The Board of Directors of Kuaishou Technology has announced the audited consolidated results of the Company for the year ended December 31, 2020. The consolidated financial statements for the year ended December 31, 2020 have been audited by PricewaterhouseCoopers, the independent auditor of the Company (the “Auditor”) in accordance with International Standards on Auditing. The results have been reviewed by the Audit Committee.

Kuaishou Technology :

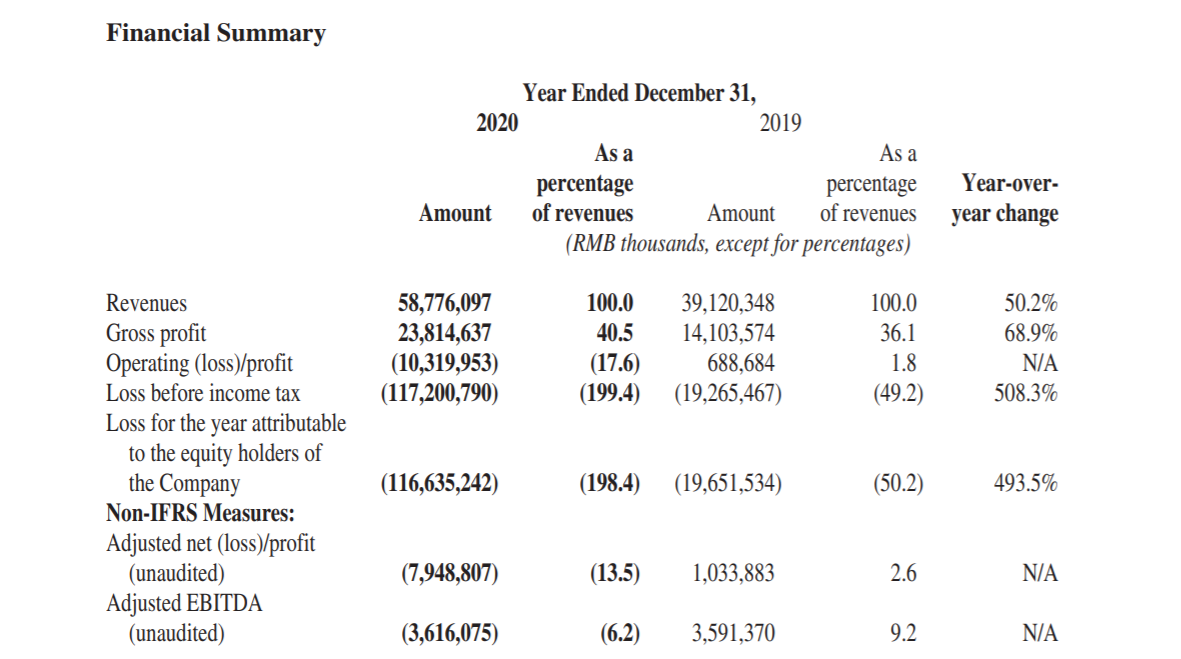

* FY ADJUSTED NET LOSS RMB 7.95 BILLION VERSUS PROFIT OF RMB1.03 BILLION

* FY TOTAL REVENUE GREW TO RMB58.8 BILLION FROM RMB39.1 BILLION IN 2019

* FY OPERATING LOSS RMB10.32 BILLION VERSUS PROFIT OF RMB688.7 MILLION

* KUAISHOU TECHNOLOGY FY LOSS ATTRIBUTABLE RMB116.64 BILLION VERSUS LOSS OF RMB19.65 BILLION

* FOR YEAR ENDED DEC 31 2020, AVERAGE DAUS 264.6 MILLION

* AVERAGE DAILY TIME SPENT PER DAU ON KUAISHOU APP INCREASED BY 17.0% TO 87.3 MINUTES IN 2020

Business Overview

Year 2020 was indeed a memorable year. COVID-19 surprised the world with challenges and uncertainties. It also changed how we live and brought new opportunities as people spent more time online to socialize, be entertained, shop, acquire knowledge and information and more. Kuaishou, as a leading content community and social platform, helped people discover a vast world of content that expands their interests and horizons. We also played a role in driving digitization and contributing to overall economic recovery. We will continue forging ahead to create value for our users and customers through our deep and diverse content offerings, effective service solutions and AI-powered technologies to help people discover their needs and use their talents to improve their lives and their unique brand of happiness.

