The Dow and S&P 500 rose on Tuesday as stronger-than-expected results and outlooks from Walmart and Home Depot bolstered views on the health of consumers, while technology shares declined and weighed on the Nasdaq.

There is also noteworthy activity in the options market, where a total volume of 37,128,981 contracts was traded on Tuesday. From the overall options trades, 41% are puts, and 59% are calls.

Unusual Options Activity

1、Communication Services Stocks

Top 10: META, FUBO, SE, NFLX, ASTS, RBLX, GOOGL, ROKU, GTN, VZ

Noteworthy Activity

- Regarding META, there is a call option sweep with bullish sentiment. It expires in 3 days on August 19, 2022. Parties traded 179 contracts at a $180.00 strike. The total cost received by the writing party was $46.5K.

- For FUBO, observe a call option trade with bullish sentiment. It expires in 3 days on August 19, 2022. Parties traded 292 contract(s) at a $7.00 strike. The total cost received by the writing party (or parties) was $25.9K.

Related News

- FuboTV: The watchword of the company's various presentations was its plans for a "path to profitability," which culminated in a late setup from the company's chief financial officer."We continue to work towards long-term targets of adjusted EBITDA profitability and positive cash flow in 2025, and the Fubo flywheel will help us track towards that goal, as we execute a plan of controlled growth, alongside margin expansion," said Chief Financial Officer John Janedis.

- Sea Ltd. posted a bigger loss than expected and withdrew its 2022 e-commerce forecast, joining other online giants struggling to gauge an increasingly uncertain global economic outlook.

2、Information Technology Stocks

Top 10: NVDA, PAYX, SNOW, MSFT, MARA, ORCL, AAPL, RGTI, CRM, PYPL

Noteworthy Activity

Regarding NVDA, there is a call option sweep with neutral sentiment. It expires in 3 days on August 19, 2022. Parties traded 204 contracts at a $195.00 strike. The total cost received by the writing party was $33.4K.

Regarding SNOW, there is a put option trade with bearish sentiment. It expires in 3 day(s) on August 19, 2022. Parties traded 123 contract(s) at a $160.00 strike. The total cost received by the writing party (or parties) was $32.5K.

Related News

SNOW: UBS analyst Karl Keirstead downgraded the software stock to neutral from buy Tuesday, writing that he would "prefer to move to the sidelines" given some more cautious signals in his latest round of conversations with partners and customers.

3、Consumer Discretionary Stocks

Top 10: BBBY, TSLA, AMZN, CLAR, CURV, F, CVNA, PTON, LOW, CCL

Noteworthy Activity

For BBBY, there is a call option trade that happens to be bearish, expiring in 3 day(s) on August 19, 2022. This event was a transfer of 97 contract(s) at a $30.00 strike. The total cost received by the writing party (or parties) was $31.0K, with a price of $320.0 per contract. There were 14663 open contracts at this strike prior to Tuesday, and 69934 contract(s) were bought and sold on Tuesday.

Regarding TSLA, there is a call option sweep with bearish sentiment. It expires in 3 days on August 19, 2022. Parties traded 25 contracts at a $930.00 strike. This particular call needed to be split into 5 different trades to become filled. The total cost received by the writing party was $44.6K, with a price of $1786.0 per contract. There were 33644 contracts were bought and sold on Tuesday.

Related News

Tesla: The company revealed that the electric vehicle manufacturer plans to enact a three-for-one share split on Aug. 17. Furthermore, CEO Elon Musk tweeted a hint that two new EV models will be shipped out.

BBBY: Cohen just loaded up on Bed Bath & Beyond call options. Via a regulatory filing yesterday, Ryan Cohen’s RC Ventures made a big bet on BBBY stock hitting very high price targets. These targets range from the $60 to $80 level, meaning Cohen could lose the entirety of his bet if shares fail to trade at these levels by the January 2023 expiry.

