Mixed Employment Data? Who is the biggest winner?

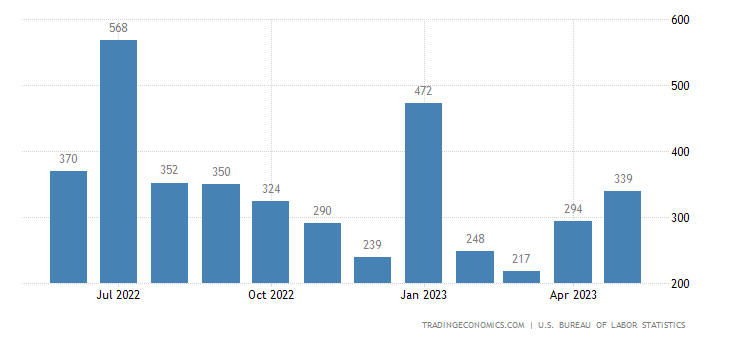

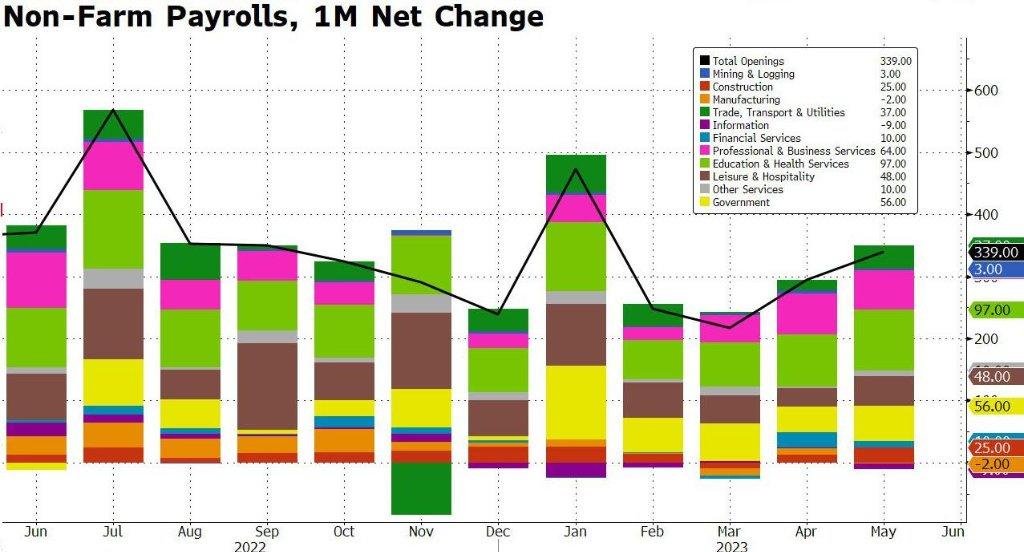

Last Friday, the May non-farm payroll data was clearly impressive. 339,000 non-farm jobs were added, nearly double the market's expectation of 195,000. Additionally, the non-farm payroll data for March and April were significantly revised upward. In March, the number of new non-farm jobs was revised from 165,000 to 217,000, and in April, it was revised from 253,000 to 294,000.

Among them, the education, healthcare, business, and leisure accommodation sectors continue to be the main sources of employment growth. Previously, due to labor market mismatches, some vacant positions in the service industry have been filled.

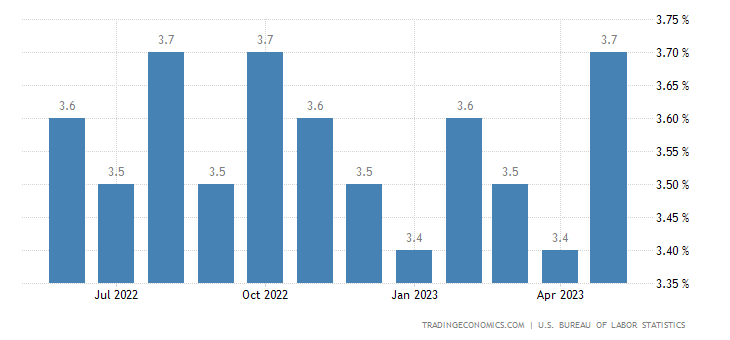

However, on the other hand, there is a contradiction as the unemployment rate increased by 0.3 percentage points to 3.7% compared to the previous month, with a decrease of 310,000 in the employment figure according to household surveys.

At the same time, the growth rate of hourly wages has slowed down, increasing by 0.3% on a monthly basis, which is in line with expectations, and by 4.3% on a yearly basis, slightly lower than the expected 4.4%.

The discrepancy between the data from business surveys and household surveys has widened, with household surveys unexpectedly showing the largest decline since April 22, resulting in a decrease of 310,000 jobs. The average weekly working hours have also declined compared to the previous month.

