A decline in gasoline prices couldn’t mask the problem that spooked investors on Sept. 13: Core consumer prices resumed their rapid increase during August.

Fear of the Federal Reserve’s ongoing tightening of monetary policy to fight inflation sent the Dow Jones Industrial Average DJIA down 1,276 points (or 3.9%) to 31,104, with all 30 components showing declines as selling activity increased late in the trading session. It was the largest drop since June 2020.

The benchmark S&P 500 SPX fell 4.3%, with all but six component stocks down for the day. The Nasdaq Composite Index COMP fared even worse with a 5.2% decline, reflecting selling of tech-oriented stocks.

Altogether, it was the worst one-day decline for the three indexes since June 11, 2020.

The Nasdaq-100 index NDX fell 5.5% with every single component stock ending in the red.

Nvidia Corp. NVDA and Meta Platforms Inc. META led the plunge for the largest tech-oriented companies in the S&P 500, each sliding 9.4%, followed by Advanced Micro Devices Inc. AMD, which dropped 8.8%.

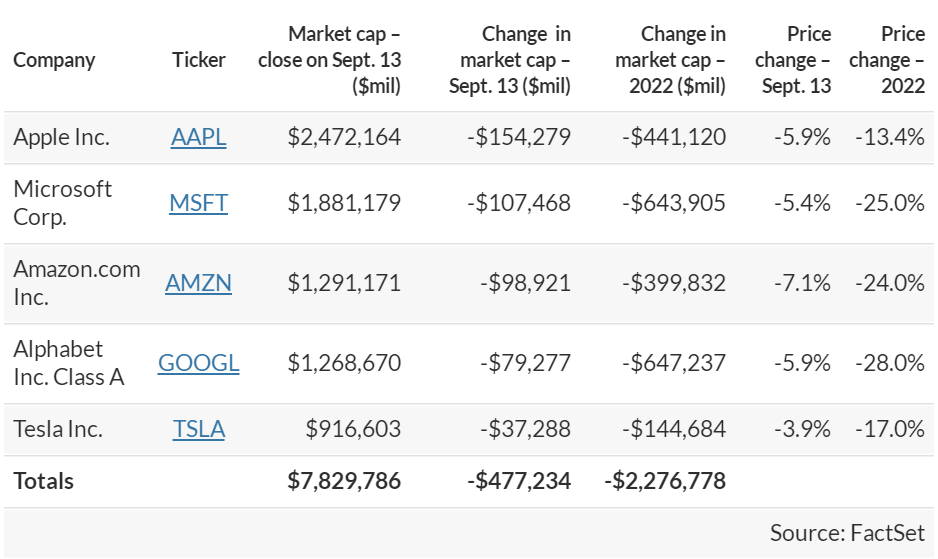

The five largest companies in the S&P 500 by market capitalization shed $477 billion in value, as you can see here:

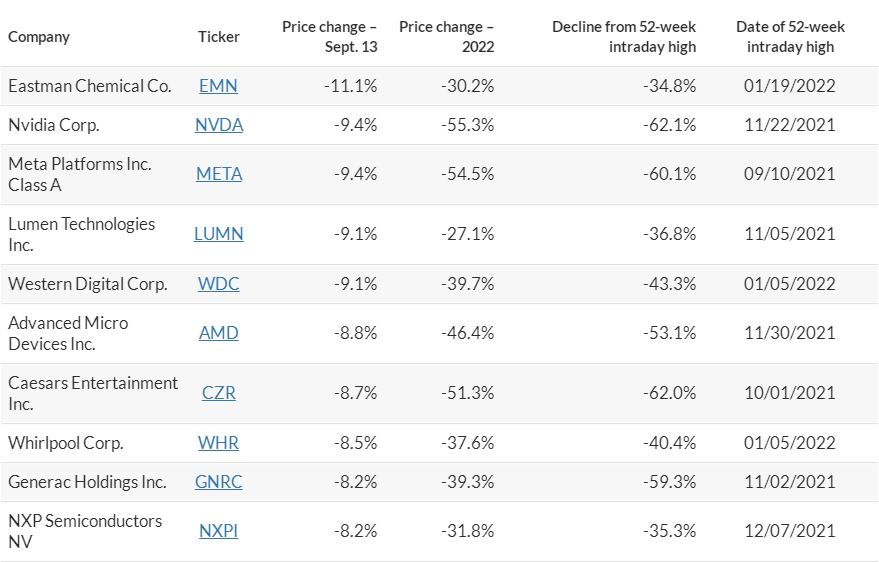

Worst decliners in the S&P 500

Worst decliners in the S&P 500

Among the six stocks in the S&P 500 that didn’t decline on Sept. 13, the standout performer was Twitter Inc. TWTR, which rose 0.8% after the company’s shareholders approved Tesla CEO Elon Musk’s disputed takeover offer. Twitter’s stock is now down 39% from its 52-week intraday high on Oct. 20, 2021.

Here are the 20 worst performers in the large-cap benchmark index for the day: