BEIJING, March 26, 2021 /PRNewswire/ -- RLX Technology Inc. ("RLX Technology" or the "Company") (NYSE: RLX), a leading branded e-vapor company inChina, today announced its unaudited financial results for the fourth quarter and the fiscal year endedDecember 31, 2020.

Fourth Quarter 2020 Financial Highlights

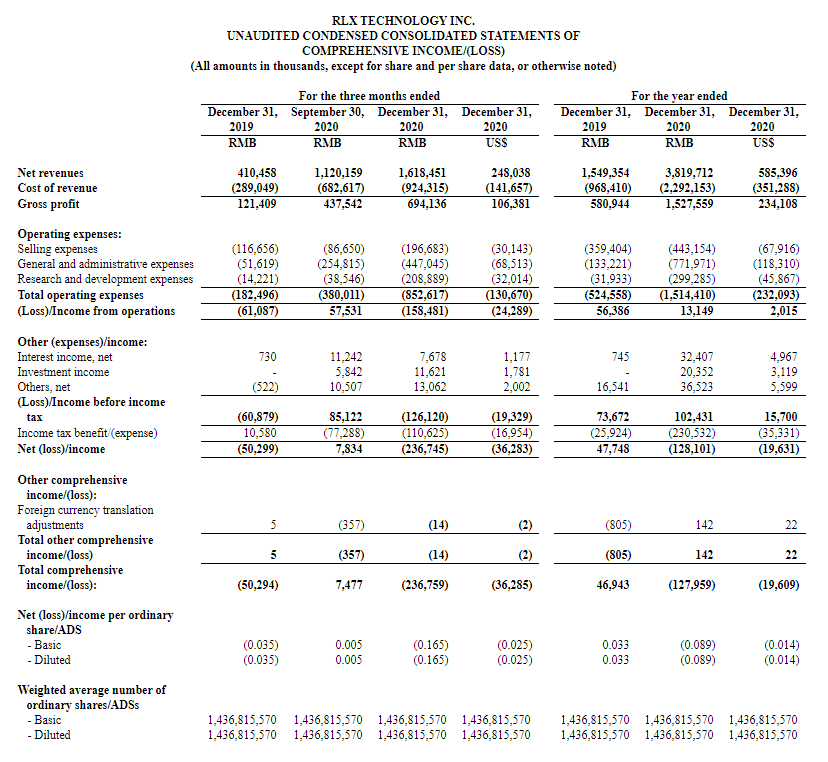

- Net revenueswereRMB1,618.5 million(US$248.0 million), representing an increase of 44.5% fromRMB1,120.2 millionin the third quarter of 2020.

- Gross marginwas 42.9%, compared to 39.1% in the third quarter of 2020.

- Net losswasRMB236.7 million(US$36.3 million), compared with net income ofRMB7.8 millionin the third quarter of 2020.

- Non-GAAP net income[1]wasRMB419.3 million(US$64.3 million).

[1]Non-GAAP net (loss)/income is a non-GAAP financial measure. For more information on the Company's non-GAAP financial measures, please see the section "Non-GAAP Financial Measures" and the table captioned "Unaudited Reconciliation of GAAP and Non-GAAP Results" set forth at the end of this press release. |

Fiscal Year 2020 Financial Highlights

- Net revenueswereRMB3,819.7 million(US$585.4 million) in fiscal year 2020, representing an increase of 146.5% fromRMB1,549.4 millionin the prior year.

- Gross marginwas 40.0% in fiscal year 2020, compared to 37.5% in the prior year.

- Net losswasRMB128.1 million(US$19.6 million) in fiscal year 2020, compared with net income ofRMB47.7 millionin the prior year.

- Non-GAAP net incomewasRMB801.0 million(US$122.8 million).

"We are pleased to report financial and operational results for the fourth quarter of 2020. Throughout 2020, despite challenges stemming from COVID-19, our business remained resilient, and our management team maintained our focus on building and strengthening RELX as a trusted brand for adult smokers," said Ms.Ying (Kate) Wang, Co-founder, Chairperson of the Board of Directors and Chief Executive Officer of RLX Technology. "We continue to consistently uphold and practice our ethical principles, including facilitating the prevention of underage use of our products through our industry pioneeringGuardian Program,introducing effective age-verification practices to the industry. This fourth quarter also witnessed the first anniversary of the launch of ourSunflower System, our technology-driven underage-access-prevention system. In addition, we continued to advance ourGolden Shield Programin cooperation with the public, media and local authorities to combat sales of counterfeit products."

