Penny stocks speculation, trading plan and analysis 細價股的投機、交易計劃和分析

Market Update

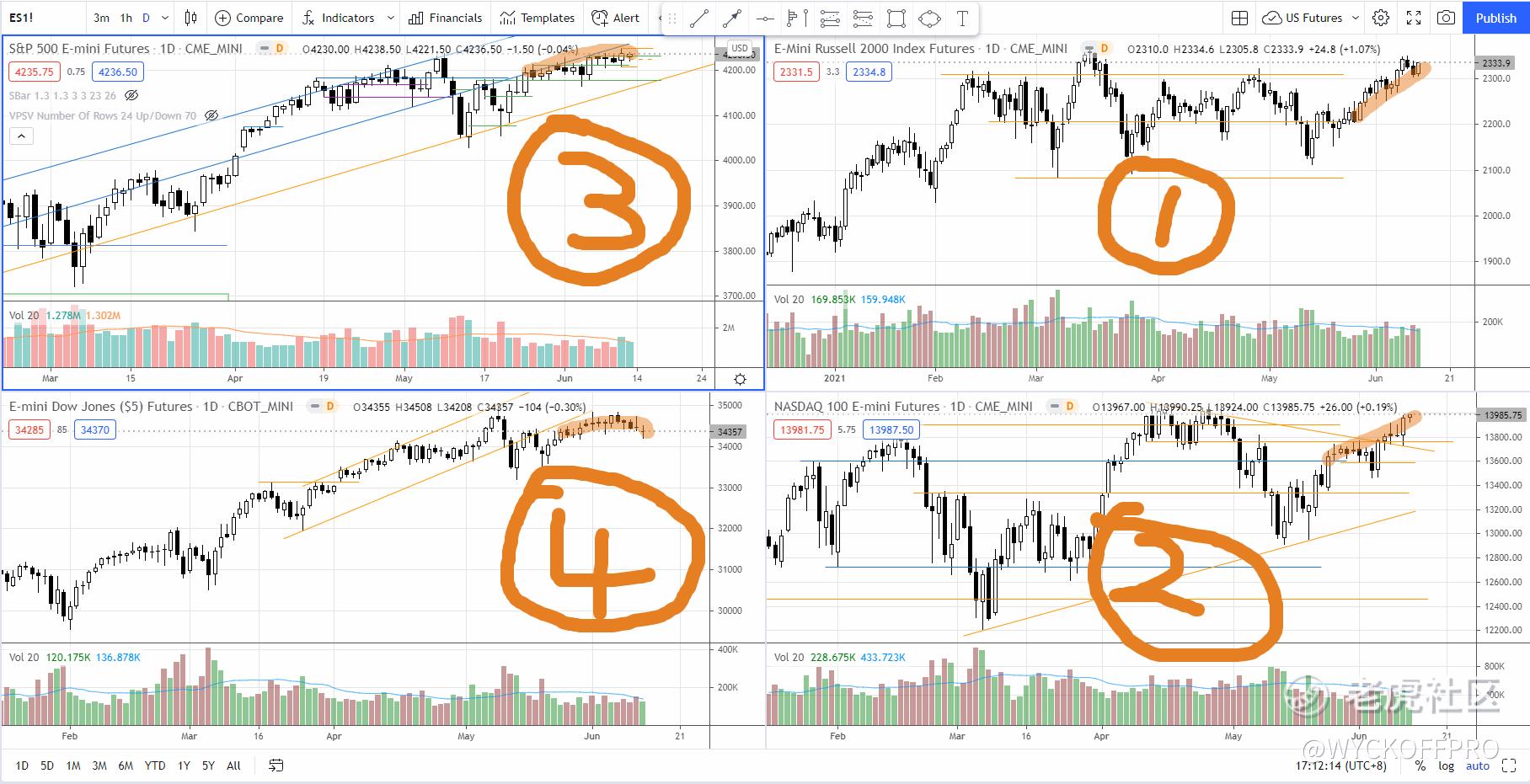

For the past 3 weeks, Russell and Nasdaq outperformed the S&P 500 and the Dow.

Let's take a look at the chart above and visually compare the 4 major indices for the past 3 weeks, where I highlighted in orange. It is clear that Russell has the most gain followed by Nasdaq, S&P 500 and the Dow.

This could suggest that some of the growth stocks (refer to my video that talked about bottomed out growth stocks if you missed it, as there is plenty of upside) and small cap stocks are beating the value stocks.

