Marvell Technology achieved its target price, a new level led by AI?

$Marvell Technology(MRVL)$ is a semiconductor company founded in 1995, headquartered in Silicon Valley, USA, with a research and development center in Shanghai, China. Marvell Technology provides a full range of broadband communication and storage solutions and is one of the top ten semiconductor design companies without chip factories globally.

The company offers an extensive product portfolio covering embedded processors, switches, microcontrollers, PHY transceivers, storage and wireless solutions aimed at bringing change to enterprise, cloud, automotive, industrial and consumer markets. The company ships over one million ARM-based processors per day including not only mobile application processors but also communication processors as well as chips for storage and WiFi.

In addition to this business model shift towards AI technology which has brought opportunities for the company by changing investment priorities among cloud customers; it has also led to cost-cutting measures such as large-scale layoffs in China's Shanghai R&D center back in October 2022.

Q1 performance overview - Bottoming out?

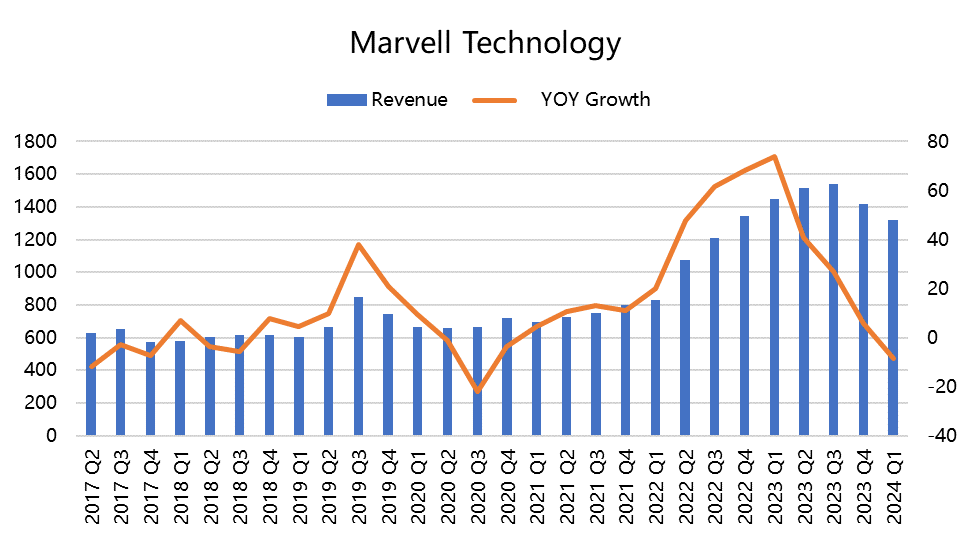

Total revenue was $1.32 billion USD down 9% YoY due to higher base last year; For operator business sector: 5G has entered maturity stage with India market becoming focus point for FY23 while overall business may decline but other opportunities will arise; For enterprise network business sector: growth may be relatively slow with inventory clearance being main theme for next few quarters.

However AI brings opportunity for the company which changes investment priorities among cloud customers.

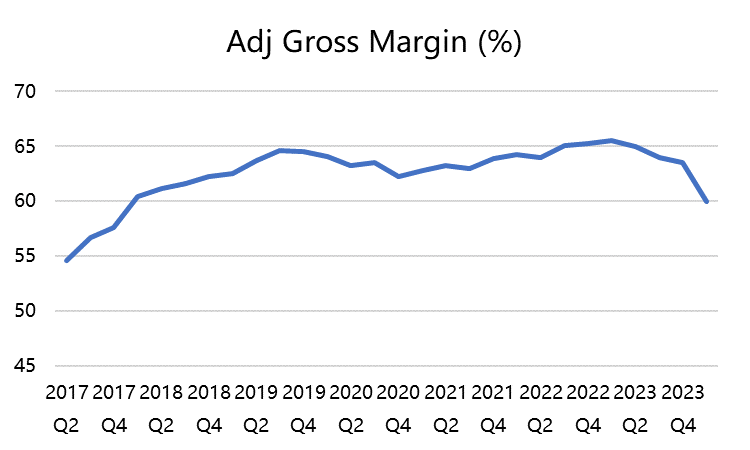

GAAP gross margin rate was 42.2%; Non-GAAP gross margin rate was 60%.

GAAP diluted EPS was -$0.20 USD; Non-GAAP diluted EPS was $0.31 USD.The CAGR of AI-related revenue is expected to reach around $200 million USD by FY23.

Guidance

FY24 expects AI-related businesses will double reaching up to $400 million USD and double again to $800 million USD by FY25. The AI data center architecture is different from the standard cloud data center architecture, and it is expected that generative AI will support overall storage and EB-level growth in HDDs and Flash.

In FY25, Marvell's direct relationship with artificial intelligence will double, but there are still indirect demands that cannot be quantified which require its storage solutions. The development speed of artificial intelligence infrastructure is so fast that technology update cycles are changing within 18-24 months rather than exceeding four years for standard infrastructure.

