If the U.S. is heading into a recession, it could show up in the biggest banks' financial results.

Rising interest rates have slowed inflation from the highest level in decades and begun to cool the hot labor market. American consumers and businesses might show signs of financial strain, and some bank chiefs have sounded dire warnings about the economy.

Banks have been setting aside money in recent quarters to cover potential losses on their loans if the economy weakens. They may add more to their coffers in the final months of the year, which would weigh on earnings.

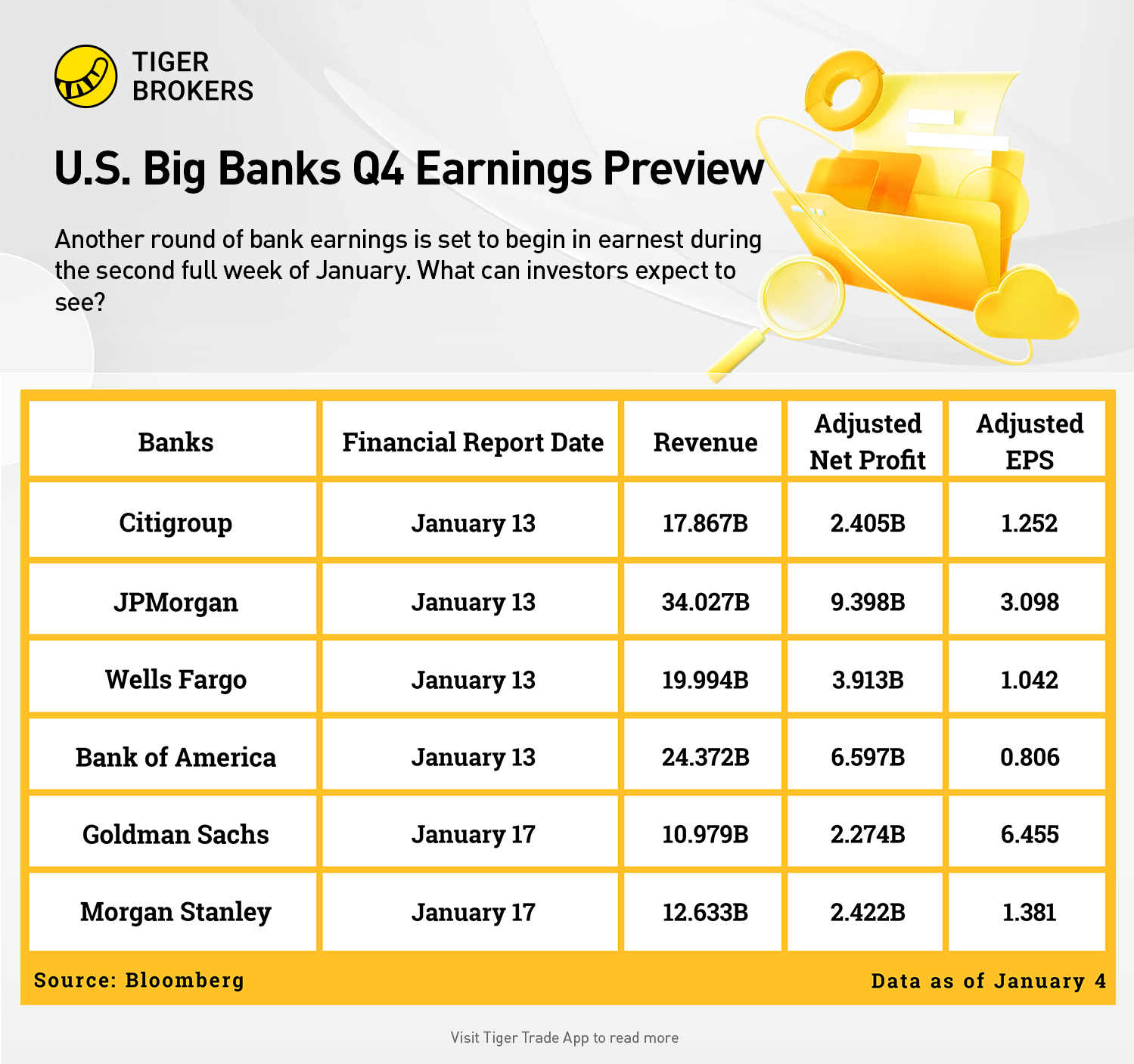

JPMorgan Chase & Co., Bank of America Corp., Citigroup Inc. and Wells Fargo & Co. will release fourth-quarter results on Friday. Goldman Sachs Group Inc. and Morgan Stanley will report next Tuesday.

