The S&P 500 and the Dow futures dip on Friday, with prices rising 8.6% from a year ago for the fastest increase since 1981.

Market Snapshot

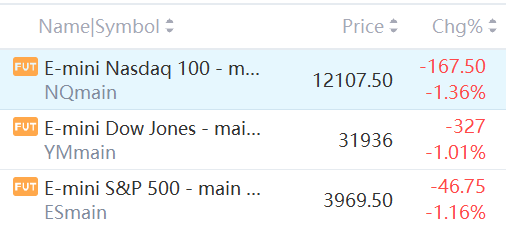

At 8:50 a.m. ET, Dow e-minis were down 327 points, or 1.01%, S&P 500 e-minis were down 46.75 points, or 1.16%, and Nasdaq 100 e-minis were down 167.5 points, or 1.36%.

Pre-Market Movers

DocuSign – The electronic-signature technology company’s stock plunged 26.1% in the premarket after its quarterly profit and revenue fell short of Wall Street forecasts. DocuSign had previously warned that a return to post-Covid working conditions could cut into its business.

Vail Resorts – Vail Resorts rallied 6.7% in premarket trading after the resort operator posted better-than-expected quarterly results. Vail benefited from an easing of Covid-related restrictions and noted successful efforts to attract visitors outside of its peak skiing season.

Stitch Fix – Stitch Fix shares slumped 15.4% in premarket action after the online clothing styler posted a wider than expected quarterly loss and gave weaker than expected revenue guidance. Stitch Fix also said it would cut 330 jobs, about 4% of its total workforce.

Rent The Runway – The fashion rental company posted a smaller-than-expected quarterly loss while its revenue came in above Wall Street forecasts. Sales doubled from a year earlier and Rent The Runway also issued an upbeat current-quarter revenue forecast. Shares jumped 8.2% in the premarket.

Illumina – The maker of gene-based therapies saw its shares decline 4.2% in the premarket after announcing the departure of Chief Financial Officer Sam Samad, who is taking the CFO role atQuest Diagnostics(DGX).

Netflix – Netflix slid 4.7% in premarket trading after Goldman Sachs downgraded the stock to “sell” from “neutral” and cut the price target to $186 per share from $265. Goldman said it was focusing on a number of factors, including an increased focus on profitability and lower investor tolerance for long-term investments as Netflix and other web-based businesses mature. In the same report, Goldman also cut to “sell” from “neutral” video game companyRoblox(RBLX), down 4.7% in the premarket, and eBay (EBAY), down 3.6%.

Angi – The home services company reported a 24% jump in May revenue, compared with a year earlier, even as service requests fell 7%. Separately, the company announced the departure of Chief Financial Officer Jeff Pederson.

CME Group – The exchange operator’s stock gained 2.3% in the premarket after Atlantic Equities upgraded it to “overweight” from “neutral.” The firm said CME has the strongest fundamental backdrop among U.S.-based exchanges and that a recent drop in the stock provides an attractive entry point.

Kontoor Brands – Goldman Sachs downgraded the stock to “neutral” from “buy,” noting that increasing cost pressures have been weighing on results and earnings growth for the parent of the Lee and Wrangler apparel brands. Kontoor Brands fell 1% in the premarket.

Market News

Nio to Make Self-Developed Battery Packs From 2024

Nio said that in 2024 it will start making high-voltage battery packs that it has developed itself, as part of a drive to improve profitability and competitiveness to take on rivals such as Tesla.

Nio, plans to start producing an 800-volt battery pack in the second half of 2024, its chairman William Li told analysts on a call on Thursday.

Most electric vehicles operate with 400-volt batteries while Porsche's Taycan electric cars are powered by 800-volt lithium-ion battery packs, which recharge faster.

TSMC posted consolidated sales of $6.27 billion

Taiwan Semiconductor Manufacturing Co. (TSMC), the world's largest contract chipmaker, set a new high for monthly sales for a second consecutive month in May, a showing analysts attributed to robust global demand for new tech applications.

In a statement Friday, TSMC said it posted consolidated sales of NT$185.71 billion (US$6.27 billion), up 7.6 percent from the previous high of NT$172.56 billion in April. The May figure was also up 65.3 percent from a year earlier.

In the first five months of 2022, TSMC's consolidated sales totaled NT$849.34 billion, up 44.9 percent from a year earlier, the chipmaker's figures showed.

Netflix Downgraded to Sell From Neutral at Goldman Sachs

Goldman Sachs analyst Eric Sheridan downgraded Netflix to Sell from Neutral with a price target of $186, down from $265, according to The Fly.

The analyst has concerns around the impact of a consumer recession as well as heightened levels of competition on demand trends, margin expansion, and levels of content spend. He views Netflix as a "show-me story with a light catalyst path in the next 6-12 months." Sheridan cut 2022 and 20023 revenue estimates to incorporate a greater probability of a weaker macro environment.

Cathie Wood Added $2.3M More Of Roblox On The Dip On Thursday

Cathie Wood-led Ark Investment Management on Thursday raised its exposure in Roblox Corp stock on the dip.

St. Petersburg, Florida-based Ark Invest bought 75,125 shares, estimated to be worth $2.29 million, in the San Mateo, California-based video game developer.