Turning Point Therapeutics stock has more than doubled after Bristol Myers Squibb announced that it had agreed to buy the company. It's just the latest deal for a beaten-up biotech stock.

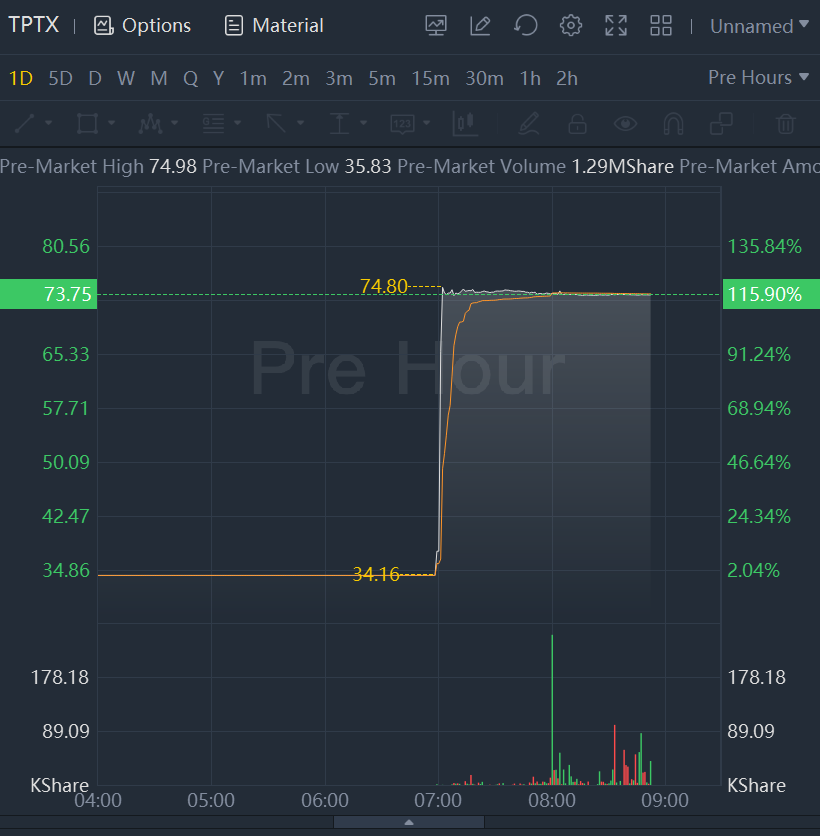

Turning Point stock (TPTX) was up 115.9% to $73.75 at 8:52 a.m. Friday after Bristol $(BMY)$ said that it would purchase the small-cap biotech company for $76 a share. Bristol stock is little changed.

Turning Point has no current products for sale, but does have a lung cancer drug in clinical trials, and is working on other cancer treatments. Apparently, Bristol feels good enough about these treatments -- and the technology behind them -- to pay up for the company.

"The acquisition of Turning Point Therapeutics further broadens our leading oncology franchise by adding a best-in-class, late-stage precision oncology asset," Bristol CEO Giovanni Caforio said in a statement. "With this transaction, we are continuing our strong track record of strategic business development to further enhance our growth profile."

The deal is just the latest in the biotech space. Pfizer $(PFE)$ announced the acquisition of Biohaven $(BHVN)$ for $11 billion on May 10, while GlaxoSmithKline $(GSK)$ said it would buy Sierra Oncology $(SRRA)$ for $1.9 billion in April.

Still, the M&A hasn't helped biotech stocks as of yet. the SPDR S&P Biotech Pacer Swan SOS Fund of Funds ETF|ETF $(XBI)$ has dropped 39% this year, and is up just 0.4% over the past week even as the SPDR S&P 500 ETF $(SPY.AU)$ has gained 3%. Turning Point stock had dropped 28% through Thursday's close.

Bristol-Myers was a Barron's stock pick on May 26, in part for a pipeline that includes more than 10 potential cancer treatments. Now it has another.