(Reuters) - Shares of AMTD Digital on Wednesday extended an eye-popping rally fueled by retail investors this week that briefly took the Hong Kong-based fintech's market value past that of Facebook-owner Meta Platforms.

AMTD's shares rose another 6% in morning trading on Wednesday. The company's market capitalization surged above $320 billion, reminding investors of the meme stock mania last year that drove record rallies in shares of companies such as GameStop and AMC.

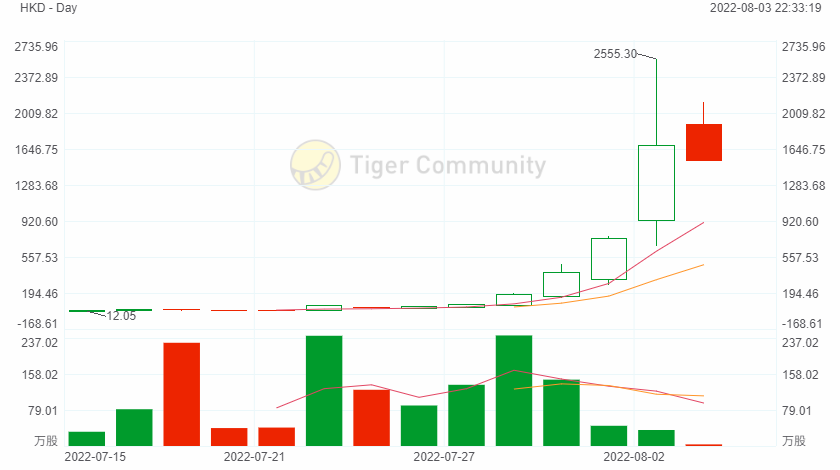

The stock has soared about 22720% since its July IPO, when it listed at a price of $7.80.

"It is clearly the newest meme stock with bands of retail traders purchasing the stock at the same time, pushing the price sharply higher," said Victoria Scholar, head of investment at Interactive Investor.

Scholar added that the bullish momentum was being exacerbated by short covering to offset losses by hedge funds with bearish positions on the stock.

The fintech company, which provides loans and services to startups in exchange for fees, has a low float and is tightly controlled by parent company AMTD Idea.

AMTD Digital said on Tuesday there was no material change or event related to the company's business and operating activities since the IPO date and that it was monitoring the share volatility.

There has been a similar surge in some other recently listed U.S. companies, including Getty Images which jumped over 200% since its debut on July 25.

"There is no quantifiable reason for the behaviour, or trajectory, as moves are sentiment driven, with these feelings being based on little information," said Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown.