Intel reports fourth-quarter earnings Thursday afternoon — and its forward commentary will be closely watched ahead of a busy 2024

Intel Corp. just kicked off a pivotal year, and investors are about to learn more about what to expect from it.

The chip company is in the midst of recovering off its lows, and its upcoming report Thursday afternoon will bear that out — adjusted earnings per share could rise more than 300% from a year earlier, while revenue is expected to increase by 8%.

But Intel still faces a host of uncertainties, as it prepares to relaunch its foundry business and makes a push to capture frenzied spending on artificial intelligence. “This is setting up to be a make-or-break year for Intel, with a lot of events, moving pieces and change on the horizon,” Bernstein’s Stacy Rasgon wrote recently.

He noted that Intel will start breaking out the financials of its manufacturing business starting in the first quarter and is looking to cut at least $5 billion from its cost of goods sold through 2025 due to the tough economics of that business. The timing of those cuts, though, is “an open question,” according to Rasgon.

Plus, there are areas “open for debate” within the core business, including the PC market, which has appeared to make a recovery relative to prepandemic levels. But at the same time, data points like fourth-quarter shipments deserve watching, Rasgon noted, as they showed potentially a bit of weakness.

There’s also the very essence of being a chipmaker. “Investors wait to see if Intel can continue to execute on their process roadmap, which (at least according to management) remains apparently on-track for now, as well as whether or not it will make a difference even if they do,” he wrote.

The company’s upcoming earnings call should offer new insight on management’s expectations for Intel’s various puzzle pieces, though Rasgon isn’t sure whether executives will give an annual forecast.

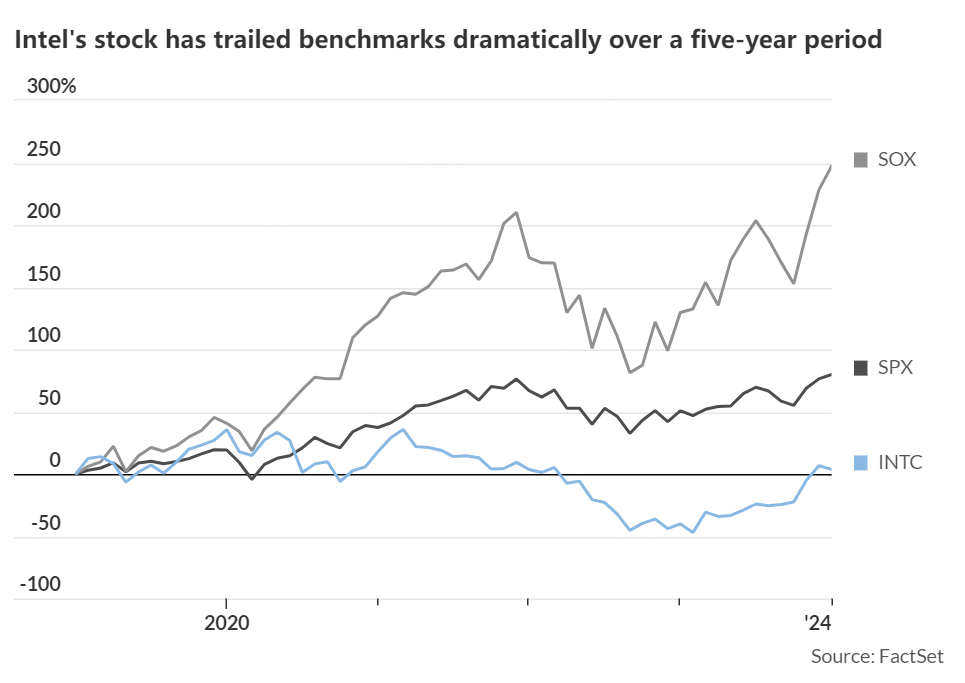

Intel’s stock has underperformed dramatically over the past five years, with near-flat performance compared with a 84% rise for the S&P 500 and a 272% surge for the PHLX Semiconductor Index over that span. But it’s riding a nice recent rally, up 44% over the past three months, beating both the S&P 500 (up 15%) and the PHLX Semiconductor Index (up 34%).

“Against the substantial recent rally in the stock, this is not a great tactical setup for the stock in our view,” UBS analyst Timothy Arcuri wrote in a note to clients last week.

Part of Intel’s recent stock run hinges on optimism that the company can capitalize on AI-hardware spending, and it remains to be seen how that narrative plays out.

“We continue to focus on Intel’s ability to increasingly participate in the rapidly growing (and undersupplied) data-center AI market with their upcoming Gaudi3 AI processor,” Wells Fargo’s Aaron Rakers wrote. “We expect Intel to reiterate its Gaudi3 launch in early 2024…and highlight its growing pipeline, any quantification of which would be incremental.”

Meanwhile, Raymond James analyst Srini Pajjuri will be watching for commentary on the nascent AI PC market, which he called “an emerging opportunity that could offer incremental opportunities as applications such as MSFT Copilot gain broader adoption.”