Why are the SEC's charges against Coinbase and Binance so significant?

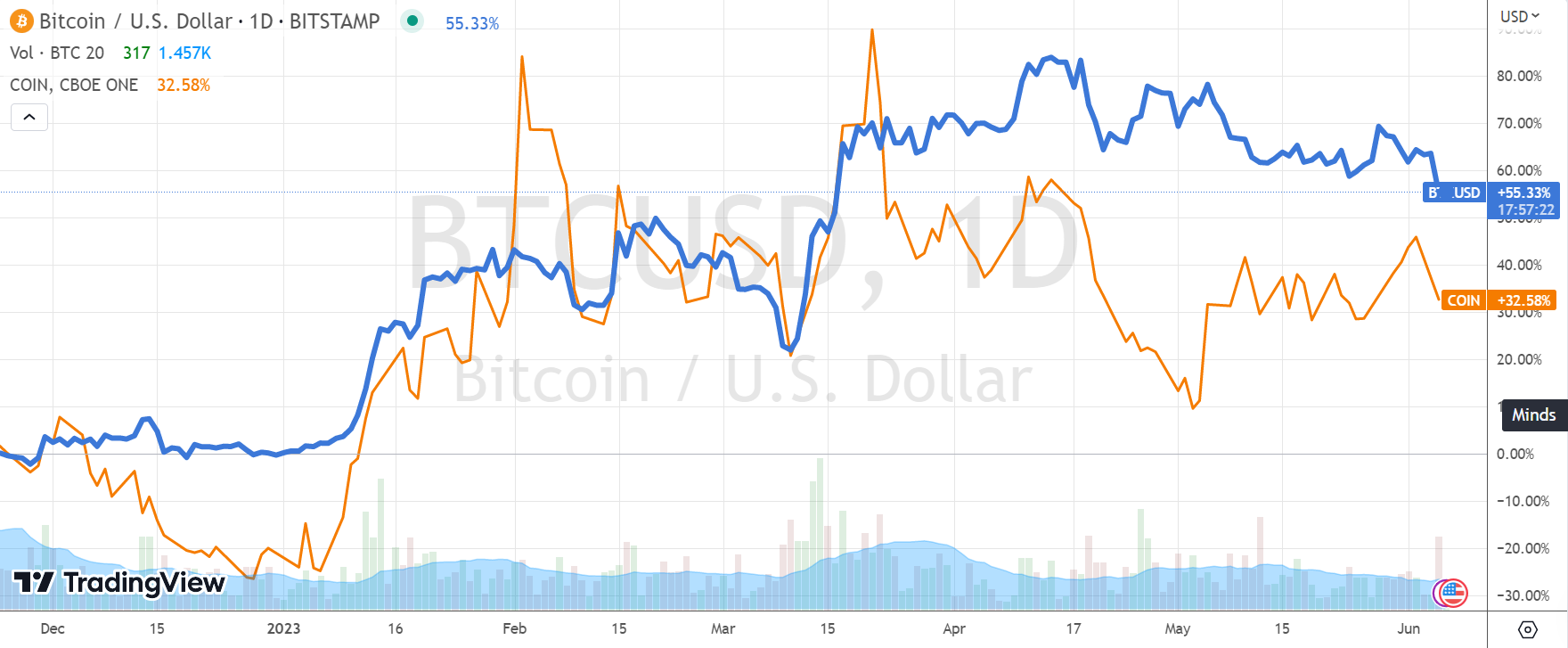

After the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against the world's largest cryptocurrency exchange, Binance, for violating U.S. securities regulations, the stock prices of $Coinbase Global, Inc.(COIN)$ dropped by 9.1%, and $MicroStrategy(MSTR)$ by 8.5%. Bitcoin (BTC-USD) also experienced a loss of 5.8% in Monday's trading.

The SEC alleges that Binance and its CEO, Changpeng Zhao(CZ), mishandled customer funds and secretly funneled them into a separate entity controlled by Zhao. As the cryptocurrency industry continues to grow, regulatory bodies are increasingly focused on ensuring compliance with securities and trading laws. This puts pressure on the entire cryptocurrency sector, particularly in areas where regulations are still unclear.

One of the charges in this case involves manipulating cryptocurrency prices through "wash trading." If proven true, this accusation would have an unprecedented impact on the cryptocurrency community, as it would undermine the foundation of decentralization, which is crucial for its existence. This also helps explain why the U.S. government has been targeting the cryptocurrency sector, as these exchanges to some extent possess attributes and functions of important U.S. institutions such as the Federal Reserve and the SEC. They have been accused of abusing their power and challenging the financial system under the governance of the U.S. elites.

The U.S. Securities and Exchange Commission believes that most digital tokens are classified as securities rather than currencies. In 2018, SEC officials stated that Bitcoin (BTC-USD) and Ethereum (ETH-USD) were not securities.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

I feel bad for the investors in Coinbase and MicroStrategy who took a hit because of this. It's scary to think about how easily things can change in the market 😔

Wow, it's crazy how much power these big cryptocurrency exchanges have, huh? I wonder what this means for the future of the industry 🤔

It's interesting how the SEC sees digital tokens as securities instead of currencies

Great ariticle, would you like to share it?