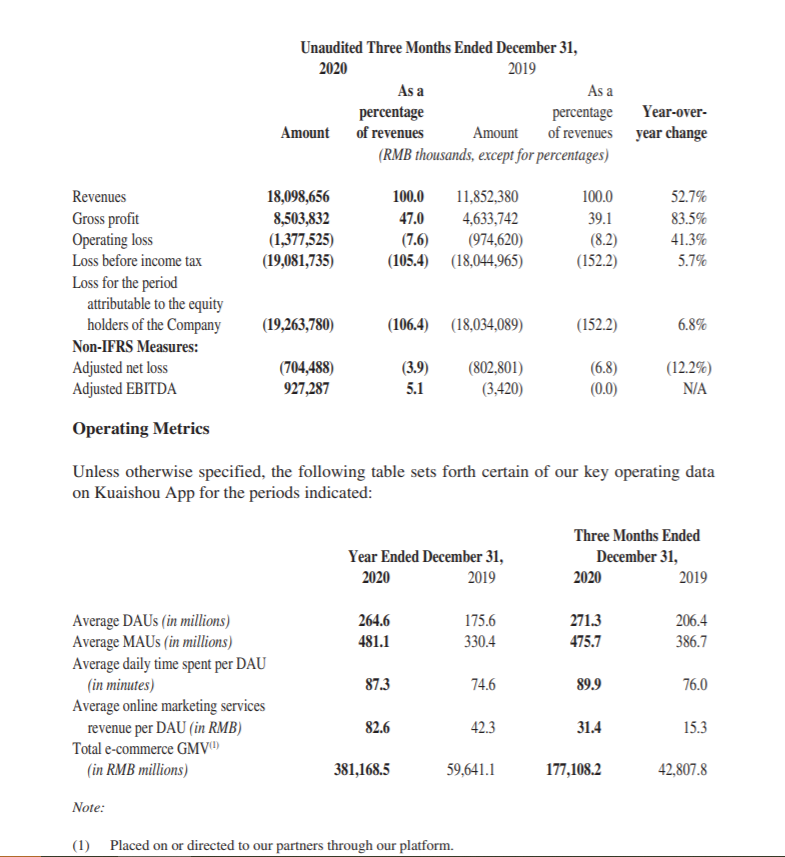

In 2020, we continued enriching our content, product and service offerings to discover and serve our users’ needs to keep them actively engaged within our ecosystem. As a result, we have seen a substantial increase of our user base in 2020 as well as robust gains in user engagement. Our average DAUs and MAUs on all our apps and mini programs in China in 2020 were 308.1 million and 777.0 million, respectively. The average DAUs and MAUs on Kuaishou App in 2020 were 264.6 million and 481.1 million, respectively, representing a year-over-year increase of 50.7% and 45.6%, respectively. The average daily time spent per DAU on Kuaishou App increased by 17.0% to 87.3 minutes in 2020 from 74.6 minutes in 2019.

We are committed to improving the quality, relevance and diversity of our content offerings to address evolving user interests and needs on our platform, which in turn encourages content creation. Our growing user base forms the bedrock of our content community and our users are the key sources of boundless creativity. Over 25% of our average MAUs on Kuaishou App were content creators in 2020. We also started exploring new content formats that can contribute to the vibrancy of our ecosystem and attract new users.

Kuaishou has inspired many to create and has become the platform of choice for content creation and business activities. As more users use Kuaishou App, the more diverse and vibrant our ecosystem becomes, thereby increasing user engagement and the value we provide to our ecosystem participants. Users’ interactions and trust greatly enhance our monetization capabilities, which in turn, attracts more advertisers, merchants and other business partners to our platform. In addition, our strong user engagement and advanced technologies enable us to understand our users better and provide more efficient and appealing services to our users and customers.

For the full year ended December 31, 2020, our total revenue grew significantly to RMB58.8 billion from RMB39.1 billion in 2019, posting a year-over-year increase of 50.2%, which was primarily attributable to the robust growth in our online marketing services and other services including e-commerce. Our online marketing services revenue continued its rapid growth in 2020, increasing by 194.6% to RMB21.9 billion from RMB7.4 billion in 2019. Revenue contribution from online marketing services to total revenue increased from 19.0% in 2019 to 37.2% in 2020. Live streaming represented 56.5% of our total revenue and the remaining 6.3% was attributable to other services. Due to the change in our revenue mix, our gross margin improved to 40.5% from 36.1% in 2019.

Online marketing services

Online video-based advertising is a promising market and online marketing service is one of the key strategic businesses for our long-term growth. Our massive and highly engaged user community makes our platform increasingly attractive to advertisers.