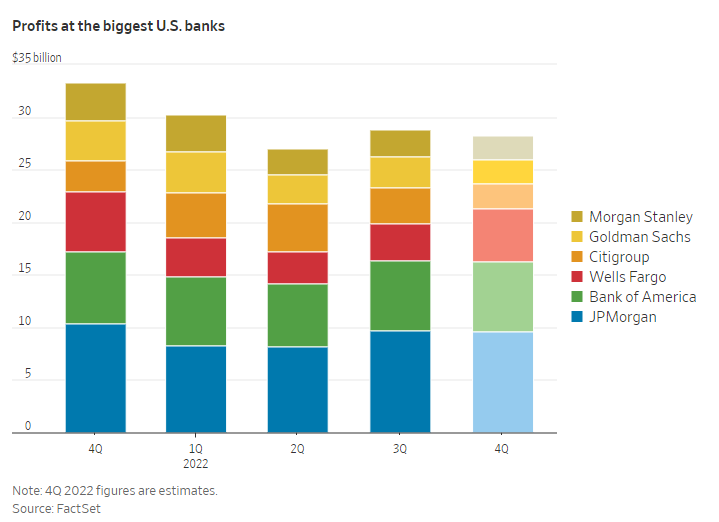

Together, the banks are expected to post some $28 billion in profits in the fourth quarter, down 15% from a year earlier, according to FactSet.

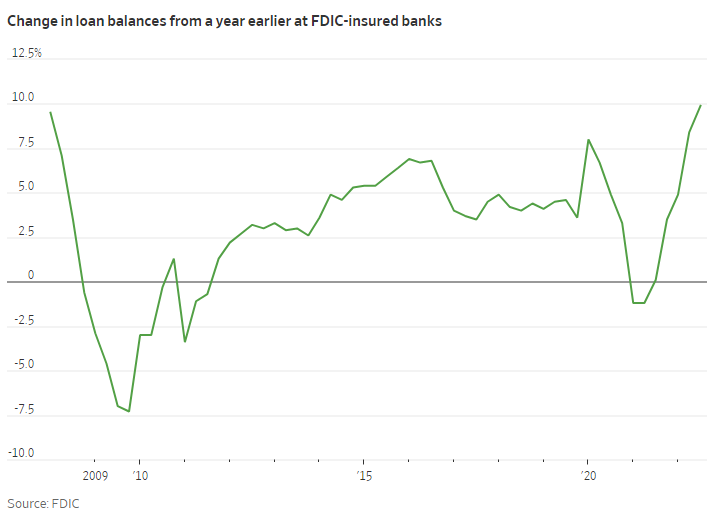

Revenues are expected to rise from a year earlier, largely thanks to the Federal Reserve's aggressive campaign to lift interest rates. That has widened the gap between what the big commercial banks pay depositors and what they earn lending money out.

The difference, known as the net interest margin, increased the most on a quarterly basis in the third quarter, according to the Federal Deposit Insurance Corp. Banks have continued to grow their loan books, particularly commercial and industrial and credit-card loans.

Higher interest rates have a downside for banks, too. At some point they will have to pay depositors more to keep that money from moving elsewhere, adding to their interest costs. So far, they have increased deposit rates marginally.

