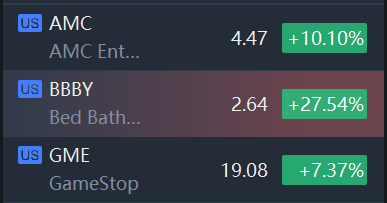

Other popular stocks among retail traders also rose on Wednesday, with GameStop(GME.N) and AMC Entertainment(AMC.N)up 7% and 10%, respectively.

Struggling U.S. home goods retailer Bed Bath & Beyond on Tuesday reported a muchwider-than-expected quarterly lossand said it would lay off more employees in an attempt to reduce costs, days after it said it wasexploring options including bankruptcy.

The potential bankruptcy news sent the company's shares to their lowest level since early 1990s at $1.27 on Friday.

"Speculation (that) Bed Bath & Beyond could be an M&A target for an opportunistic buyer, combined with its cost cutting measures have helped support the stock," said Victoria Scholar, head of investment at Interactive Investor.

"However, the risk of bankruptcy remains and the stock is still down 60% over the last 6 months."

The company's shares were among the top three most traded stocks on Fidelity's retail platform on Tuesday.

Bed Bath & Beyond has about 38.6% of its shares under short position, per Ortex data as of Monday.

Nearly two years ago, retail punters bid up Bed Bath & Beyond's shares by banding together on online forums, costing bearish hedge funds billions of dollars.