U.S. stock index futures wavered on Monday as investors clung to hopes of Russia-Ukraine peace talks, with bank stocks higher ahead of a Federal Reserve policy meeting this week where it is widely expected to raise interest rates.

Market Snapshot

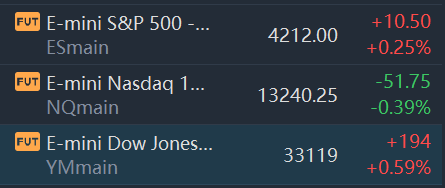

At 8:00 a.m. ET, Dow e-minis were up 194 points, or 0.59%, S&P 500 e-minis were up 10.5 points, or 0.25%, and Nasdaq 100 e-minis were down 51.75 points, or 0.39%.

Pre-Market Movers

Alibaba (BABA), JD.com (JD) – The e-commerce stocks were among China-based companies taking a hard hit on concerns about U.S. delistings, as well as the impact of new Covid-19 outbreaks in the Chinese tech hub of Shenzhen. Alibaba fell 4.7% in the premarket while JD.com sank 5.1%.

Occidental (OXY), Chevron (CVX) – The energy stocks were downgraded to “equal-weight” from “overweight” at Morgan Stanley, which notes that both have outperformed peers in recent months and now offer less attractive relative valuations. Occidental fell 3.3% in the premarket while Chevron slid 2.4%. Both are also moving lower in step with the drop in crude prices this morning.

Lockheed Martin (LMT) – The defense contractor’s shares gained 1.6% in premarket trading after sources told Reuters that Germany would purchase up to 35 of Lockheed’s F-35 fighter jets.

Coupang, Inc. (CPNG) – Softbank’s Vision Fund sold $1 billion of its stake in the South Korean software company, according to a regulatory filing. The sale of 50 million shares still leaves the fund with 461.2 million Coupang shares. The stock slipped 1.2% in premarket trading.

Ford (F) – Ford is forecasting a 12% drop in U.S. sales this year, according to a report in Automotive News, citing people present at a meeting with dealers. The publication said Ford has lost 100,000 units of production so far this year due to parts shortages. Despite that news, Ford added 1% in premarket action.

Berkshire Hathaway (BRK.B) – Berkshire is urging the rejection of four shareholder proposals, including the replacement of Warren Buffett as chairman and a proposal that Berkshire report on its plans to handle climate risk. Berkshire added 1% in the premarket.

Rio Tinto PLC (RIO) – Rio shares fell 2.9% in premarket trading after the mining company offered to buy the 49% of Canada’s Turquoise Hill that it doesn’t already own for about $2.7 billion. The price is a more than 32% premium to Turquoise Hill’s Friday close.

Tyson (TSN) – The beef and poultry producer’s stock slipped 1% in premarket action after BMO Capital Markets downgraded it to “market perform” from “outperform.” BMO cites valuation, noting that Tyson has materially outperformed the S&P 500 over the past year, as well as the potential for lower beef margins.

Market News

Shares of Volt Information Sciences Inc. $(VOLT)$ rocketed 95.36% toward a near five-year high to pace all premarket gainers Monday, after the staffing services company announced an agreement to be acquired by Vega Consulting Inc. in a deal that values Volt at $132.6 million.

The S&P 500 index will end 2022 about 1% lower as commodity prices surge and the outlook for global economic growth weakens amid the conflict in Ukraine, Goldman Sachs said. Goldman economists in a note on Friday trimmed their year-end target for the benchmark index to 4,700 from 4,900, which would have implied a nearly 3% rise in 2022. Goldman's target still implies a nearly 12% jump for the S&P from current levels.

OceanPal (NASDAQ:OP) received a written notice from the Nasdaq indicating that it is not in compliance with the minimum bid price requirement of $1/share.The company has 180 days, or until September 5, 2022 to regain compliance.

Major cryptocurrency exchange Coinbase Global Inc(NASDAQ: COIN) is testing out a new subscription product that lets users exchange digital assets without trading fees, according to a Blockworks report.

In a series of tweets on Sunday, Tesla Inc CEO Elon Musk clarified his stance on fiat, as well as, cryptocurrencies."It is generally better to own physical things like a home or stock in companies you think make good products, than dollars when inflation is high," Musk tweeted. "I still own & won’t sell my Bitcoin, Ethereum or Doge [for what it's worth]."