Nasdaq futures erased losses and turned positive on Friday after data showed the U.S. Federal Reserve's favored inflation gauge, the core personal consumption expenditure (PCE) price index, rose for the month of December in line with expectations.

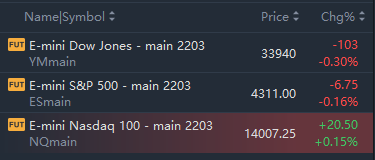

Market Snapshot

At 8:48 a.m. ET, Dow e-minis were down 103 points, or 0.30%, S&P 500 e-minis were down 6.75 points, or 0.16%, and Nasdaq 100 e-minis were up 20.5 points, or 0.15%.

Pre-Market Movers

Caterpillar (CAT) – Caterpillar earned an adjusted $2.69 per share for the fourth quarter, beating the $2.26 consensus estimate, with revenue also coming in above analyst forecasts. The heavy equipment maker’s sales were up 23% from a year earlier despite supply chain constraints. However, increased costs weighed on Caterpillar’s profit margins and the stock slipped 1.4% in premarket trading.

Chevron (CVX) – Chevron slid 2.8% in the premarket after missing bottom-line estimates for the fourth quarter, although revenue exceeded analyst forecasts. Chevron earned an adjusted $2.56 per share, compared with a $3.12 consensus estimate, despite higher oil and gas prices.

VF Corp. (VFC) – The company behind North Face, Vans and other apparel brands saw its stock fall 2% in premarket trading after it cut its full-year sales forecast due to delivery delays and worker shortages. VF reported better-than-expected profit and revenue for its most recent quarter.

Apple (AAPL) – Apple reported record profit and revenue for its latest quarter, despite supply chain issues that cut into sales. Apple earned $2.10 per share, compared with a $1.89 consensus estimate, and revenue also topped Street forecasts. CEO Tim Cook said those supply chain challenges are showing signs of improvement. Apple shares jumped 3.1% in the premarket.

Visa (V) – Visa beat estimates by 11 cents with an adjusted quarterly profit of $1.81 per share. The payment network’s revenue also beat estimates. Visa was helped by a jump in travel spending and continued growth in e-commerce, with the company seeing quarterly revenue above $7 billion for the first time. Visa rallied 3.6% in premarket trading.

Mondelez (MDLZ) – Mondelez fell a penny short of analyst forecasts with adjusted quarterly earnings of 71 cents per share, though the snack maker’s revenue did beat estimates. Mondelez raised prices during the quarter, but it was not enough to make up for increased costs for ingredients and logistics. Mondelez slid 2.2% in premarket action.

Robinhood (HOOD) – Robinhood slumped 13% in the premarket after warning that current-quarter revenue could fall significantly from a year ago. The trading platform operator reported a quarterly loss of 49 cents per share, 4 cents wider than estimates, although revenue was slightly above analyst forecasts.

Western Digital (WDC) – Western Digital shares plunged 10.4% in premarket trading after the disk drive maker issued a weaker-than-expected outlook, and supply chain issues that prevented it from fully meeting strong demand. Western Digital did beat top and bottom-line estimates for its latest quarter, earning an adjusted $2.30 per share compared with a consensus estimate of $2.13.

3M (MMM) – 3M will appeal a ruling that awarded $110 million to two U.S. Army veterans who said they suffered hearing loss after using 3M’s combat earplugs. 3M has faced multiple lawsuits over allegations that the design of the earplugs is defective. The stock fell 1% in the premarket.

Beazer Homes (BZH) – Beazer Homes jumped 5.1% in premarket trading after beating top and bottom-line estimates for the quarter ending in December. Beazer earned $1.14 per share, well above the 67-cent consensus estimate, and said the housing market continues to see strong demand and limited supply

Market News

GogoX, the Hong Kong-based logistics startup, has won stock exchange approval for its planned initial public offering in the city, people with knowledge of the matter said.

DBS Group Holdings Ltd. agreed to buy Citigroup Inc.’s consumer banking assets in Taiwan, as Southeast Asia’s largest lender pushes ahead with plans to boost its regional presence.

Biogen is selling its stake in a pharmaceutical joint venture with the South Korean conglomerate Samsung for $2.3 billion, the company said Thursday, bolstering the drugmaker’s balance sheet.

Google will invest as much as $1 billion in India’s second-largest mobile phone operator, as firms race to offer inexpensive data and digital offerings in the only billion-people-plus market still open to foreign companies.

A federal jury on Thursday awarded $110 million to two U.S. Army veterans who said combat earplugs sold by 3M Co to the military caused them to suffer hearing damage, the largest verdict yet to result from hundreds of thousands of lawsuits over the product.

Warren Buffett is once again richer than Mark Zuckerberg, a reminder of the enduring power of his value-investing approach.