U.S. stock index futures slipped on Wednesday as a rally in technology and growth stocks from the previous session eased, while higher oil prices stoked worries of a further rise in global inflation.

Market Snapshot

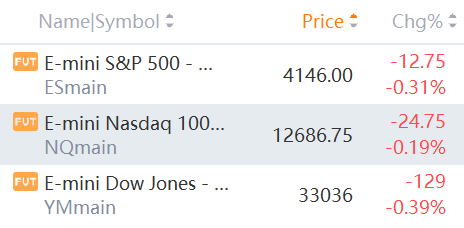

At 7:50 a.m. ET, Dow e-minis were down 129 points, or 0.39%, S&P 500 e-minis were down 12.75 points, or 0.31%, and Nasdaq 100 e-minis were down 24.75 points, or 0.19%.

Pre-Market Movers

Campbell Soup – The food producer’s shares rallied 3.7% in the premarket after Campbell reported an adjusted quarterly profit of 70 cents per share, 9 cents above estimates. Sales also beat forecasts, and the company raised its full-year sales outlook. Campbell also maintained its prior earnings forecast, noting it now expects core inflation to run hotter than its previous outlook.

Thor Industries – The recreational vehicle maker’s stock surged 6.9% in premarket trading following better-than-expected quarterly results. Thor earned $6.32 per share, well above the $4.77 consensus estimate, amid strong demand for its products. Thor also said it is seeing signs of improved supply chain issues.

Moderna – Moderna added 1.6% in the premarket after a modified version of its Covid-19 booster shot prompted a stronger immune response than the company’s original vaccine against the omicron variant. Data will be submitted to U.S. regulators in the coming weeks.

Western Digital – Western Digital said it is reviewing strategic alternatives, including a possible split of its flash memory and disk drive businesses. Activist investor Elliott Management, which owns 6% of Western Digital, has been pushing for those changes. Shares jumped 3.8% in premarket action.

Roku – Shares of the video streaming device maker rallied 8.1% in the premarket after a Business Insider article highlighted talk inside Roku about possibly being acquired by Netflix.

Hasbro – Hasbro will be successful in pushing back a board challenge from activist investor Alta Fox, according to people familiar with the matter who spoke to Reuters. Alta Fox has been critical of various aspects of the toymaker’s strategy and wants Hasbro to spin off its Wizards of the Coast unit.

Credit Suisse – Credit Suisse warned of a likely second-quarter loss, due to the negative impacts of the Russia/Ukraine war, monetary tightening and other financial market conditions. The bank did not specify how large such a loss may be. Credit Suisse slumped 6.1% in the premarket.

Novavax – Novavax soared 15.7% in premarket trading after it won an endorsement of its Covid-19 vaccine from an FDA advisory panel. The full FDA will now consider whether or not to approve the vaccine.

DocuSign – DocuSign shares rallied 4.6% in premarket action after the electronic signature technology company announced an expanded global partnership with Microsoft. The deal enhances the integration of DocuSign technology into Microsoft software applications.

Market News

Musk Tells Staff that SpaceX IPO is at least a few years away

Elon Musk recently told SpaceX employees that an initial public offering for the company is at least a few years away, according to a report from CNBC.

In an audio recording, the billionaire founder and chief executive of the private space company can be heard saying at an all-hands meeting last week that he guessed an offering for SpaceX to go public could happen "three or four years from now."

Credit Suisse issues profit warning for second quarter

Credit Suisse said despite the trading revenues benefiting from the spike in volatility, the impact of these conditions, combined with “continued low levels of capital markets issuance” and widening credit spreads, have “depressed the financial performance” of the investment bank in April and May.

This is “likely to lead to a loss for this division as well as a loss for the Group in the second quarter of 2022,” the trading update said.

Grab Launches GrabMaps As a New Enterprise Service

GRAB is launching a new enterprise service, GrabMaps, as it seeks to tap the US$1 billion mapping and location-based services market in South-east Asia.

The mapping and location services GrabMaps provide include routing, estimated time of arrival, distance and points of interest.

“Commercialising this technology is another step forward for our young but fast-growing Enterprise and New Initiatives business,” said Tan Hooi Ling, co-founder, Grab.

Cathie Wood Continues Tesla Snap-Up Spree With $2.15M Buy

Cathie Wood-led Ark Invest Investment Management added more Tesla stock to its portfolio on Tuesday, raising its exposure to the electric vehicle maker for the second time this month.

Ark Invest bought 3,000 shares, estimated to be worth $2.15 million, in Tesla on Tuesday.