U.S. stock index futures edged higher on Tuesday as investors awaited a crucial inflation report and other economic data that would shape expectations for interest rate cuts from the Federal Reserve and test the recent rally in markets.

Market Snapshot

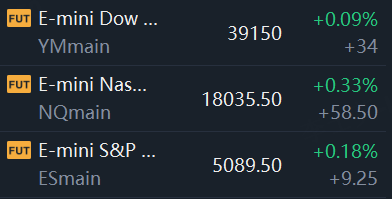

At 07:50 a.m. ET, Dow e-minis were up 34 points, or 0.09%, S&P 500 e-minis were up 9.25 points, or 0.18%, and Nasdaq 100 e-minis were up 58.5 points, or 0.33%.

Pre-Market Movers

Crypto Stocks (Cleanspark, Bitfarms, Marathon Digital, Coinbase, and more) - Crypto stocks shined in premarket trading Tuesday as Bitcoin topped $57,000 price level for the first time since late 2021. Cleanspark, Bitfarms, Marathon Digital, MicroStrategy, Coinbase, Bit Digital and Canaan climbed between 4% and 15%.

Unity (U) - Unity Software was tumbling 15.4% after the company said it expects fiscal first-quarter adjusted earnings before interest, taxes, depreciation and amortization of $45 million to $50 million, well below analysts’ expectations of $112 million. Unity, which operates a platform for developing videogames and other software applications, said in a letter to shareholders that it was resetting its portfolio to focus on its core businesses—its engine, cloud, and monetization business units—which it refers to as its strategic portfolio. Unity said it anticipates first-quarter revenue for its strategic portfolio of between $415 million and $420 million versus analysts’ predictions of $534 million.

Zoom (ZM) - Zoom Video Communications rose 10.5% after the videoconferencing company’s fourth-quarter adjusted profit topped expectations and revenue of $1.15 billion beat estimates of $1.13 billion. Enterprise revenue in the period rose 4.9% and the number of enterprise customers increased 3.5%. Zoom Video’s fiscal first-quarter adjusted earnings forecast also topped Wall Street consensus. The company’s board authorized Zoom Video to buy back $1.5 billion of stock.

Li Auto (LI) - Shares of Li Auto jumped another 8% in premarket trading Tuesday after soaring 19% on Monday as the Chinese EV company beat fourth-quarter earnings expectations. The automaker reported net income of 11.8 billion yuan ($1.6 billion) last year, making it the first of the three major Chinese EV startups — ahead of Xpeng Inc. and Nio Inc. — to post an annual profit after vehicle shipments more than doubled.

Workday (WDAY) - Workday reported better-than-expected fourth-quarter adjusted earnings and revenue that slightly beat analysts’ estimates, and the enterprise software company reiterated its outlook for fiscal 2025. Workday said it expects subscription revenue of $7.73 billion to $7.78 billion, up 17% to 18%, in fiscal 2025. Workday also announced an agreement to acquire HiredScore, a New York-based start-up that sells “AI-powered” talent software. Workday shares fell 3.5%.

CarGurus (CARG) - CarGurus, the online car-selling platform, reported better-than-expected fourth-quarter adjusted earnings and revenue but issued a fiscal first-quarter forecast that missed Wall Street estimates. The company said it expects adjusted profit in the first quarter of between 24 cents and 29 cents a share, below expectations of 31 cents. Shares fell 13%.

Palo Alto Networks (PANW) - Palo Alto Networks shares surged 7.3% on Monday as Congresswoman Nancy Pelosi disclosed that she bought positions in the cybersecurity company. The shares gained another 5.6% in premarket trading Tuesday.

Intuitive Machines (LUNR) - Shares of Intuitive Machines fell 22% on Tuesday as the company's lunar mission neared a premature end after a sideways touchdown hindered communications and solar charging capability of its moon lander Odysseus.

Hims & Hers Health (HIMS) - Hims & Hers Health surged 19.3% after the telehealth-consultation platform said it expects fiscal-year revenue of $1.17 billion to $1.2 billion, higher than analysts’ estimates of $1.11 billion. The company also expects adjusted earnings before interest, taxes, depreciation and amortization for the year of $100 million to $120 million. Hims & Hers posted earnings in the fourth quarter of 1 cent a share compared with analysts’ estimates that called for a loss of 2 cents.

Macy's (M) - Macy's forecast annual sales largely below market expectations on Tuesday on weak demand for its apparel and shoes, and said it would close 150 stores through 2026 as part of its new turnaround plan. The shares dropped 2.2% in premarket trading.

Lowe’s (LOW) - Lowe’s reported fourth-quarter earnings of $1.77 a share on revenue of $18.6 billion. Analysts had expected the home-improvement retailer to post adjusted earnings of $1.68 a share on revenue of $18.5 billion. Same-store sales in the quarter fell 6.2%, with Lowe’s citing a “slowdown in DIY demand and unfavorable January winter weather.” Same-store sales were projected to fall by 7%. The stock rose 0.2%.

SoundHound AI (SOUN) - SoundHound AI stock soared 46.7% on Monday and jumped another 25% in premarket trading Tuesday. SoundHound AI is surgingthanks to an announcement that Nvidia has formed a new partnership with other influential hardware and software players to advance AI technologies in the telecommunications industry.

Viking Therapeutics (VKTX) - Viking Therapeutics Inc.’s stock soared 100% early Tuesday, after the company announced positive results from a Phase 2 trial of its weight-loss drug VK2735, a GLP-1 receptor agonist that it’s developing in both injectable and oral form as a treatment for obesity and diabetes.

Pubmatic (PUBM) - Programmatic advertising platform Pubmatic reported Q4 FY2023 results beating Wall Street analysts' expectations, with revenue up 13.9% year on year to $84.6 million. On top of that, next quarter's revenue guidance ($62 million at the midpoint) was surprisingly good and 6.3% above what analysts were expecting. It made a non-GAAP profit of $0.45 per share, improving from its loss of $0.08 per share in the same quarter last year. The shares jumped 26.1% in premarket trading.

Hess (HES) - Hess Corp. declined 3% in premarket trading Tuesday after a disclosure related to an agreement with ExxonMobil raised concerns about a takeover by Chevron.

Five9 (FIVN) - Five9 Inc's stock is down 5.8% in premarket trading Tuesday as call center software firm looks to refinance near-term debt.

Cava (CAVA) - Cava Group Inc. posted fourth-quarter sales that beat estimates as more people visited and shelled out for premium dishes. Cava shares jumped 6.9% in premarket trading Tuesday. The stock has advanced 17% this year through Monday’s close.

Janux Therapeutics (JANX) - Shares of Janux Therapeutics shot up 126% in premarket trading Tuesday after the company released encouraging updated data for its oncology drug candidates JANX007 and JANX008.

Market News

Bitcoin Tops $57,000 Price Level for First Time Since Late 2021

Bitcoin retook the $57,000 level on Tuesday for the first time since late 2021, supported by investor demand through exchange-traded funds as well as further purchases by MicroStrategy Inc.

Bitcoin's price has increased 33% since the turn of the year, extending a prolonged rally that has also stoked speculative appetite for smaller tokens like Ether and BNB.

A net $5.6 billion has poured into a batch of landmark Bitcoin ETFs that began trading in the US on Jan. 11, signaling a widening of demand for the token beyond committed digital-asset enthusiasts. An upcoming reduction in the token’s supply growth, the halving, is adding to the optimistic sentiment.

Shein Considers London IPO Amid US Resistance to Listing

Fast-fashion company Shein is considering the possibility of switching its initial public offering to London from New York because of hurdles to the listing in the US, according to people with knowledge of the matter.

Shein, which was founded in China but is now headquartered in Singapore, is in the early stages of exploring the London option as it has judged it unlikely that the US Securities and Exchange Commission will approve its IPO, the people said, asking not to be identified discussing confidential information.

Shein is still working on its application to list in the US — its preferred location, the people said. It would need to file a new overseas listing application with Chinese regulators if it decided to switch to London or elsewhere, they added. Other venues including Hong Kong or Singapore may also be considered, two of the people said.