately police his apps and lying about their risks. In one dramatic moment, he was pushed to turn and apologise to a crowd of families present who said their children had been harmed on his platforms.