(June 8) Most of semiconductor stocks fell in morning trading.

Semiconductor Stocks Face Up To Chip Shortage As U.S. Government Plots Investments

The global chip shortage has disrupted manufacturing of everything from cars and washing machines to smartphones and toys just as industries struggle to recover from the pandemic slump. Supply chain problems could start to ease by next year, but semiconductor stocks will feel the geopolitical ripples much longer, experts say. And the imbalance is creating new winners, some losers and added cyclical risk.

The chip shortage has sparked calls on Capitol Hill to reinvigorate domestic semiconductor manufacturing, with bipartisan support for $50 billion in federal aid to the industry.

During the virtual Computex trade show May 31,Intel(INTC) Chief Executive Pat Gelsinger said the global semiconductor shortage could take "a couple of years" to resolve.

A "cycle of explosive growth in semiconductors" has placed huge strain on supply chains ranging from automobiles to personal computers, Gelsinger said. "But while the industry has taken steps to address near-term constraints, it could still take a couple of years for the ecosystem to address shortages of foundry capacity, substrates and components."

Semiconductor Stocks: Impact On Automakers

Chip shortages were the topic du jour duringfirst-quarter corporate earnings season. Investors in semiconductor stocks paid close attention to the commentary.

Tesla(TSLA) Chief Executive Elon Musk called the chip shortage "a huge problem" during the electric-car maker's Q1 conference call with analysts.Tesla stockbacked off sharply following the report.

Ford(F) CEO Jim Farley said the semiconductor shortage and impact to car production "will get worse before it gets better." He predicted that the second quarter will be the trough for the year.Ford stockdropped 9% following the earnings call.

"The global semiconductor shortage reduced our planned Q1 volume by about 17%, or 200,000 units," Farley said. "We now expect to lose about 50% of our planned Q2 production."

General Motors(GM) Chief Financial Officer Paul Jacobson said GM also expects the largest production disruptions from the chip shortages to occur in the June-ending quarter.

Many automakers have had to shut down factories amid the chip shortages. Modern cars use semiconductors in everything from anti-lock brakes and air bags to in-dash displays.

Semiconductor Stocks Hit By Texas Freeze

In addition to automakers, companies citing a negative impact of component shortages in the first quarter included PC makersApple(AAPL),Dell Technologies(DELL) andHP(HPQ).

Others affected included game console makersNintendo(NTDOY) andSony(SNE), enterprise headset vendorPoly(POLY) and Roomba robotic vacuum cleaner makeriRobot(IRBT), to name a few.

The chip shortages are mostly for semiconductors made using older process technologies. These include basic components such as power management chips, display controllers, microprocessors and analog chips.

Manufacturers of these chips were hit with an unprecedented number of orders after the economy sprang back faster than expected following disruptions from the Covid-19 pandemic. The situation was further aggravated by an ice storm in Texas in February that caused three chip fabrication plants, or fabs, to shut down and a fire in April at a Renesas Electronics fab.

Japan's Renesas is one of the largest suppliers of automotive chips. Among semiconductor stocks, other top auto chip suppliers include Germany's Infineon,NXP Semiconductors(NXPI),ON Semiconductor(ON),STMicroelectronics(STM) andTexas Instruments(TXN).

A Dearth Of Low-End Chips

The chips in short supply are mostly those made at trailing-edge 28-nanometer and larger process nodes. Transistor dimensions on chips are measured in nanometers, which are one-billionth of a meter. Cutting-edge chips, such as central processing units and graphics processors, employ circuit lines separated by as little as 5 nanometers.

"A couple of years ago, nobody was even talking about these older nodes," said Bharat Kapoor, lead partner, Americas, in the high-tech practice of global strategy and management consulting firm Kearney. "Everybody was talking about cutting-edge 7 nanometer, 5 nanometer, 3 nanometer, etc. But the narrative has changed."

Even the latest gadgets, such as 5G smartphones, need chips made with older technologies. But expanding production capacity is difficult when the equipment is often 10 years old or older.

"Frankly a lot of the equipment just isn't made anymore," said Robert Maire, president of consulting firm Semiconductor Advisors. Many companies in the U.S. and Europe have sold their older chip-gear equipment to entities in China, Maire said.

Erosion Of U.S. Manufacturing

For the industry and its customers, the near-term issue is a shortage of trailing-edge chips. Meanwhile, U.S. politicians have focused on bringing home production of leading-edge semiconductors — a segment where the shortage situation is much less pronounced. In this segment, the U.S. chip industry has lost its manufacturing lead to foundries Samsung in South Korea, andTaiwan Semiconductor Manufacturing Co.(TSM), known as TSMC.

Overall, the U.S. share of global semiconductor manufacturing capacity has eroded from 37% in 1990 to 12% today, according to the Semiconductor Industry Association. Some 75% of the world's chip manufacturing capacity is now concentrated in East Asia.

