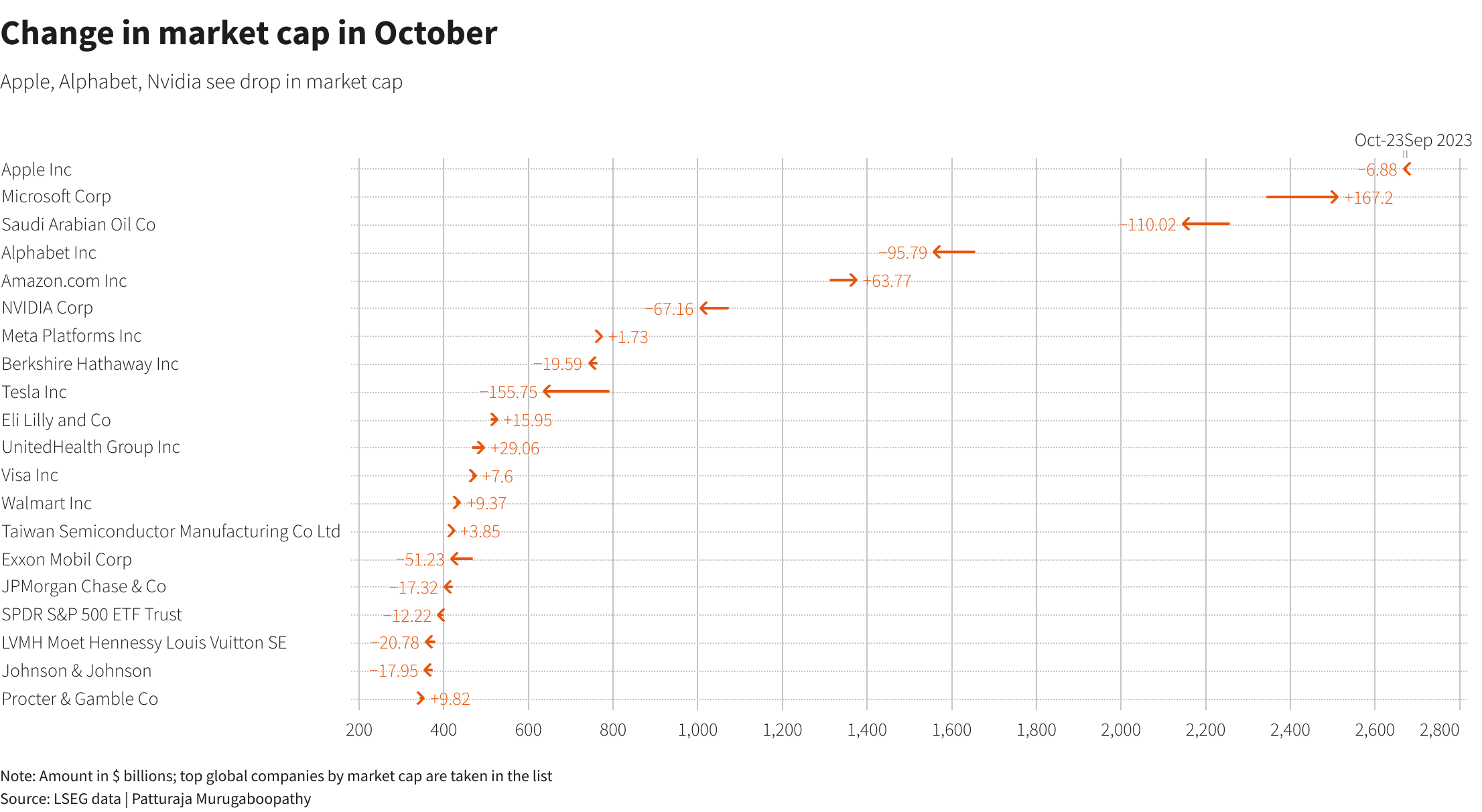

(Reuters) - Most global mega-cap stocks continued their slide in October, hit by the rise in U.S. interest rates and lacklustre third-quarter earnings growth among some top U.S. tech firms.