These factors contribute to reducing concerns about wage inflation. As we mentioned before, both business surveys and household surveys have their advantages and disadvantages. The difference between them mainly stems from

a. In terms of sample size, business surveys have much larger sample sizes than household surveys. This makes the former have smaller statistical errors in a sense, so they are considered to have higher credibility.

b. In terms of survey scope, household surveys cover a wider range because they interview individuals from different households, rather than being limited to the population employed by businesses and institutions. For example, the survey includes self-employed individuals who are not covered by business surveys, unpaid family workers, agricultural workers, and private household workers.

c. Household surveys do not duplicate the calculation of individual employment situations, as they interview individuals, while business surveys may involve duplicate calculations, such as one person having multiple jobs.

Now the question is, do these employment data support the Fed's decision to continue raising interest rates, or do they support a new high for US stocks? T

he Federal Reserve will hold its interest rate meeting in June, and there are still differences among officials regarding whether to raise interest rates. One view believes that the current data is not enough to support a pause in rate hikes, and they support further tightening of monetary policy. Officials holding this view include Dallas Fed President Logan, Atlanta Fed President Bostic, St. Louis Fed President Bullard, and others. Another view leans toward a pause in rate hikes, waiting for more economic data to emerge. Officials holding this view include Fed Chairman Powell, Vice Chairman Jefferson, Philadelphia Fed President Harker, and Chicago Fed President Gulsby, among others.

Therefore, the current issue is that if we look at the non-farm payroll data, it clearly supports a rate hike in June. However, if we consider the changes in the unemployment rate and wage growth, it may be appropriate to pause for a month and reconsider in July. In this regard, there is a possibility of divergent voting among Federal Reserve officials regarding whether or not to raise rates in June.