"It is very much a national security issue," Maire said. "All of today's defense and intelligence systems are based on semiconductors — from missiles to satellites to GPS to intelligence gathering and facial recognition."

The CHIPS For America Act

The loss of semiconductor manufacturing prowess is "an existential threat to the U.S.," Maire said. "We've let that capability go. Apple,Qualcomm(QCOM), Nvidia, AMD are all reliant on a country that is a short boat ride from China. So, the economy would come to a screeching halt if there was a problem with Taiwan right now."

The biggest concern is China trying to exert control over what it considers a runaway province.

Legislation called the CHIPS (Creating Helpful Incentives to Produce Semiconductors) for America Act was enacted in January as part of the annual U.S. defense bill. It authorized federal investments in domestic chip manufacturing and research. But it didn't include funding for those provisions.

Another piece of legislation, the U.S. Innovation and Competition Act, includes $50 billion in funding for the semiconductor provisions in the CHIPS for America Act. The Senate may act on that bill during the week of June 7, when it returns from recess. The industry hopes President Joe Biden can sign the final bill into law before the August recess.

"There's a broad consensus in Washington that this is a priority," said John Neuffer, chief executive of the Semiconductor Industry Association. The bill currently would provide $40 billion in grants for semiconductor manufacturing projects and $10 billion in research funding.

Tech industry leaders Apple,Microsoft(MSFT),Alphabet(GOOGL) andAmazon(AMZN) have joined a coalition to lobby the U.S. government to fund additional domestic chip production capacity. The group, called the Semiconductors in America Coalition, also includes chipmakers, computer manufacturers and telecom firms.

Intel, Samsung Pursue Incentives

Meanwhile, Europe also is seeking to bolster its homegrown chipmaking.

Intel has been pushing hard for government assistance to build new chip factories in the U.S. In March,Intel announced plans to spend $20 billion to build two semiconductor fabsin Arizona. In May, the company said it would invest $3.5 billion to equip its New Mexico operations to make advanced semiconductor packaging technologies.

"Intel clearly has its hand out," Maire said. Critics accuse Intel of chasing corporate welfare to make up for its own business missteps.Intel stockis attempting to rebound after falling off sharply in early April.

Meanwhile,TSMC in April pledged to spend $100 billionover the next three years to boost its capacity. Plans include a new advanced chip plant in Arizona.

And South Korea's Samsung has earmarked $116 billion in investment by 2030 to diversify its chip production. In January, The Wall Street Journal reported the company was considering investing as much as $17 billion in a U.S. chipmaking plant and was scouting locations in Arizona, Texas and New York.

An important factor in the decision is the potential incentive offered by the U.S. government, vs. those offered by competing countries.

"The reality is that when it comes to chip manufacturing, we are not operating on a level playing field," SIA's Neuffer said. "All other major chip-manufacturing countries offer significant manufacturing incentives. We don't. What this CHIPS (CHIPS for America Act) funding would do is make America an attractive place again to manufacture chips."

Privately held GlobalFoundries, based in Malta, N.Y., is capitalizing on the interest in chip manufacturing from another angle. The company is planning an initial public offering valued at about $30 billion.

Semiconductor Stocks: Equipment Makers

All that spending is good news for semiconductor equipment suppliers. Some of the best-performing semiconductor stocks lately belong to chip-gear vendors.

IBD's semiconductor equipment industry group currently ranks No. 60 out of197 industry groups tracked by IBD. Collectively, the 32-stock group has gained 30% for the year through Thursday.