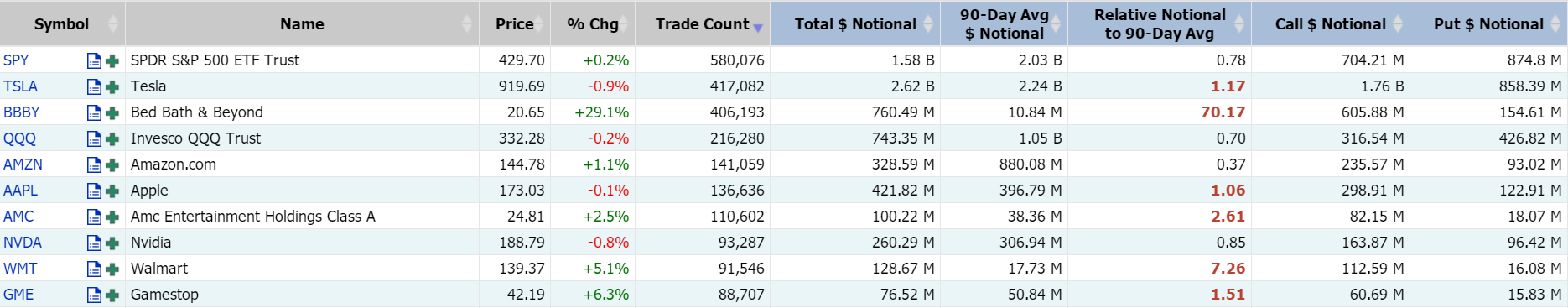

Top 10 Option Volumes

Option traders turn to Tesla before a three-for-one share split, where a total volume of 417,082 contracts has been traded on Tuesday.

Note: High option volumes provide clues as to investor interest or sentiment. Symbols with high volumes relative to recent historical averages indicate unusual investor activity, backed up with a commitment to trade based on their sentiment.

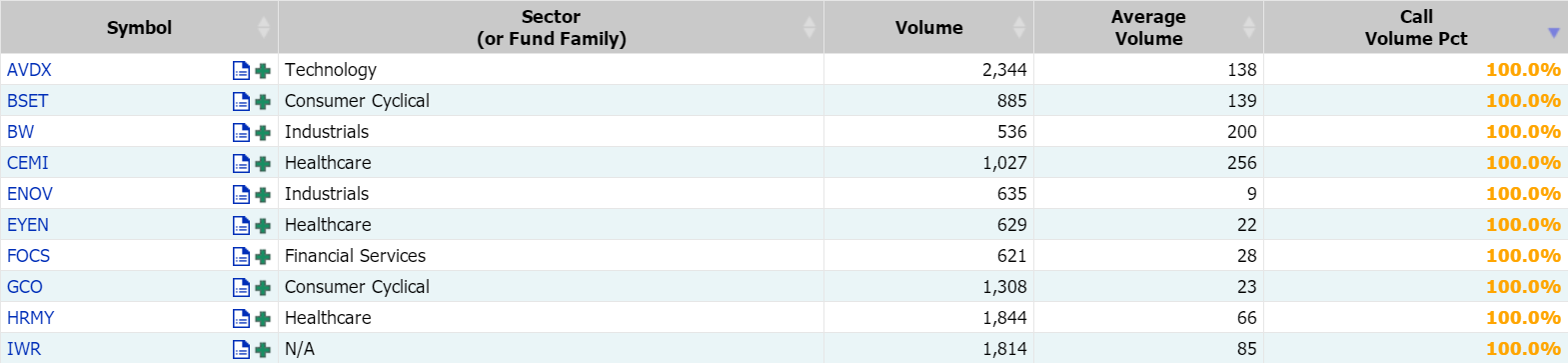

High Call/Put Volume

High Call Pct

There are 18 stocks with a call volume pct of 100%, of which 7 have a turnover of over 1,000, of which the data services company AvidXchange has a turnover of 2,344.

