Amazon.com Inc. reported its least profitable holiday quarter since 2014 on Thursday, leading to the biggest annual loss on record for the e-commerce giant, which also disappointed Wall Street with its forecast amid concerns about cloud growth.

Amazon $(AMZN)$ reported a holiday profit of $278 million, or 3 cents a share, down from $1.39 a share a year ago. Revenue increased to $149.2 billion from $137.41 billion a year ago. Analysts on average were expecting earnings of 17 cents a share on sales of $145.71 billion, according to FactSet.

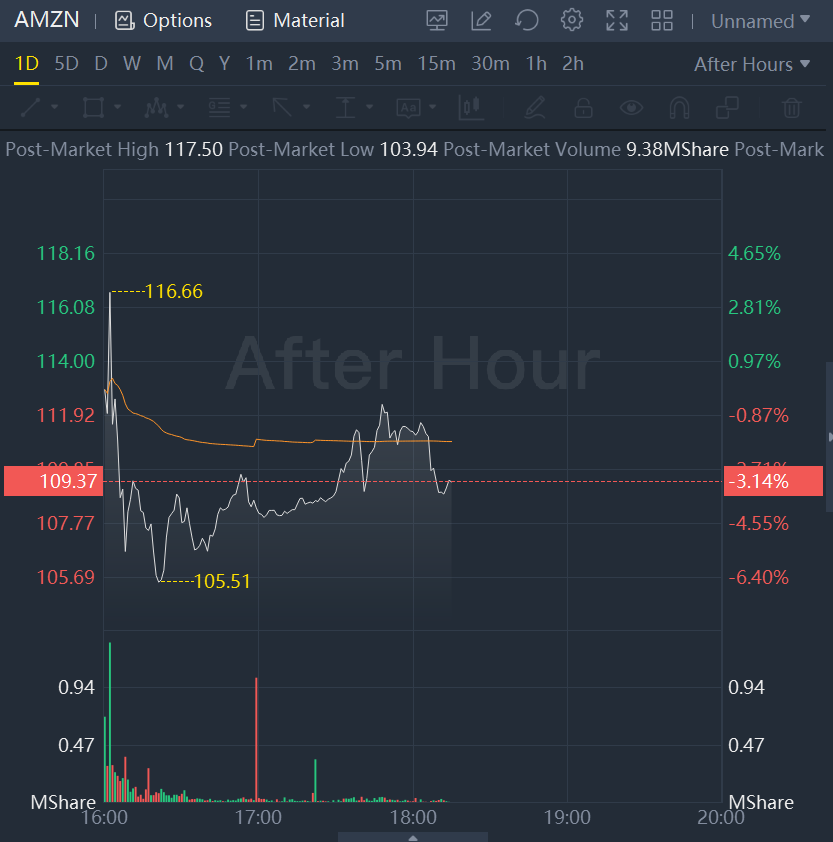

Shares fell more than 3% in after-hours trading immediately following the release of the results, after closing with a 7.4% increase at $112.91.

"In the short term, we face an uncertain economy, but we remain quite optimistic about the long-term opportunities for Amazon," Chief Executive Andy Jassy said in a statement.

Amazon was expected to post a loss for the whole year for the first time since 2014, but worse-than-expected holiday earnings actually led Amazon to the company's worst annual loss on record. For the year, Amazon produced a net loss of $2.7 billion and revenue of $513.98 billion, up from $469.82 billion a year ago and the company's first annual sales total to surpass a half-billion dollars. Amazon had never lost more than $1.4 billion in a single year since going public in 1997, according to FactSet records.

Amazon's fourth-quarter profit was hindered again by the decline of Rivian Automotive Inc. $(RIVN)$ stock, which cost Amazon $2.3 billion in net income in the quarter. In addition, Amazon recognized many of the costs of its recently announced layoffs and other cost cuts in fourth-quarter results as well -- a $2.7 billion impairment charge included $640 million in severance charges related to layoffs and $720 million related to closures and impairment of physical stores, Chief Financial Officer Brian Olsavsky said in a call with reporters.

Amazon's ability to turn a profit in 2023 amid massive layoffs and other cost cuts will be the focus of Wall Street, and most of that turns on Amazon Web Services, or AWS. The cloud-computing offering has supplied the bulk of Amazon's profit in recent years, including 2022 -- for the year, AWS had operating profit of $22.84 billion, while the rest of the business produced an operating loss of $10.59 billion.

But cloud-computing growth has slowed, as Microsoft Corp. $(MSFT)$displayed in its results and forecast last week, and Olsavsky confirmed the slowdown Thursday after AWS results missed expectations. He said that slowness in AWS he mentioned three months ago had continued through the fourth quarter, and while he did not provide any color about what executives were seeing this quarter or forecast beyond the first quarter, he did say he expected "slower growth rates for the next few quarters" for AWS.

In the fourth quarter, AWS produced operating income of $5.21 billion on revenue of $21.38 billion. Analysts on average were expecting profit of $5.73 billion on sales of $21.85 billion, according to FactSet.

Any slowdown in AWS would hit Amazon's bottom line as well as its overall top line, and executives' forecast for the first quarter shows less optimism than Wall Street expected. Amazon's guidance calls for operating profit of break-even to $4 billion and revenue of $121 billion to $126 billion, while FactSet recorded an average analyst forecast of $4.04 billion in operating profit on sales of $125.09 billion.

Amazon's e-commerce business has struggled for growth amid the worst inflation in decades, with Olsavsky saying in a call with reporters that Amazon "saw customers spend less on discretionary items... [while] continuing to spend on everyday essentials." Amazon recently announced it would start charging for grocery delivery for Prime members, which could increase revenue from sales of fresh food.

For more: Amazon Fresh to start charging Prime customers up to $10 for grocery deliveries

Amazon's domestic e-commerce business posted an operating loss of $240 million on sales of $93.36 billion, after a $206 million loss on sales of $82.36 billion in the holiday quarter of 2021. Olsavsky said cuts in the company's physical stores and device businesses would improve operating margins in North America.

Amazon's international efforts struggled more, with a sales decline and increasing losses, as Olsavsky said the U.K. and other parts of Europe showed slowdowns. Amazon reported an operating loss of $2.23 billion on revenue of $34.46 billion overseas, after a loss of $1.63 billion on sales of $37.27 billion a year ago.

One bright spot in Amazon's report was a record quarter for its advertising business, which has grown fast in recent years in a challenge to Alphabet Inc.'s $(GOOGL)$(GOOGL) Google and other online ad giants. Ads brought in $11.56 billion in the holiday quarter, growing nearly 19% from $9.71 billion a year ago and beating the analysts' consensus.

Amazon stock has fallen more than 25% over the past 12 months, but has experienced a rebound so far in 2023, gaining more than 33% year to date. The S&P 500 index has declined 10.2% in the past year while gaining 7.3% since the calendar flipped to 2023.