In 2020, we launched an integrated advertising platform, further solidifying the foundation of our online marketing services. Our strong user engagement and advanced technologies empowered us to achieve precise understanding of our users, and sophisticated advertising content development and distribution, which led to improved advertising efficiency and effectiveness. We introduced an increasing number of powerful and intuitive tools and services to empower advertisers, allowing them to more precisely reach and engage with their target customers. Furthermore, we expanded our sales team and channel coverage, as well as giving greater emphasis to a more diverse set of advertising formats, such as branding advertisement and advertising union, in addition to short video feeds advertisement. In order to optimize our user experience, we also reinforced our cooperation with advertisers and content creators to deliver unique and customized ad content. At the same time, through refined algorithms and enriched ad materials, the ad content became less disruptive to our users.

As a result, we enjoyed robust growth in online marketing services. Revenue from online marketing services in 2020 increased by 194.6% to RMB21.9 billion, from RMB7.4 billion in 2019. Our average online marketing services revenue per DAU in 2020 increased by 95.3% to RMB82.6 from RMB42.3 in 2019. In the fourth quarter of 2020, online marketing services became the largest contributor to our total revenue, as a percentage of revenue, it surpassed the contribution of live streaming business for the first time.

Live streaming

We believe that people’s needs will be increasingly met online and that live streaming provides an ideal format and an infrastructure through which those needs can be met, due to its highly social, interactive, and immersive nature. As our scale continues to grow, together with the stronger network effect, our live streaming business nurtures our ecosystem and serves more than just a revenue contributor, but a vibrant and solid foundation from which more social interactions and new valuable businesses are derived, such as e-commerce live streaming.

In 2020, we further expanded our abundant and diverse live streaming content with more premium content, such as game events and sports events live streaming, as well as through cooperation with more high-quality content creators. We also devoted ourselves to developing more interactive features and events to enhance our live streaming experience. These efforts have been effective in increasing live streaming user engagement. In 2020, over 1.7 billion live streaming sessions were hosted on Kuaishou App. For the year ended December 31, 2020, revenue from live streaming increased by 5.6% to RMB33.2 billion from RMB31.4 billion in 2019. More importantly, as a result of our diverse content offering, highly interactive features as well as unique and strong social trust, the user community was even more engaged on our platform, which was demonstrated by the increase in average MPUs for live streaming. For the full year 2020, our average MPUs for live streaming increased by 17.8% to 57.6 million from 48.9 million in 2019, while our monthly ARPPU for live streaming was RMB48.0, which was RMB53.6 in 2019. For the fourth quarter of 2020, our average MPUs for live streaming was 50.8 million, increased from 50.2 million in the same period of 2019. Our monthly ARPPU for live streaming in the fourth quarter was RMB51.8, which was RMB56.6 in the same period of 2019.

Other services including e-commerce

Other services, which primarily comprise e-commerce services, also achieved rapid growth in 2020. The highly engaged user base and strong social trust on our platform gave rise to natural opportunities for transactions between users and our business partners.

In 2020, we continued to support the improvement of our ecosystem, as well as to provide more products and services to address our users’ needs, thereby further enhancing the trust and encouraging interactions among users, merchants and our platform. First, we invested in e-commerce infrastructure to facilitate transactions on our platform by providing various tools to help merchants manage their stores on our platform. Second, we incentivized high-quality merchants, as well as supported middle and long-tail merchants by providing training to help them improve their service capabilities and quality. Third, we were dedicated to strengthening platform governance, especially quality control and merchants supervision. We are pleased to see that the overall customer purchasing experience and satisfaction were further optimized.

By doing these, we attracted a greater number of superior merchants and expanded the product categories and offerings on our platform. As a result, the total GMV of e-commerce transactions facilitated on our platform increased significantly from RMB59.6 billion in 2019 to RMB381.2 billion in 2020. The average repeat purchase rate increased further to 65% in 2020 from 45% in 2019.

Business Outlook

In 2021, we will continue to serve our users and customers, create value for them, and solidify our leading position in the global short video and live streaming industry.

In this promising industry, we will continue to reinforce and invest in our ecosystem by continuing enriching and improving the quality and diversity of our content offerings to attract and retain a broad user base; improving the experience of our users and business partners through enhanced functionalities, products and services to fulfill evolving user needs; expanding user reach through precise marketing and promotional activities; as well as strengthening our user-centric commercialization capabilities by further enhancing technological capabilities and developing more monetization opportunities. We believe platforms with stronger social attributes and interactions will enjoy stronger network effects and lay a solid foundation for long-term development.