"Looking forward, we plan to further solidify our leadership as we endeavor to continue investment in scientific research, enhance our technology and product development, strengthen our distribution and retail network, bolster supply chain and production capabilities, and extend our global capabilities. These strategic initiatives are designed to support our growth over the long-term," Ms. Wang concluded.

Closing of Initial Public Offering ("IPO")

OnJanuary 26, 2021, the Company completed the closing of its initial public offering of 133,975,000 American depositary shares ("ADSs"), each representing one Class A ordinary share. The number of ADSs issued at closing included 17,475,000 ADSs issued pursuant to the exercise in full of over-allotment option by the underwriters. At a price to the public ofUS$12.00per ADS, the total offering size wasUS$1,607.7 million.

Fourth Quarter 2020 Unaudited Financial Results

Net revenues increased by 44.5% toRMB1,618.5 million(US$248.0 million) in the fourth quarter of 2020 fromRMB1,120.2 millionin the third quarter of 2020. The increase was primarily due to an increase in net revenues from sales to offline distributors, which was mainly attributable to the expansion of the Company's distribution and retail network.

Gross profit increased by 58.6% to RMB694.1 million (US$106.4 million) in the fourth quarter of 2020 fromRMB437.5 millionin the third quarter of 2020.

Gross margin increased to 42.9% in the fourth quarter of 2020, compared to 39.1% in the third quarter of 2020.

Operating expenses wereRMB852.6 million(US$130.7 million) in the fourth quarter of 2020, representing an increase of 124.4% fromRMB380.0 million in the third quarter of 2020.

Selling expensesincreased by 127.0% to RMB196.7 million (US$30.1 million) in the fourth quarter of 2020 fromRMB86.7 millionin the third quarter of 2020. The increase was mainly driven by (i) an increase in share-based compensation expenses, and (ii) an increase in branding material expenses.

General and administrative expenses increased by 75.4% toRMB447.0 million(US$68.5 million) in the fourth quarter of 2020 fromRMB254.8 millionin the third quarter of 2020. The increase wasprimarilydue to (i) an increase in share-based compensation expenses, and (ii) an increase in professional service fees.

Research and development expensesincreased by 441.9% to RMB208.9 million (US$32.0 million) in the fourth quarter of 2020 fromRMB38.5 millionin the third quarter of 2020. The increase wasprimarilydriven by (i) an increase in share-based compensation expenses, and (ii) an increase in software and technical service expenses.

Share-based compensation expenses recognized in selling expenses, general and administrative expenses and research and development expenses in total wereRMB656.1 million (US$100.6 million) in the fourth quarter of 2020 andRMB238.2 million in the third quarter of 2020. The increase was primarily due to the increase in fair value of ordinary shares of Relx Inc.

Loss from operations wasRMB158.5 million (US$24.3 million) in the fourth quarter of 2020, compared with income from operations ofRMB57.5 millionin the third quarter of 2020.

Income tax expense wasRMB110.6 million (US$17.0 million) in the fourth quarter of 2020, compared with income tax expense ofRMB77.3 millionin the third quarter of 2020, primarily due to an increase in taxable income.

Net loss wasRMB236.7 million (US$36.3 million) in the fourth quarter of 2020, compared with net income ofRMB7.8 millionin the third quarter of 2020.

Non-GAAP net incomewasRMB419.3 million(US$64.3 million) in the fourth quarter of 2020.

Basic and diluted net loss per American depositary share ("ADS") were bothRMB0.165(US$0.025)in the fourth quarter of 2020, compared to basic and diluted net income per ADS ofRMB0.005in the third quarter of 2020.

Non-GAAP basic and diluted netincome per ADS[2]were bothRMB0.292(US$0.045)in the fourth quarter of 2020, compared toRMB0.171in the third quarter of 2020.