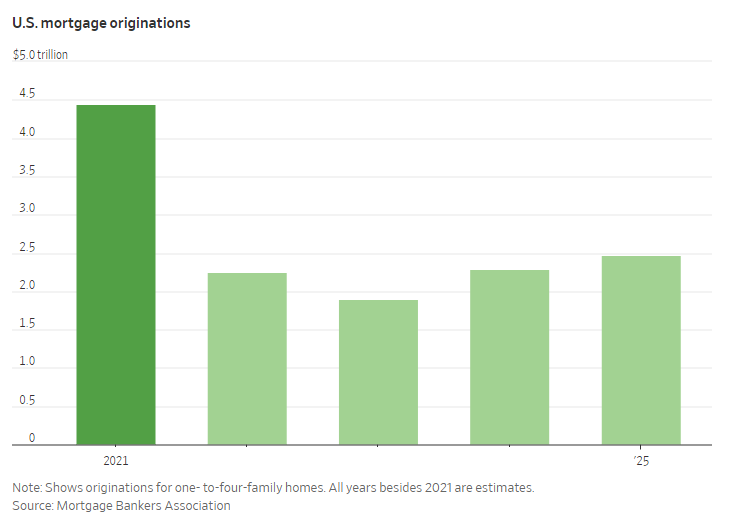

Higher rates have also brought the housing market to a standstill by sharply raising the cost to get a mortgage. That has eaten into the fee income that banks earn from home lending after a few blockbuster years during the height of the pandemic. The outlook isn't particularly bright.

Banks have stowed tons of excess cash in securities, which have been racking up billions of dollars in unrealized losses because of swooning markets. JPMorgan took a loss of almost $1 billion from selling Treasurys and mortgage-backed securities in the third quarter.

Consumers still seem to be in relatively good shape. Bank of America's internal data show median household checking and savings balances remain above prepandemic levels. Spending on debit and credit cards has continued to rise. But the bank warned that 2023 is likely to be more challenging.

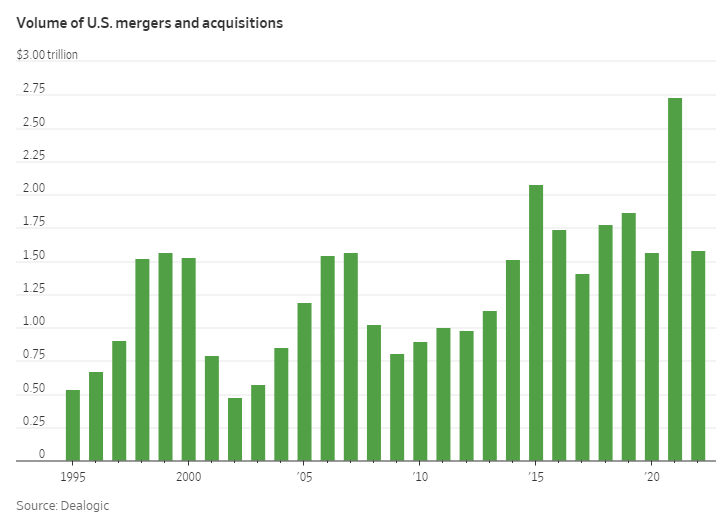

Rickety financial markets have all but ended a hot streak for deal-making. Fewer initial public offerings and mergers mean less revenue for the banks that advise them. Some investment banks have been cutting staff. On the flip side, volatility has boosted trading revenue.

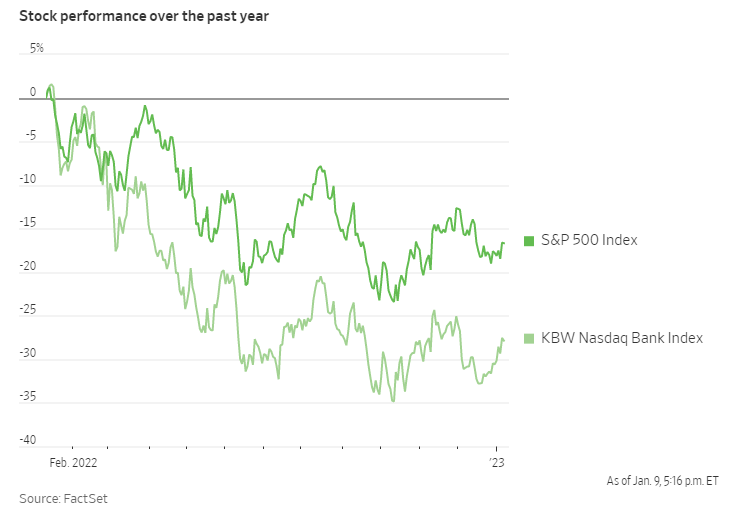

The outlook for bank shareholders is murky. The KBW Nasdaq Bank Index, which includes the largest banks, underperformed the broader S&P 500 in 2022 but has beaten the market to start this year.