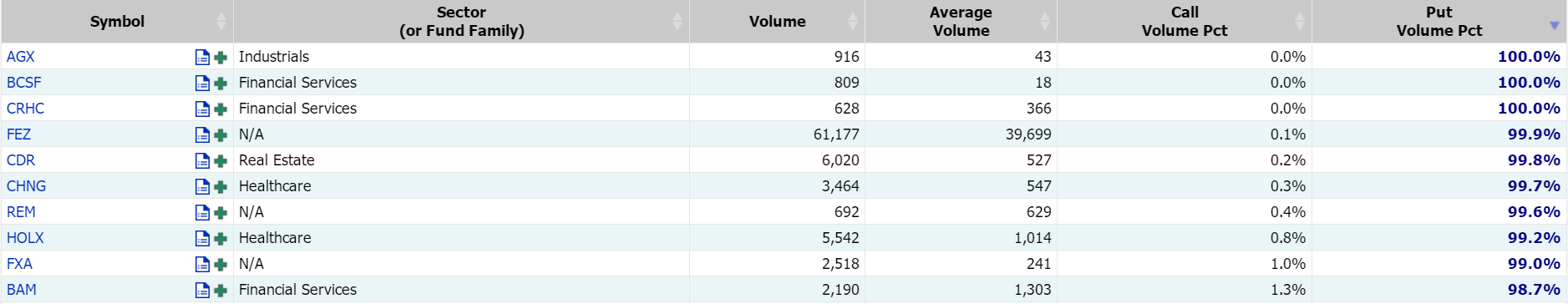

High Put Pct

Note: High Call Pct/High Put Pct refers to the current call/put ratio of the relevant option underlying. The higher the ratio, the higher the call/put contract ratio of the option underlying.

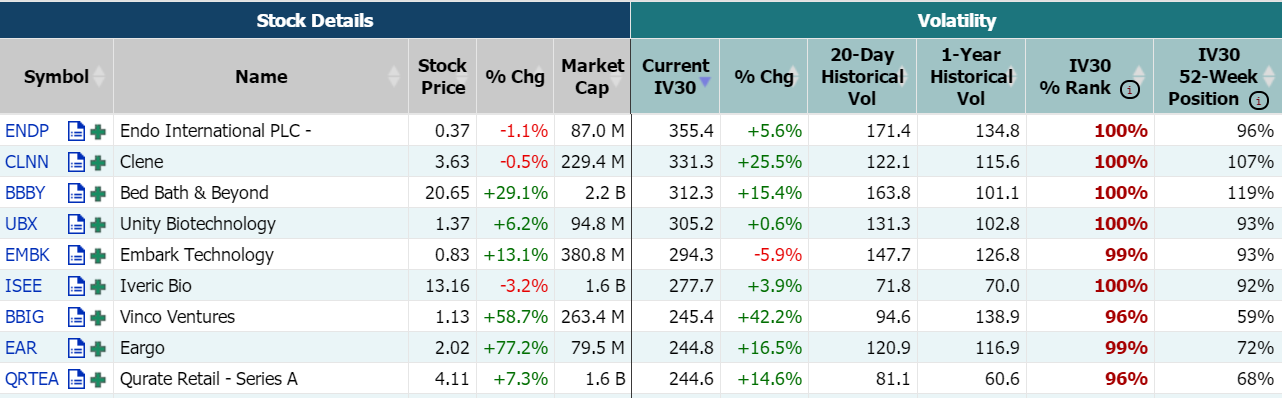

Option Implied Volatility Rankings

Implied volatility of WSB concept 3B home reached 312.3. The stock price has fluctuated greatly recently, and it has been on the list for several days.

Note: The level of the implied volatility of an option signals how traders may be anticipating future stock movements. By comparing implied volatility to historical averages, investors find insights into which equities may be facing higher or lower future volatility in the future.

Options with elevated implied volatility are an indication that investors are anticipating the underlying equity to experience higher than normal price swings relative to its historical range.