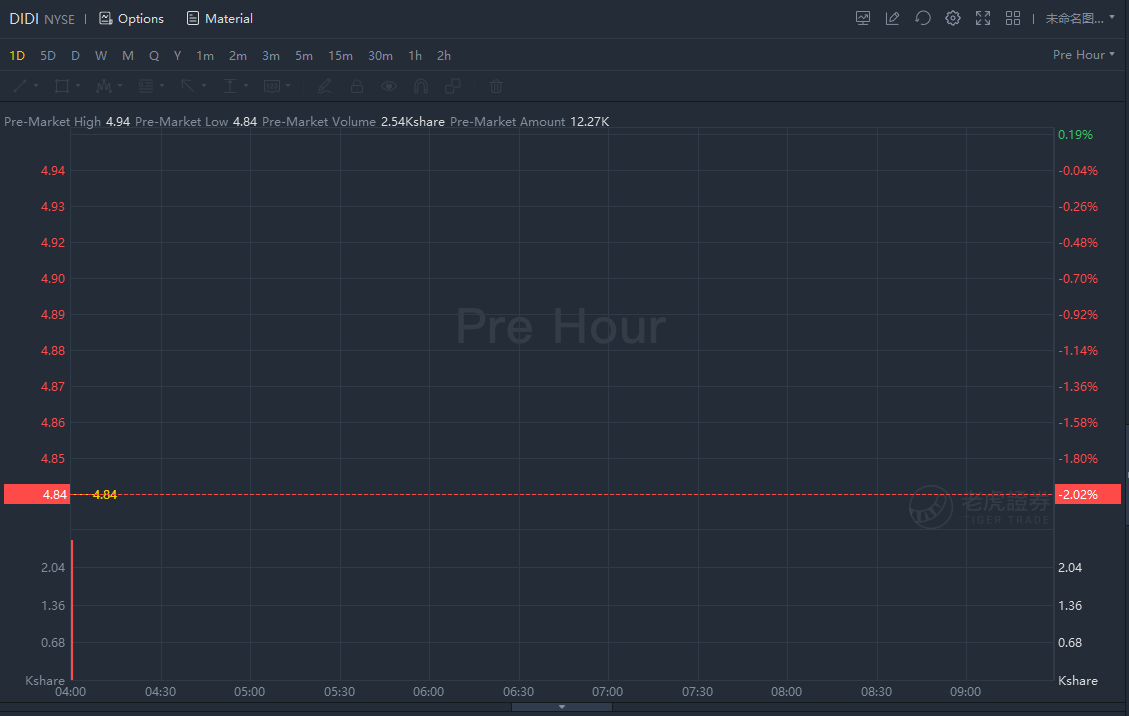

DiDi stock dropped 2% in premarket trading. DiDi posted Q3 net loss attributable to ordinary shareholders of RMB 30.6B (US$4.7B) in its Q3 earning report.

Core platform transactions for Q3 were 2.86B vs. 3.00B in Q2, with transactions for its China Mobility segment at 2.36B vs. 2.57B in the prior quarter. Transactions for the International segment were 499M.

Q3 core platform gross transaction value reached RMB 68.7B (US$10.7B), down from $MB73.3B in Q2; GTV from the China Mobility segment of RMB 58.4B (US$9.1B) slipped from RMB 64.6B in Q2.

Q3 total revenue of RMB 42.7B (US$6.6B), dropped from RMB 48.2B in Q2, with revenue from China Mobility at RMB 39.0B (US$6.1B) vs. RMB 44.8B in Q2 2021.

The company also said it will schedule a shareholders meeting for a vote on choosing another internationally recognized stock exchange for listing shares that will convert from its ADSs, which now trade on the NYSE. On Dec. 3, DiDi's (DIDI) board said it would delist its ADSs from the NYSE.

The company also announced changes to its board.DiDi (DIDI) ADSsrise 1.1% in after-hours trading in New York.