Sea shares dropped 3% in morning trading after the report that another Cathie Wood fund exits sea after $175 billion selloff.

Funds managed by Cathie Wood are exiting the beleaguered Southeast Asian e-commerce giant Sea Ltd. one by one.

Ark Next Generation Internet ETF on Thursday sold its last few shares in Sea, almost a quarter after flagship Ark Innovation ETF exited from the company in June, according to Ark trading data compiled by Bloomberg.

Exchange traded funds backed by Wood’s firm Ark Investment Management LLC’s have been selling shares in Sea since mid-May. Ark Fintech Innovation ETF is now the only one holding shares in the Singapore-based company, according to Bloomberg data.

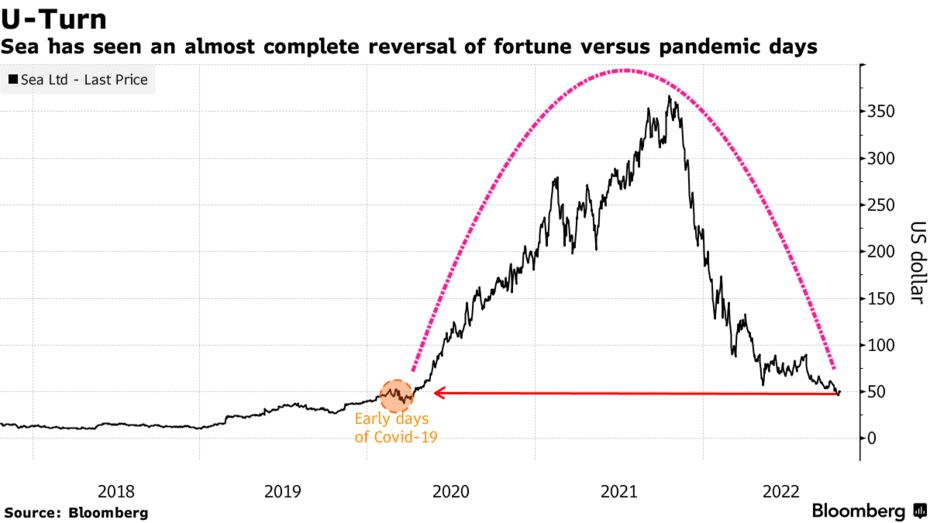

Ark’s selling has come in the backdrop of Sea losing about $175 billion of market value from its record high a year ago amid intensifying competition from Alibaba Group Holding Ltd. and concerns over its money-making prospects in an era of rising interest rates.

Stock has plunged nearly 80% this year and is now trading near its pre-pandemic levels, a far cry from once being the world’shottestlarge-cap in 2020.

The Tencent Holdings Ltd.-backed company’s top management has started forgoing salaries, tightening expense policies and firing staff as it tries to curb ballooning losses and woo investors again.

“Ark bailing out on Sea does not bode well for the ASEAN Tech giant,” said Nirgunan Tiruchelvam, head of consumer and Internet at Aletheia Capital. “Sea needs to convince investors that it can generate cash sooner rather than later.”