U.S. stock futures headed for a mixed open on Wednesday as investors took in a host of quarterly earnings results and looked ahead to more data.

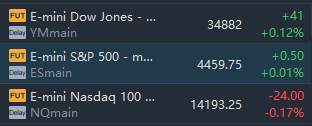

Market Snapshot

At 7:50 a.m. ET, Dow e-minis were up 41 points, or 0.12%, S&P 500 e-minis were up 0.5 point, or 0.01%, and Nasdaq 100 e-minis were down 24 points, or 0.17%.

Netflix – Netflix plummeted 26.8% in the premarket after reporting it lost 200,000 subscribers during the first quarter. The streaming service had projected subscriber additions of 2.5 million. Netflix also said it was exploring an ad-supported version.

Walt Disney,Roku Inc,Warner Bros. Discovery– Other streaming-related companies saw their stocks fall in sympathy with Netflix. Disney slid 5% in the premarket, Roku tumbled 6.7% and Warner Brothers Discovery lost 4.3%.

Procter & Gamble – The consumer products giant’s stock gained 1.1% in premarket trading after a top and bottom-line beat. Procter exceeded estimates by 4 cents with adjusted quarterly earnings of $1.33 per share and saw its biggest year-over-year sales gain in two decades as demand remained high for household products, even in the face of higher prices. Procter also raised its organic sales guidance.

Baker Hughes – The oilfield services company fell 5 cents short of estimates with adjusted quarterly earnings of 15 cents per share, and revenue also missed forecasts. Baker Hughes said its results reflected a volatile operating environment, and the stock fell 2% in premarket action.

Lululemon Athletica – Luluemon added 2.2% in the premarket after the apparel maker announced a five-year plan to double revenue. The plan focuses on quadrupling international sales and doubling revenue from its men’s and digital operations.

IBM – IBM reported an adjusted quarterly profit of $1.40 per share, 2 cents above estimates, with revenue also coming in above analyst forecasts. IBM’s results got a boost from strong hybrid cloud platform business. IBM shares rallied 2.7% in premarket trading.

ASML Holding NV – ASML’s latest quarter beat analyst forecasts on the top and bottom lines, with the Amsterdam-based semiconductor equipment maker reporting strong demand from chip makers trying to ramp up production. ASML shares jumped 5.4% in the premarket.

Teva Pharmaceutical – Teva shares slid 4.8% in premarket trading after the FDA sent a rejection letter in response to a new drug application for a schizophrenia treatment. Teva said it is studying possible next steps and will work with the FDA to address the agency’s concerns.

Omnicom – Omnicom reported better-than-expected profit and revenue for its latest quarter, despite what the ad agency operator called “uniquely challenging global events.” Omnicom took a $113.4 million charge relating to its investment in Russian businesses. Shares added 3.7% in premarket action.

Market News

Private equity firms including Blackstone Group LP and Equity Partners have ruled out financing Elon Musk’s takeover bid for Twitter Inc., according to people familiar with the matter.

ASML Holding NV reported on Wednesday first-quarter sales of 3.5 billion euros ($3.8 billion) and net income of 695 million euros, slightly ahead of expectations.

CalPERS said it will vote for a shareholder proposal that Berkshire Hathaway replace Warren Buffett as chairman, though he would remain chief executive officer.

Taiwan Semiconductor Manufacturing has raised $3.5 billion in bonds for its new plant in the U.S. state of Arizona, according to a term sheet.

Lululemon Athletica aims to double its 2021 revenue in the next five years, putting it on track to hit $12.5 billion in sales by 2026, as the retailer rides a wave of pandemic-fueled demand for workout clothes.

Scientists in Australia are testing printed solar panels they will use to power a Tesla Motors on a 15,100-km (9,400-mile) journey beginning in September, which they hope will get the public thinking about steps to help avert climate change.

SHELL PLC started to withdraw staff from its joint ventures with Russia’s Gazprom PJSC as it moves forward with plans to exit investments in response to the war in Ukraine.

Median pay for top U.S. CEOs rose 31% last year to a record $20 million, a new study found, surging after a slight decline during the COVID-19 pandemic, as companies showered leaders with stock awards and cash bonuses.