The Dow Jones Industrial Average inched slightly higher Thursday after the release of better-than-expected August retail sales, but the latest weekly jobless claims report pointed to a mixed economic picture.

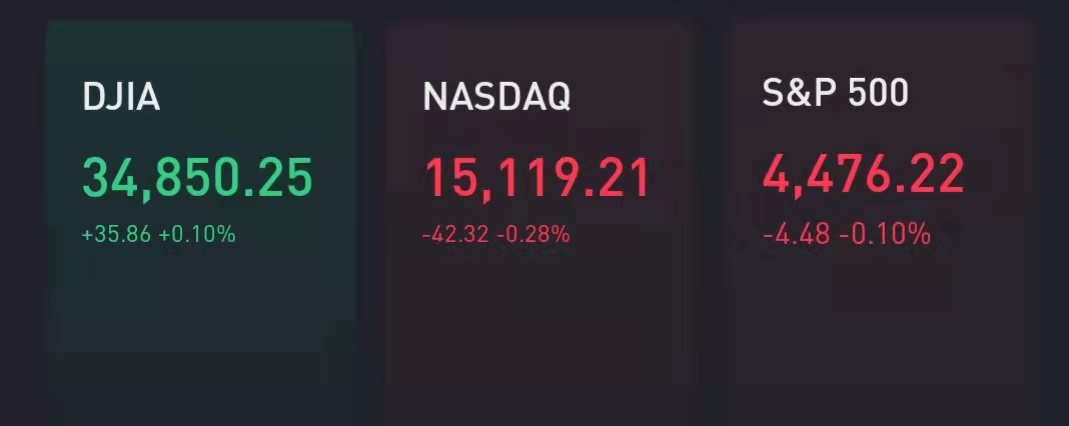

The Dow added about 35 points, or 0.1%. The S&P 500 traded near the flatline and the Nasdaq Composite shed 0.3%.

August retail sales rose 0.7% from the month prior, surprising the market. Economists surveyed by Dow Jones expected a 0.8% month-over-month decline.

Meanwhile, the latest unemployment insurance weekly data showed 332,000 first-time jobless claims last week. Economists polled by Dow Jones expect a total of 320,000 initial claims.

Despite a rebound on Wednesday, the S&P 500 and the Dow are still in the red for September. After seven straight months of gains for the S&P 500 and a near 20% rally to records this year, many on Wall Street expect bumpier trading and lower returns for the rest of the year.

History is also not on the market's side as September tends to be a typically negative month for stocks. The S&P 500 has fallen 0.56% during the month on average since 1945, according to data from CFRA.

Friday begins a particularly weak period for stocks as those September losses typically come in the back half of the month.

"The wall of worry is becoming increasingly challenging to climb, with rising depth and breadth of concerns and a potentially tired market," said Mark Hackett, Nationwide's chief of investment research.

"The stress factors facing the market have not materially changed, including the Delta variant, earnings headwinds from supply chain and labor challenges, fiscal and monetary tailwind shifting to headwinds and bubbling concerns around China," Hackett said.

Another reason why the back half of September could be volatile is due to so-called quadruple witching occurring at the end of the week as stock and index futures and options are set to expire on the same day.