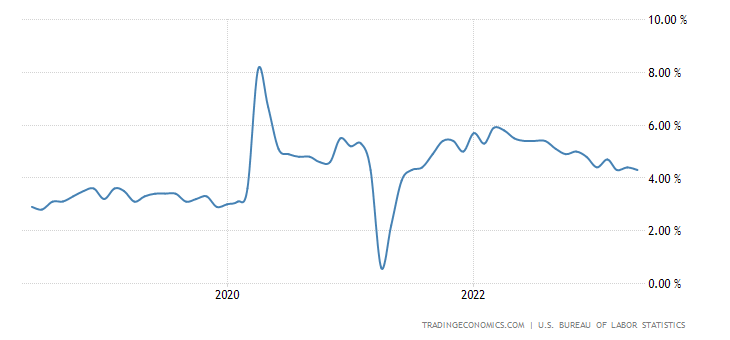

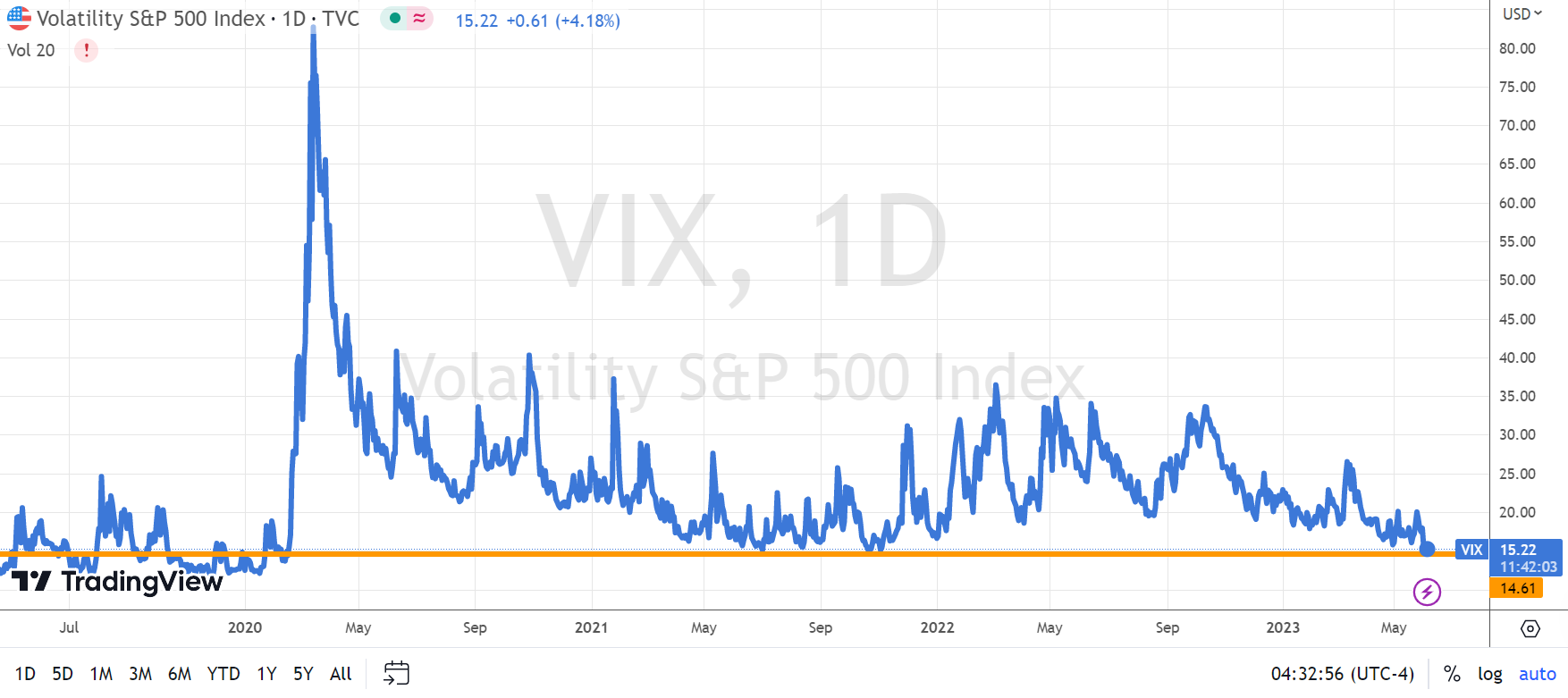

However, the US stock market didn't seem to care about the interest rate hike at all. Led by the Nasdaq Composite Index, the US stock market continued to surge. At the same time, $Cboe Volatility Index(VIX)$ , which measures the volatility of the S&P 500, has dropped to 14.6, the lowest point since the outbreak of the COVID-19 pandemic on February 14, 2020. Investors' pricing of downside risk protection has become extremely extreme, as if there is no downside risk at all.

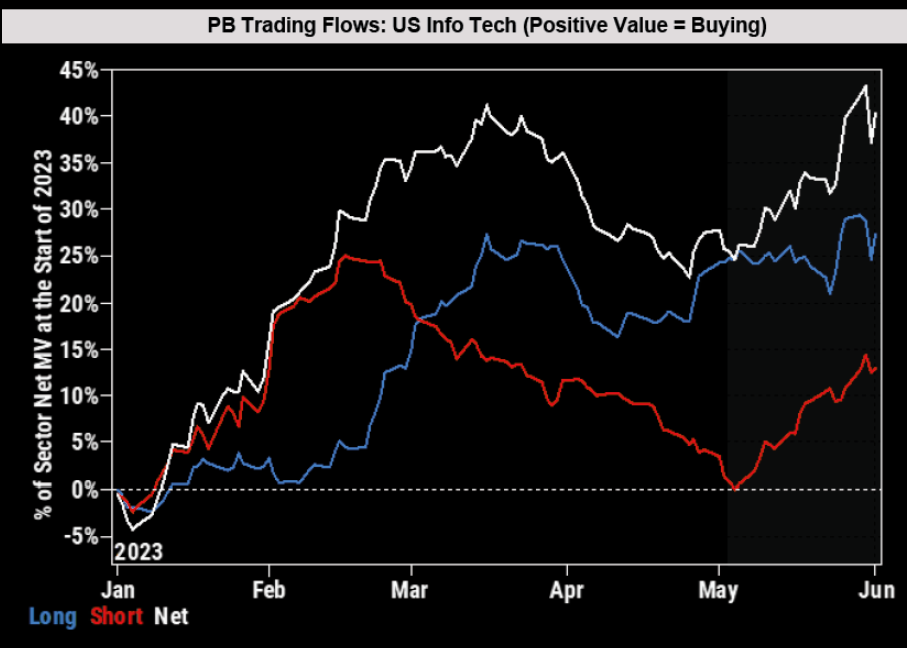

Among them, this includes hedge funds that have been underweight on technology stocks (relative to the broader market) so far this year. According to data from Goldman Sachs (GS), they have underweighted their positions in the seven major technology stocks by 15%.

So, who will support the new highs in the US stock market next?

Value investing (large companies with low valuations and good cash flows) may regain favor.

Value investing tends to perform better when real interest rates are positive and growth rates are slow. However, recently, as real interest rates have slowed down, value investing has lost a significant amount of advantage comparatively. If the trend of real interest rates is expected to continue, the possibility of an economic soft landing is greater, and investors may continue to favor value investing in the second half of the year.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

看起来一些美联储官员希望继续加息,而其他人则希望等待更多数据。③️.

So, will interest rates go up or will stocks hit a new high? 🤔

But don't worry too much, different surveys have different results. 😅

Great ariticle, would you like to share it?

这篇文章不错,转发给大家看看

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?