Valuation level & price

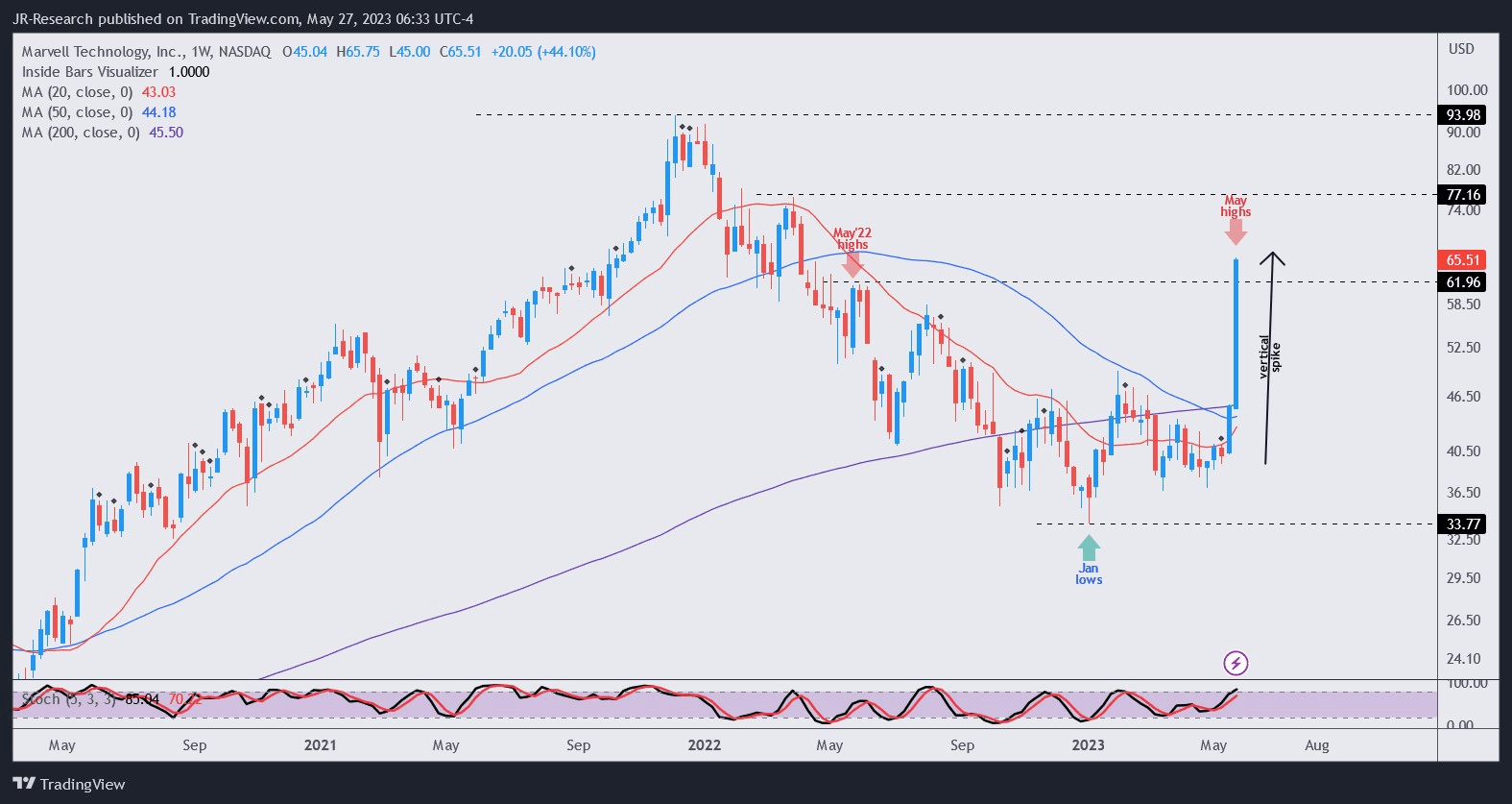

After the last financial report was released, bulls began buying at low prices; therefore MRVL's stock price has remained at a low point since January 2023. Long-term investors may find this price attractive.However after Q1 earnings (FY24) were announced more investors flocked into the stock due to NVDA-led AI concept causing MRVL's share price to skyrocket vertically as management significantly raised their forecast for AI-related revenue thereby stimulating optimism among investors and analysts about future prospects.

In terms of valuation, the market consensus target price is around $60 USD (2023-2024), implying a forward P/E ratio (PE TTM) of 28-30 times.However if revenues from AI reach management expectations heightening company profit margins then the target PE corresponding to $60 USD would be below 25 times.

Compared with $NVIDIA Corp(NVDA)$ , Marvell Technology appears very cheap while market sentiment remains reasonable because Marvell benefits from data center trends being one of industry leaders.Currently fluctuations in stocks related to AI are less affected by performance but more influenced by market sentiment leading MRVL like other companies involved in this field having greater volatility than before.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

$迈威尔科技(MRVL)$ is a well-positioned company with a strong track record of growth.

The company has been making significant investments in AI in recent years, and it is possible that these investments have helped to drive the company's stock price higher.

It is difficult to say for sure whether Marvell Technology achieved its target price, a new level led by AI.

Tech will boom