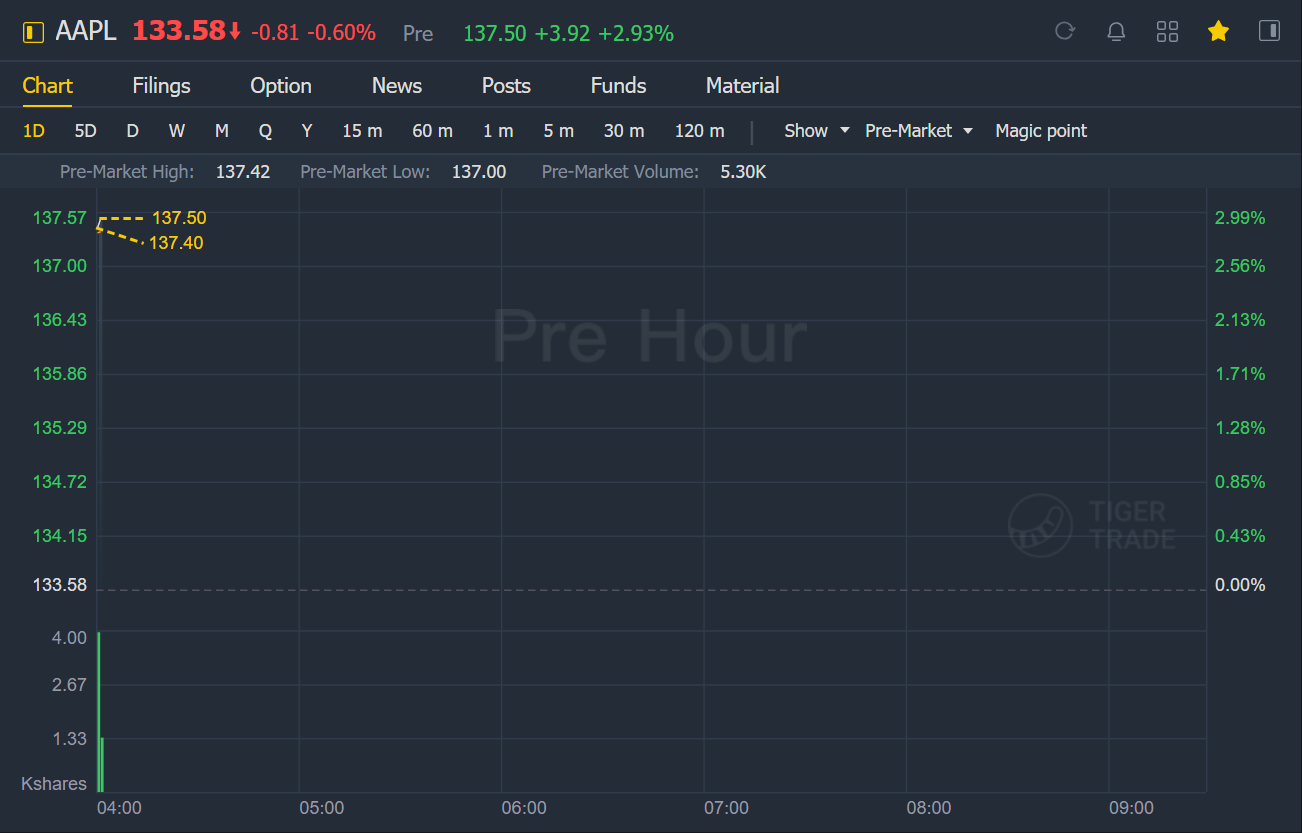

Apple rose nearly 3% in premarket trading, Q2 revenue increased by 54%, and announced a $90 billion repurchase of stock.

Apple Delivers Blowout Q1, Lifts Buybacks by $90B

Apple reported Wednesday better-than-expected first-quarter results as revenue hit a record high following a surge in services and iPhones growth. Apple said it would increase its existing share buyback program by $90 billion.

Apple announced earnings per share of $1.40 on revenue of $89.58 billion. Analysts polled by Investing.com anticipated EPS of 98 cents on revenue of $76.71 billion.

iPhone revenue, which makes up about half of total revenue, rose to $47.94. billion from $28.96 billion a year earlier, beating estimates of $40.8 billion, driven by strong demand from the latest slate of iPhones.

Revenue from Apple’s service business including Apple News, Apple TV+ and iCloud, grew to $16.90 billion from $13.3 billion, beating estimates of $15.53 billion.

Wearables, home and accessories generated $7.8 billion in revenue, up from $6.3 billion, beating consensus of $7.45 billion.

Apple declared a cash dividend of 22 cents per share, an increase of 7%.

"These results allowed us to generate operating cash flow of $24 billion and return nearly $23 billion to shareholders during the quarter," Apple said in a statement.