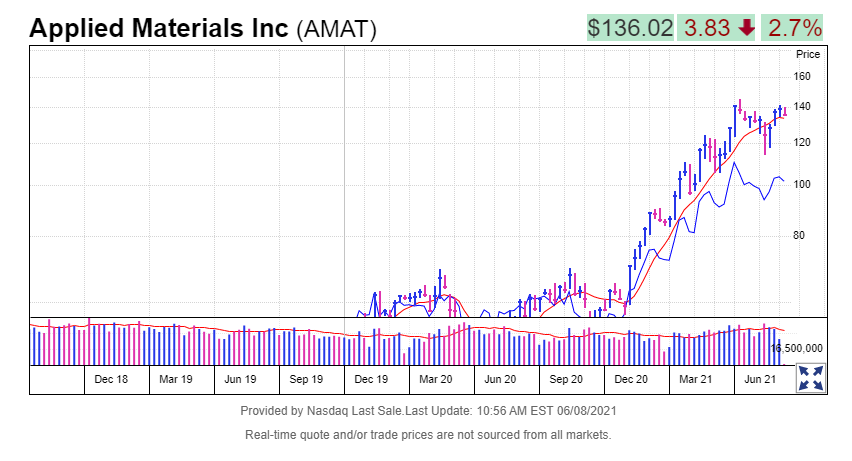

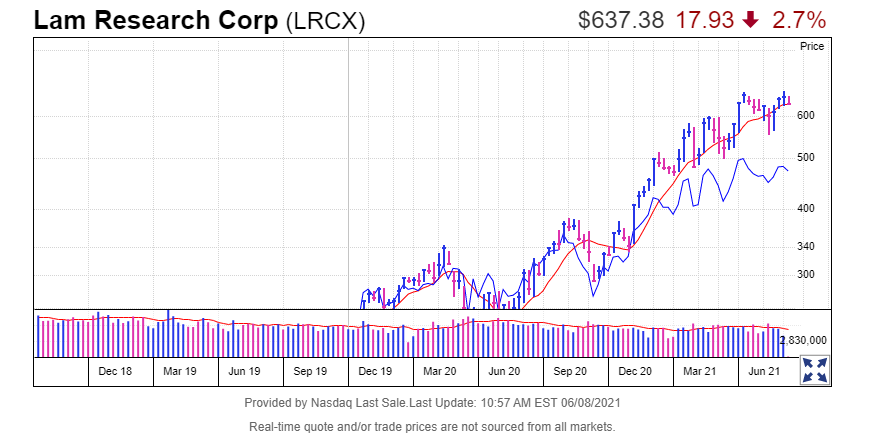

Top stocks in the chip equipment group are trading near record highs, such asApplied Materials(AMAT), Netherlands-basedASML Holding(ASML) andLam Research(LRCX). All are likely to benefit from heightened capital investments by chipmakers.

Lam Research andApplied Materials stockare both trading above key levels of support, and below buy points invalid bases. Any positive news regarding the general chip environment could trigger breakouts. Chip designer Nvidia isextendedafter a late-May breakout.

Applied Materials, ASML Holding and Nvidia areIBD Leaderboard stocks. Applied Materials is also onIBD's SwingTrader line up. In addition, ASML Holding and Nvidia are on theIBD 50 list.

Fixing The Chip Shortage

But building fabs is a long-term play. It takes at least two years to build and equip a semiconductor fab.

The U.S. still leads the world in designing semiconductors but has outsourced chip production to lower-cost countries. If the U.S. wants to onshore chip production it will need not only wafer fabs, but facilities that can turn those raw wafers into final products, Maire said.

That means plants for cutting wafers and packaging individual chips so they're ready to go on circuit boards.

"You have to look at it from a supply resiliency perspective," Kapoor said. "Having some meaningful chip production in the U.S. is imperative."

Research firm Gartner says the current chip shortage will persist through 2021. Supply should recover to normal levels by the second quarter of 2022 as existing capacity catches up with demand, Gartner said.

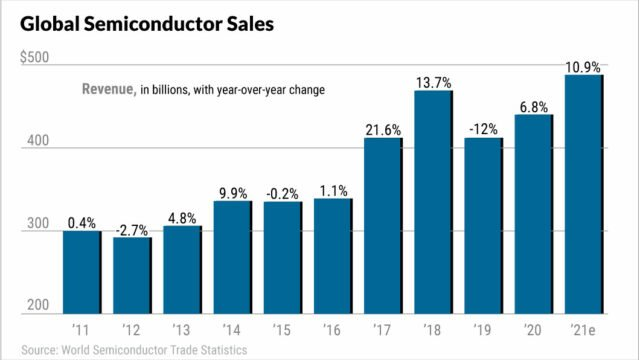

Despite the shortage, World Semiconductor Trade Statistics forecasts global semiconductor sales will grow 10.9% in 2021 to $488 billion. Last year, chip sales rebounded from both a cyclical downturn and the pandemic to increase 6.8% to $440 billion. That compares with a 12.1% decline in 2019 and a 13.7% increase in 2018.

Cyclical Nature Of Semiconductor Stocks

Chips are traditionally a brutally cyclical industry. Susquehanna Financial Group analyst Chris Rolland is concerned that reactions to the current chip shortage will lead the industry straight back into an oversupply scenario. In a May 18 note to clients, he said chip lead times — the gap between ordering a chip and taking delivery — increased to 17 weeks in April.

"Elevated lead times often compel 'bad behavior' at customers, including inventory accumulation, safety stock building and double ordering," Rolland said. "These trends may have spurred a semiconductor industry in the early stages of over-shipment above true customer demand."

For semiconductor stocks, thechip shortage situationhasn't been a boon. While chipmakers have been able to raise prices, their revenue upside has been capped by capacity constraints.

In addition to chip equipment makers, IBD covers two other chip industry segments. The semiconductor manufacturing industry group, led by Intel and Taiwan Semiconductor, ranked a weak No. 161 out of 197 groups. And IBD's fabless chipmaker group, made up of chip designers such as Nvidia, Qualcomm and AMD, ranked No. 163.

For the year to date through Thursday, the manufacturers group had a gain of 12.2%. The fabless group was up 7.7%.