Apple Inc. Chief Executive Tim Cook is getting ever closer to leading a $3 trillion empire.

Shares of the consumer-electronics giant continue their march higher, such that Apple $(AAPL)$ is within spitting distance -- yet again --of a $3 trillion valuation. The stock, up 0.5% Wednesday afternoon to a recent $188.93, needs to close above $190.73 for Apple to achieve the feat.

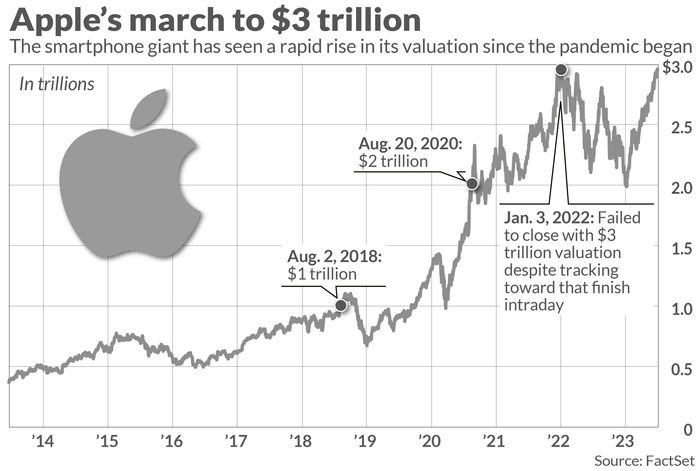

Apple's last crusade toward the milestone didn't quite succeed. While shares traded intraday on Jan. 3, 2022, at levels that would have amounted to a $3 trillion valuation at the close, the stock failed to finish there. Apple seeks to be the first U.S. company to end in $3 trillion territory.

More from MarketWatch: Money-losing food chain Cava showed IPO success. Is it finally time for some tech deals?

Shares of Apple surpassed their Jan. 3, 2022, pricing levels earlier this June and closed Tuesday at yet another record high. But because market capitalizations take into account the number of shares outstanding, and Apple's share count has been falling due to a robust buyback program, the company has yet to best its early 2022 performance from a valuation perspective.

For context, Apple has come a long way since 2007, the year of the iPhone's debut, when it first clinched an $100 billion market value.

Although Apple has failed to make market-cap progress relative to the start of January 2022, the company had been racking up valuation gains quite quickly in the years before that.

Apple needed 7,874 trading days from its public debut to achieve a $500 billion market cap, according to Dow Jones Market Data, and it accomplished that feat Feb. 29, 2012. From there, the company needed 1,617 days to double its valuation and reach the $1 trillion milestone on Aug. 2, 2018.

The company then took 466 trading days to reach $1.5 trillion and achieved the $2 trillion mark 50 days after that. Apple notched a $2.5 trillion valuation 258 days later, but it's moving a bit more slowly in its quest for $3 trillion, as it's currently 477 trading days out from when it first cracked $2.5 trillion.

Wedbush analyst Daniel Ives predicts the company's valuation will fly higher from here, writing Wednesday that he thinks Apple can secure a $3.5 trillion valuation by fiscal 2025, or a $4 trillion valuation in his bull case.

"In our opinion the Street has severely underestimated the massive installed base upgrade opportunity around iPhone 14 and now a mini super cycle iPhone 15 ahead with roughly 25% of Apple's golden customer base not upgrading their iPhones in over four years," he wrote in a Wednesday note to clients.

The company also has emerging catalysts on the horizon, including the debut of its $3,499 Vision Pro headset early next year. That staggering price tag will impact early adoption, but Apple likely has more planned for the virtual-reality category.

Apple shares have climbed 46% so far this year alongside a broader Big Tech rally that's also lifted shares of Nvidia Corp. $(NVDA)$ (up 183%), Meta Platforms Inc. $(META)$ (up 137%), Amazon.com Inc. $(AMZN)$ (up 54%), Microsoft Corp. $(MSFT)$ (up 40%) and Alphabet Inc. $(GOOGL)$(GOOGL) (up 36%).