One element that stood out during such a rough year for technology stocks was that the FAANG group (Facebook holding company Meta Platforms Inc., Apple Inc. , Amazon.com Inc., Netflix Inc. , Google holding company Alphabet Inc. plus Microsoft lost $1.404 trillion in market capitalization during April. More data about the group's performance is below.

Index summary

- On April 29 the Dow Jones Industrial Average DJIA was down 939 points (or 2.8%) to close at 32,977.21. The Dow fell 4.9% during April and is now down 9.2% for 2022. (All price changes in this article exclude dividends.)

- The S&P 500 index SPX was hit harder, with a decline of 3.6% on Friday. The U.S. benchmark declined 8.8% in April and has now fallen 13.3% in 2022. Among the worst performers on Friday was Amazon, which took a 14% dive after the company reportedits first quarterly losssince 2015.

- The Nasdaq Composite Index COMP tumbled 4.2% on Friday; its decline for the week was 3.9% and it is now down 21.2% for 2022. One of the highest-profile decliners in the Nasdaq was Teladoc Health Inc.TDOC,which was down 42% for the week (although it was up slightly on Friday). The stock plunged 40% on April 28 after the companyreduced its outlook for sales and earningssignificantly.

- The Nasdaq-100 Index NDX fared even worse on Friday, sliding 4.5%. Its one-week decline was 3.8% and it has gone down 21.2% this year.

FAANG summary

Here’s a snapshot of market capitalizations for the FAANG + Microsoft group this year, with data in billions:

S&P 500 decliners

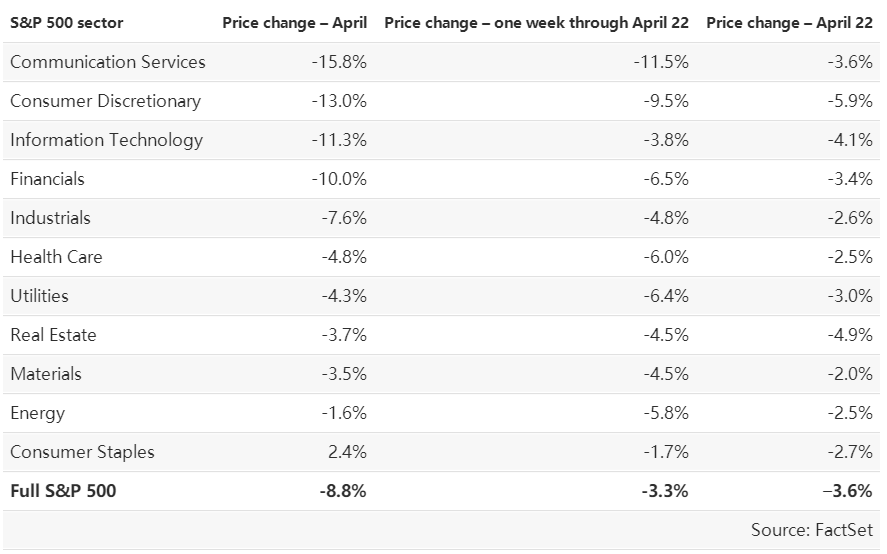

All sectors of the S&P 500 were down during April, except consumer staples: