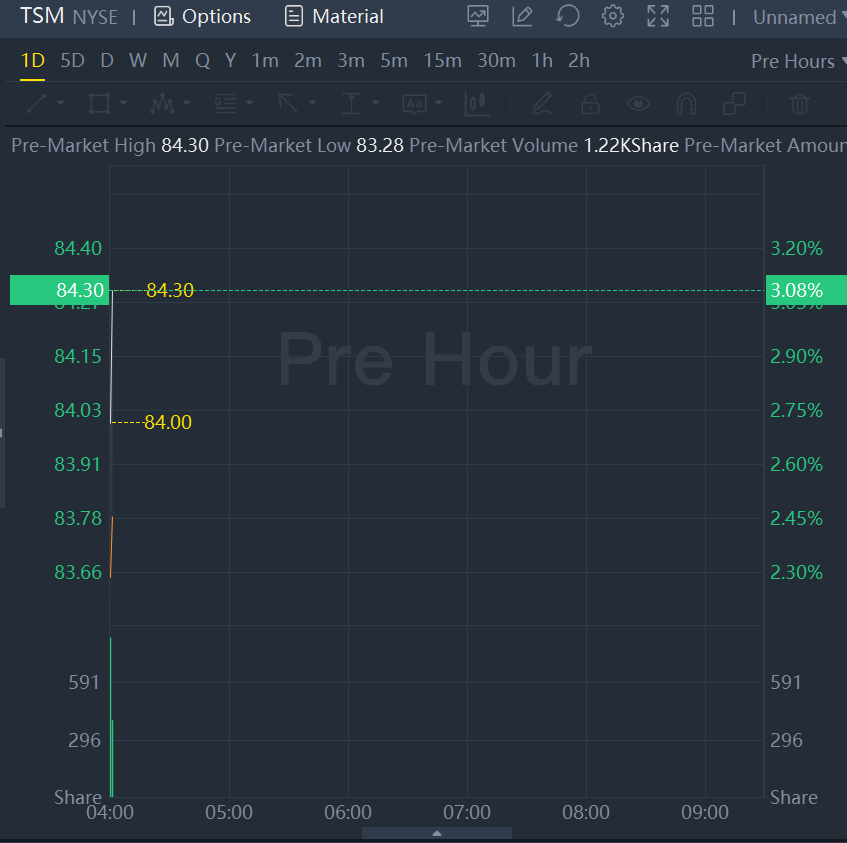

TSMC stock jumped 3% as Q4 profit rises 78%, beats market expectations.

Taiwanese chipmaker TSMC posted a 78% rise in fourth-quarter net profit on Thursday, as strong sales of advanced chips helped it defy a broader industry downturn that battered cheaper commodity chips.

Taiwan Semiconductor Manufacturing Co Ltd (TSMC) , the world's largest contract chipmaker and a major Apple Inc supplier, saw net profit for October-December rise to T$295.9 billion ($9.72 billion) from T$166.2 billion a year earlier.

That compared with the T$289.44 billion average of 21 analyst estimates compiled by Refinitiv.

TSMC's business has been boosted by a global chip shortage that was sparked by pandemic-fuelled sales of smartphones and laptops. While the shortage has eased, analysts said the firm's dominance in making some of the world's most advanced chips has kept its order book full.

Revenue for the fourth quarter climbed 26.7% to $19.93 billion, versus TSMC's prior estimated range of $19.9 billion to $20.7 billion.

Shares in TSMC fell 38.1% in 2022, but are up 9.8% so far this year giving the company a market value of $424.12 billion.

In October, TSMC cut its annual investment budget by at least 10% for 2022 and struck a more cautious note than usual on upcoming demand, flagging challenges from rising inflationary costs and predicting a chip downturn for 2023.

The firm said it spent $36.29 billion on capital expenditure in 2022, compared to a previous forecast of around $36 billon.