U.S.-listed Chinese electric vehicle makerNio IncNIO 0.06%deliveries more than doubled in the month of July on a year-on-year basis but fell short of homegrown peers Xpeng Inc XPEV 0.2% and Li Auto LI.

What Happened: The Shanghai-headquartered EV maker delivered 7,931 vehicles in July, up about 124.5% when compared with the year-ago number but a 1.8% decline from June, when sales picked up pace sharply sequentially despite the ongoing global semiconductor shortage.

The split for July was 1,702 six-seater and seven-seater ES8 SUVs, 3,669 five-seater ES6s and 2,560 five-seater EC6 coupe models.

The company has cumulatively delivered 125,528 vehicles as of July.

Rival Xpeng delivered 8,040 vehicles in China, a jump of 228% year-over-year and a rise of 22% over last month's numbers while Li Auto reported a 251.3% jump to 8,589 deliveries for the month of July.

Why It Matters: In March, Nio was forced to halt production at its Hefei manufacturing plant for five working days starting March 29. The company had in May said sales were adversely hurt for several days due to the volatile semiconductor supply and certain logistical adjustments.

Despite challenges amid plans to begin deliveries in Norway, Nio has reiterated the delivery guidance of 21,000 to 22,000 vehicles in the second quarter of 2021.

For Nio, Norway will play out to be a gateway to expand into other countries in Europe where it will compete with bigger and established rivals such asTesla IncTSLAandVolkswagen AGVWAGY. The company aims to begin deliveries in Norway from September.

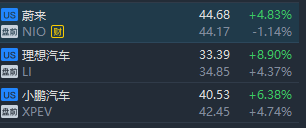

Price Action: Nio shares closed 4.83% higher at $44.68 on Friday.

Nio shares fell over 1% in premarket trading, at the same time, Li Auto and Xpeng Inc rose over 4% .