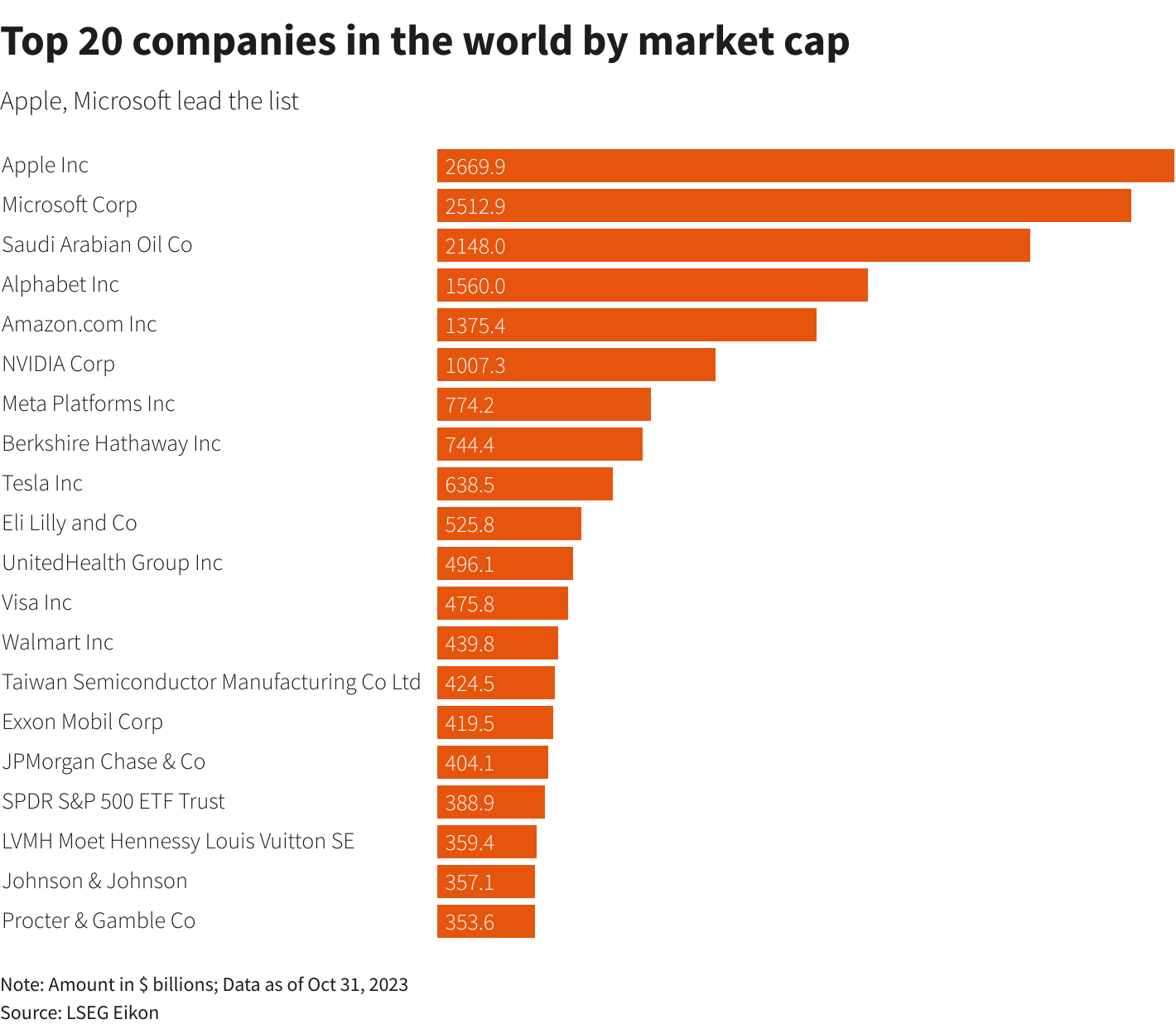

Google parent Alphabet's market capitalization dropped nearly 6% to $1.56 trillion at the end of October, as its cloud business faced its slowest growth in 11 quarters, primarily due to reduced corporate spending on cloud-related services in response to the global economic slowdown.

Tesla's market value tumbled almost 20% to $638 billion last month, largely due to the impact of rising U.S. interest rates on electric vehicle (EV) demand. Additionally, Panasonic Holdings, a key supplier to Tesla, announced a reduction in automotive battery production in Japan for the September quarter, highlighting a global slowdown in EV sales.

U.S. chipmaker Nvidia Corp's market cap dropped 6.3% to $1.01 trillion at the end of last month on reports it may be forced to cancel up to $5 billion worth of advanced chip orders to China in compliance with new U.S. government restrictions.

On the other hand, Microsoft's market value jumped 7.1% to $2.5 trillion, buoyed by its strong fiscal first-quarter results in all segments. This growth was attributed to strong performances in cloud computing and PC businesses, bolstered by increased customer interest in its artificial intelligence offerings.

Meanwhile, Saudi Arabian Oil Co's market cap slumped nearly 5% to $2.1 trillion, affecting by ongoing conflict in the Middle East and a decline in oil prices.