PepsiCo Inc. stock rose sharply in early premarket trading after the company posted better-than-expected Q3 earnings and raised full-year guidance.

For the third quarter, the company notched $21.97B in revenue alongside $1.97 in core earnings per share. Analysts had expected $1.85 and $20.81B, respectively. A 20% jump in revenue derived from the Fito-Lay North America and a rapidly accelerating business in Latin America were cited as key drivers of the strong performance.

“Given our year-to-date performance, we now expect our full-year organic revenue to increase 12% (previously 10%) and core constant currency earnings per share to increase 10 percent (previously 8%),” CEO Ramon Laguarta said. “We are encouraged by the progress we are making on our strategic agenda, and remain committed to investing in our people, brands, supply chain, and go-to-market systems and winning in the marketplace.”

A core EPS forecast of approximately $6.73 was raised $0.10 from the previous guidance despite raising the negative impact expectation for foreign exchange. A core annual effective tax rate of 20% and slated shareholder returns of $7.7B via dividends and buybacks were maintained within the guidance.

Elsewhere, a $1.6B pre-tax impairment charge related to the company’s withdrawal from Russia was noted as impacting year-to-date profits. An $868M jump in SG&A expense in the third quarter of 2022 as compared to the prior year quarter reflected "higher selling and distribution costs," according to the company.

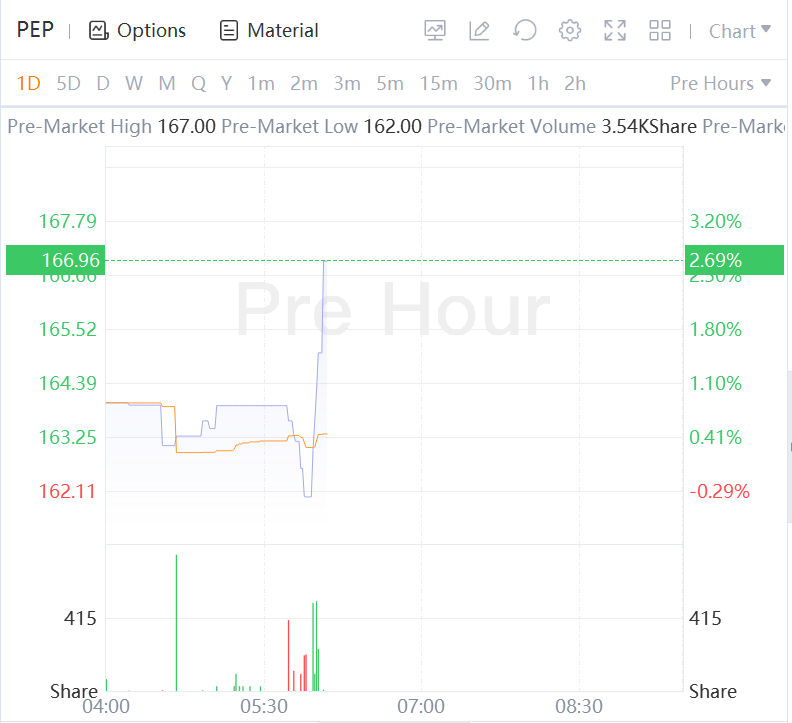

Shares of the Purchase, New York-based beverage and snack giant rose 2.55% shortly after the earnings were posted.

Shares of Pepsico jumps 2.69% on better-than-expected earnings report.