U.S. stock futures were subdued on Thursday as investors focused on the raging conflict in Ukraine and the outlook for U.S. interest rate hikes, with the main indexes on course for their worst quarterly performance since the pandemic crash in 2020.

Much of the optimism seen earlier this week around the peace talks faded as Ukrainian forces prepared for fresh Russian attacks in the southeast region. The countries will resume peace talks online on April 1.

Oil majors Exxon Mobil and Chevron both fell about 2% in premarket trading, tracking a 5% tumble in crude prices after news that the United States was considering a record release of reserves.

U.S. initial jobless claims rose 14,000 to 202,000 in latest week; Consumer spending increases 0.2% in February, below forecast; PCE inflation index rises 0.6% in February, core up 0.4%; 12-month increase in PCE climbs to 6.4% in February from 6.0%; 12-month increase in core PCE rises to 5.4% from 5.2%; Personal incomes increases 0.5% in February; U.S. savings rate climbs to 6.3% in February from 6.1%.

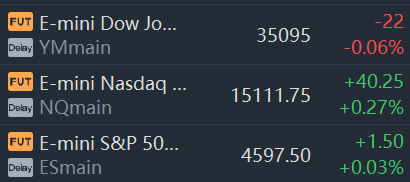

Market Snapshot

At 08:35 a.m. ET, Dow e-minis were down 22 points, or 0.06%, S&P 500 e-minis were up 1.5 points, or 0.03%, and Nasdaq 100 e-minis were up 40.25 points, or 0.27%.

Pre-Market Movers

Baidu(BIDU) – Baidu lost 2.2% in premarket trading after the SEC added the search engine company to its list of U.S.-traded China stocks that could be delisted if they don’t allow American regulators to review three years’ worth of financial audits. Online entertainment company iQYI(IQ) was also added to that list, with its shares sliding 10.7%.

Advanced Micro Devices(AMD) – Advanced Micro Devices was downgraded to “equal weight” from “overweight” at Barclays, which points to cyclical risk in several different end markets for the semiconductor maker. AMD fell 2% in premarket action.

Novavax(NVAX) – The drug maker’s shares gained 1% in premarket trading after it asked EU regulators to clear its Covid-19 vaccine for use in teenagers.

Walgreens(WBA) – The drug store operator reported an adjusted quarterly profit of $1.59 per share, 19 cents above estimates, with revenue also topping Wall Street forecasts. Comparable pharmacy sales rose 7.3%, helped by demand for Covid vaccines. Walgreens shares initially rose in the premarket but lost their gains and dipped negative.

HP Inc.(HPQ), Dell Technologies(DELL) – Morgan Stanley downgraded both computer equipment makers, predicting companies will shift spending away from hardware due to macroeconomic uncertainty. HP was cut to “underweight” from “equal-weight” while Dell was cut to “equal-weight” from “overweight.” HP fell 3.7% in premarket trading, while Dell lost 3.2%.

Kinross Gold(KGC) – The gold mining company is in talks to sell a Russian mine to Russia-backed investment firm Fortiana Holdings, according to people familiar with the matter who spoke to The Wall Street Journal. It would be the first sale of an asset left behind in Russia by a Western company.

Amylyx Pharmaceuticals(AMLX) – An FDA panel voted against recommending the approval of an experimental ALS drug developed by Amylyx. The panel said study data failed to prove that the drug was effective in fighting the disease. Amylyx erased early premarket losses to rise by 2.4%.

Expensify(EXFY) – Expensify tumbled 8.9% in the premarket after the online expense management company reported a lower-than-expected quarterly profit and issued a weaker-than-expected revenue forecast for the current quarter.

Market News

The Biden administration is considering releasing up to 180 million barrels of oil over several months from the Strategic Petroleum Reserve (SPR), four U.S. sources said on Wednesday, as the White House tries to lower fuel prices.

The Securities and Exchange Commission on Wednesday added Baidu Inc. to a growing list of companies that may get kicked off American stock exchanges because of Beijing’s refusal to permit U.S. officials to review their auditors’ work.

The SEC’s publication of the businesses’ names is required by a 2020 U.S. law that started a three-year clock for firms to comply with inspection requirements that cover all public companies in the U.S. The SEC also added Futu Holdings Limited, Nocera Inc., iQIYI Inc. and CASI Pharmaceuticals Inc. to its provisional list for possible delisting.

From a team at Goldman Sachs led by chief global strategist Peter Oppenheimer, warns this stock market’s best days are over for now.While it’s perfectly understandable that investors may have missed this latest rally, Oppenheimer’s team sees “little upside in the short term” — the team’s end-2022 target is 4,700, just 2% above current levels.