U.S.-listed shares of Chinese e-commerce giant Alibaba slid on Thursday after it announced that it would not proceed with the full spin-off of its cloud group due to U.S. chip export restrictions.

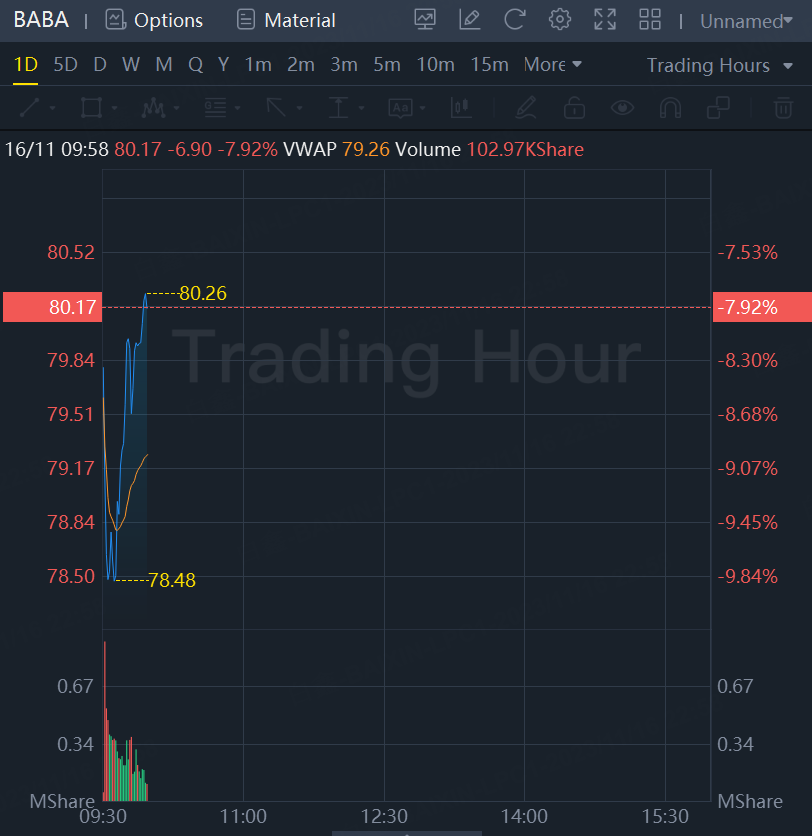

The company’s stock was down 8% in morning trading following the news.

In its earnings release Thursday, Alibaba said that it would no longer proceed with a spin-off of its Cloud Intelligence Group — the cloud computing arm of Alibaba that competes with Amazon Web Services and Microsoft Azure. Alibaba had planned to list the division publicly.

Alibaba said U.S. chip export restrictions have made it harder for Chinese firms to get critical chip supplies from U.S. companies. The U.S. barred sales of Nvidia’s advanced artificial intelligence-focused H800 and A800 chips in October.

On Thursday, Alibaba said that the restrictions have “created uncertainties for the prospects of Cloud Intelligence Group.”

“We believe that a full spin-off of Cloud Intelligence Group may not achieve the intended effect of shareholder value enhancement,” the company said, adding that it would instead focus on developing a sustainable growth model for the unit “under the fluid circumstances.”

Ahead of the earnings announcement Thursday, Alibaba announced in a regulatory filing that the family trust of founder Jack Ma was planning to sell down its stake in the business, selling 10 million shares for $870.7 million in cash.

The decision to walk back its cloud unit spinout marks a hitch in Alibaba’s plan to reorganize into six individual business units — one of the most radical shake-ups in the company’s history.

Alibaba had earlier announced that it would put on hold plans to list its Freshippo retail chain for groceries “as we evaluate market conditions and other factors.”

The company still intends to list its Cainiao smart logistics division in Hong Kong.

The Thursday results mark the first set of Alibaba earnings since veteran executive Eddie Wu succeeded former boss Daniel Zhang as CEO. As part of a broader management reshuffle, the company’s co-founder Joe Tsai also took over as chairman, Alibaba said in June.

Alibaba reported net income attributable to shareholders of 27.7 billion yuan ($3.8 billion) for the September quarter, below the 29.7 billion yuan expected by analysts.

Revenue met expectations, however, coming in at 224.79 billion yuan ($31 billion), up 9% year-over-year.

Chairman Joe Tsai sought to assuage investor concerns about the roadblock to Alibaba’s reorganization on the earnings call Thursday, saying that the company had more than enough cash on its balance sheet to support its operating business.

“We ended the quarter with $63 billion in net cash, and we generated $27 billion in free cash flow in the last 12 months,” Alibaba’s Tsai said. “Alibaba has never been in a better financial position to invest for the growth of our businesses.”

He added that Alibaba was looking to prove to investors it can can grow its cloud business as part of the Alibaba Group rather than focus on “financial engineering.”

“In the AI driven world, to develop a fully-grown business based on a very networked and highly scaled infrastructure it requires investment,” Tsai said. “We would rather show investors through our operations of the cloud business rather than spinning it off.”

Eddie Wu, Alibaba’s CEO, said that the firm would embark on a strategic review of its existing businesses, distingishuing between “core” and “non-core” businesses.

The company will give different businesses different levels of priority “based on their market size, business model, and product competitiveness.”

Core businesses are where Alibaba will keep a long-term focus, pursue research and development, and evolve its products and services. Non-core businesses are ones where Alibaba wants to realize value by making them profitable, “or through other means of capitalization,” Wu said.

First-ever dividend payout

The company also announced that it will issue its first-ever annual cash dividend in 2023. Companies use dividends to share a portion of their profit with shareholders.

In the release, Alibaba said that its board of directors had approved an annual $0.125 per ordinary share or $1 per American depositary share (ADS) cash dividend for the fiscal year.

The aggregate amount of the dividend will be roughly $2.5 billion. Alibaba will pay the sum out to investors at the close of business on Dec. 21, 2023, Hong Kong Time and New York Time, respectively.

“Going forward, we will continue to review and determine the dividend amount based on factors such as business fundamentals, capital requirements, among others, on an annual basis,” Alibaba said in its earnings release.

On the earnings call Thursday, Wu said that Cainiao, one of the remaining divisions still pursuing an IPO, saw “relatively rapid growth this quarter,” and that the business was continuing to focus on building out its global smart logistics network.

He outlined a three-year plan for the unit, including scaling up investment in technology, seeking growth in cross-border e-commerce, and growing its international business.