So far, there is nothing threatening on the indices in terms of the price action and the volume. Although Dow and S&P 500 are under-performed, it could probably suggest a pause of those value stocks rather than a reversal to the downside.

I am still cautious about growth theme where I spelled out the reasons in my last Sunday's email using Cathie Wood's ETF as growth proxy.

Trading Plan & Analysis

"What do you mean by let the market play out? I though you are bullish!" A reader asked.

A lot of time, I tend to respond with stick to your trading plan and let the market play out despite I have formed a directional bias with my analysis.

For example, If I am bullish on Stock A based on the analysis of the characters of the price action and the volume, I will still consider the opposite case (or the failure case).

Some of the questions I would ask myself:

1. At what point my analysis will be invalidated and turn bearish?

2. What are the characters of the price action and volume would I anticipate for a failure case?

My trading plan is to prepare for both scenarios despite it is very clear that there is only 1 scenario plays out at the moment. My trading plan helps me to react and execute according to how the market move, rather than to prove me right, it needs to help me to get out when the market doesn't agree with me.

So, analyze the charts as usual and have your trading plan ready so that you will react and execute your plan comfortably.

US: 3 Top Penny Stocks to Watch or Buy Before They Pop — RESN, NOK, F

In the past 3 weeks the small cap stocks especially the penny stocks have seen buying interests rush in that propel the stocks up.

In this video,you will find out the 3 top penny stocks — $Resonant Inc(RESN)$ , $諾基亞(NOK)$ , $福特汽車(F)$ that could be ripe to pop after days of consolidation. Watch the video below:

市場最新情況

過去3周,羅素和納斯達克指數的表現超過了標準普爾500指數和道瓊斯指數。

讓我們看一下上面的圖表,直觀地比較一下過去3周的4個主要指數,其中我用橙色標註。很明顯,羅素的漲幅最大,其次是納斯達克、標普500和道指。

這可能表明,一些成長股(如果你錯過了,可以參考我的視頻,其中談到了觸底的成長股,有大量的上升空間)和小盤股正在領先價值股。

到目前爲止,從價格走勢和成交量來看,股指沒有任何威脅性。雖然道指和標普500指數表現不佳,但這可能表明這些價值型股票的歇息,而不是反轉下行。

我仍然對增長型主題持謹慎態度,我在上週日的郵件中用凱西-伍德的ETF作爲增長型的代表,闡明瞭其中的原因。

交易計劃和分析

"你說的讓市場發揮出來是什麼意思?我認爲你是看漲的!" 一位讀者問道

很多時候,我傾向於回答:堅持你的交易計劃,讓市場發揮,儘管我的分析已經形成了方向性的偏見。

例如,如果我根據對價格行爲和成交量的分析看好股票A,我仍然會考慮相反的情況(或失敗的情況)。

我會問自己一些問題。

- 在什麼時候我的分析會失效並轉爲看跌?

- 在失效的情況下,我預期的價格行爲和成交量的特徵是什麼?

我的交易計劃是爲這兩種情況做準備,儘管非常清楚目前只有一種情況在發生。我的交易計劃幫助我根據市場的走勢做出反應和執行,而不是證明我是對的,它需要幫助我在市場不同意我的觀點時脫身。

所以,像往常一樣分析圖表,並準備好你的交易計劃,這樣你就能從容地做出反應並執行你的計劃。

美國:3只最值得關注的細價股,或在它們爆炸前買入--RESN, NOK, F

在過去的3個星期裏,小盤股尤其是細價股出現了購買興趣,推動了股票的上漲。

在這段視頻中,你會發現3只頂級細價股--RESN、NOK、F,它們在經過幾天的盤整之後,可能已經成熟,會出現爆炒。請看上面的視頻。

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- IcySilver·2021-06-13很多时候开始前只是做个研究、找个预期的操作方案。股价怎么波动还真不是我们可以控制的。不过做好准备可以提高成功的机率[Applaud]1Report

- genius1me·2021-06-17留个脚印,谢谢分享1Report

- Samlunch·2021-06-14有一个退出计划总是好的1Report

- 谭楚弘·2021-06-28你的油管名称是什么?1Report

- 睿姐姐·2021-06-15好1Report

- 口丁口米口米·2021-06-14mark1Report

- IamZhong·2021-06-14[微笑]1Report