[2]Non-GAAP basic and diluted net (loss)/income per ADS is a non-GAAP financial measure. For more information on the Company's non-GAAP financial measures, please see the section "Non-GAAP Financial Measures" and the table captioned "Unaudited Reconciliation of GAAP and Non-GAAP Results" set forth at the end of this press release. |

Fiscal Year 2020 Unaudited Financial Results

Net revenues increased by 146.5% to RMB3,819.7 million (US$585.4 million) in fiscal year 2020 fromRMB1,549.4 million in the prior year. The increase was primary due to an increase in net revenues from sales to offline distributors.

Gross profit increased by 162.9% to RMB1,527.6 million (US$234.1 million) in fiscal year 2020 fromRMB580.9 millionin the prior year.

Gross margin was 40.0% in the fiscal year 2020, compared to 37.5% in the prior year.

Operating expenses wereRMB1,514.4 million(US$232.1 million) in fiscal year 2020, representing an increase of 188.7% fromRMB524.6 million in the prior year.

Selling expensesincreased by 23.3% toRMB443.2 million(US$67.9 million) in fiscal year 2020 fromRMB359.4 millionin the prior year. The increase was primarilydue to (i) an increase in share-based compensation expenses, and (ii) an increase in salaries and welfare benefits to the Company's selling personnel, partially offset by a decrease in e-commerce platform service expenses as the Company closed its stores on e-commerce platforms and ceased collaboration with e-commerce platform distributors in response to theOctober 2019Announcement.

General and administrative expenses increased by 479.5% toRMB772.0 million(US$118.3 million) in fiscal year 2020 fromRMB133.2 millionin the prior year. The increase was primarilyattributable to (i) an increase in share-based compensation expenses, and (ii) an increase in salaries and welfare benefits to the Company's general and administrative personnel.

Research and development expensesincreased by 837.2% toRMB299.3 million(US$45.9 million) in fiscal year 2020 fromRMB31.9 millionin the prior year. The increase was primarilydue to (i) an increase in share-based compensation expenses, and (ii) an increase in salaries and welfare benefits to the Company's research and development personnel.

Share-based compensation expenses recognized in selling expenses, general and administrative expenses and research and development expenses in total wereRMB929.1 million(US$142.4 million) in fiscal year 2020 andRMB52.7 millionin the prior year, primarily due to the increase in fair value of ordinary shares of Relx Inc.

Income from operationsdecreased by 76.7% toRMB13.1 million(US$2.0 million) in fiscal year 2020 fromRMB56.4 millionin the prior year.

Income tax expense wasRMB230.5 million (US$35.3 million) in fiscal year 2020, representing an increase of 789.3% fromRMB25.9 million in the prior year. The increase was primarilydue to an increase in taxable income.

Net loss wasRMB128.1 million(US$19.6 million) in fiscal year 2020, compared with net income ofRMB47.7 millionin the prior year.

Non-GAAP net incomewasRMB801.0 million(US$122.8 million) in fiscal year 2020.

Basic and diluted net loss per ADS were bothRMB0.089(US$0.014)in fiscal year 2020, compared to basic and diluted net income per ADS ofRMB0.033in the prior year.

Non-GAAP basic and diluted netincome per ADSwere bothRMB0.557(US$0.085)in fiscal year 2020, compared toRMB0.070per ADS in the prior year.

Balance Sheet

As ofDecember 31, 2020, the Company had cash and cash equivalents, restricted cash, short-term bank deposits and short-term investments ofRMB3,421.4 million (US$524.4 million), compared toRMB811.7 millionas ofDecember 31, 2019.

Business Outlook

For the first quarter of 2021, the Company currently expects net revenues to exceedRMB2,300 million, and expects non-GAAP net income to exceedRMB590 million. The Company's expected net income will also include share-based compensation expenses which depend on the Company's share price and are not available without unreasonable efforts. The Company also expects gross margin toremain steady.

The above outlook is based on the current market conditions, including those related to the COVID-19 pandemic, and reflects the Company's preliminary estimates of market and operating conditions, and users' demand, which are all subject to change. Please refer to "Safe Harbor Statement" in this press release for risks associated with forward-looking statements.