3 Reasons Why You Should Buy US Stocks Now

Even in the case of economic recession, the selling pressure on the stock market will not be as severe as in the past.

Simon White, macro strategist at Bloomberg, believes that the excessive focus on economic recession stems from its impact on portfolio. The S&P 500 index fell an average of 5% before the recession began, and may fall a further 30% during the recession. But the price trend shows that stocks may not suffer such serious losses this time.

However, first of all, the risk of recession has obviously increased, even if it is not an absolute certainty.

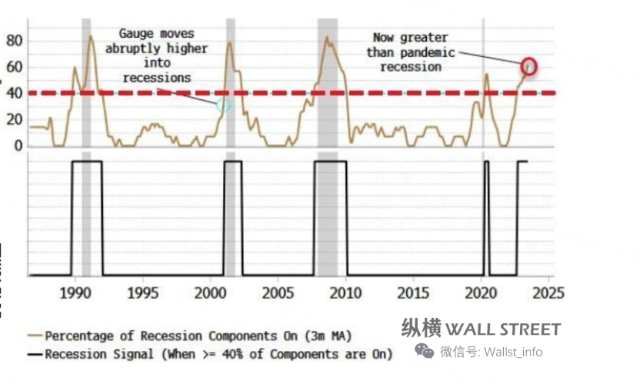

One of the most comprehensive and reliable leading indicators for measuring economic recession is the recession gauge. It consists of 14 recession sub-indicators, covering a wide range of market and economic conditions. When at least six of these indicators are triggered, it means that there will be a recession in the next 3-9 months.

As shown in the figure below, the measurer was triggered in September, and the number of sub-indicators continued to rise. The latest sub-indicator triggered last week came as Friday's employment data showed a further decline in temporary labor services, one of the most leading parts of the job market.This brings the number of sub-indicators consistent with recession to 9 out of 14, the highest level since 2008.

Friday's employment data should not be regarded as a sign that the recession can be avoided.While employment may be stronger than expected, household survey data shows the monthly increase in unemployment is the biggest since April 2020, the peak during lockdown.

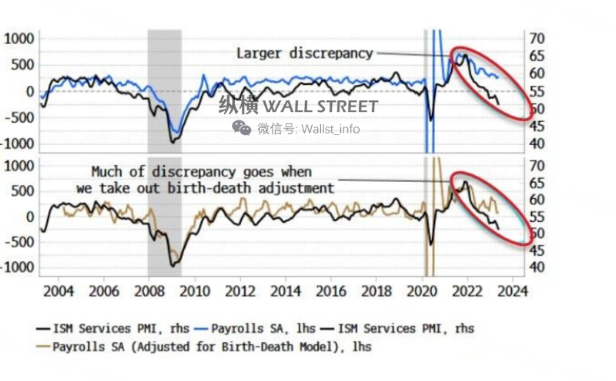

In addition, the number of employed people continues to deviate from the number of employed people in household surveys, which means that nearly 2 million more jobs have been created than employees since March last year.This is not a convincing sign of a strong job market, and it also risks a sharp decline in employment, because odd jobs will give up multiple jobs and take a full-time job instead.

This difference of 2 million is similar to the number of jobs added in the second-death model in the following figure. The model aims to capture the net number of new jobs created in newly formed and closed companies that were not covered during the sampling period, and has been adding more jobs since the start of the pandemic.

As payrolls data begins to become outliers, it becomes increasingly necessary to question the model.Notably, payrolls data runs counter to weak ISM Services(Data released on Monday confirmed the trend). However, after subtracting the adjustment of the second-death model from payrolls, the difference between the two series is much smaller. (Strictly speaking, we should use non-seasonally adjusted payrolls for adjustment, but this will introduce other unwanted seasonal effects).

So if the recession is bad for equities and the risk of a recession now increases why is it different this time around?

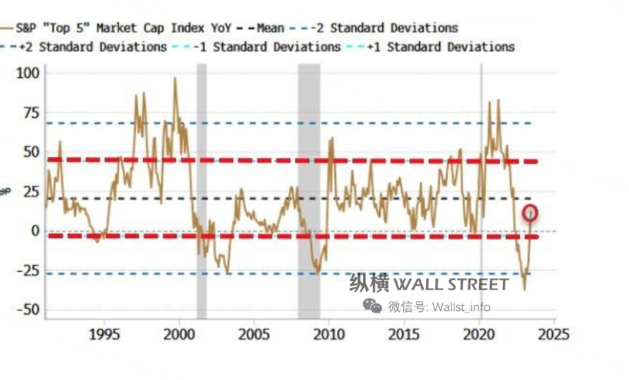

First of all, the extremely narrow breadth is often a sign of further strength.

Whenever the "Top 5" index (the Top 5 S&P stocks by market value) outperforms the whole index, it usually leads to the S&P index performing well in the next three months, six months and 12 months.

This may be even more so today, as the Top 5 index is still in the process of rebounding from oversold. The Top 5 index shows a trend of overshooting and undervaluation, and seems to be in the process of overshooting upwards, while the index of stocks with the lowest remaining market value is still oversold, so it has the potential to rebound.

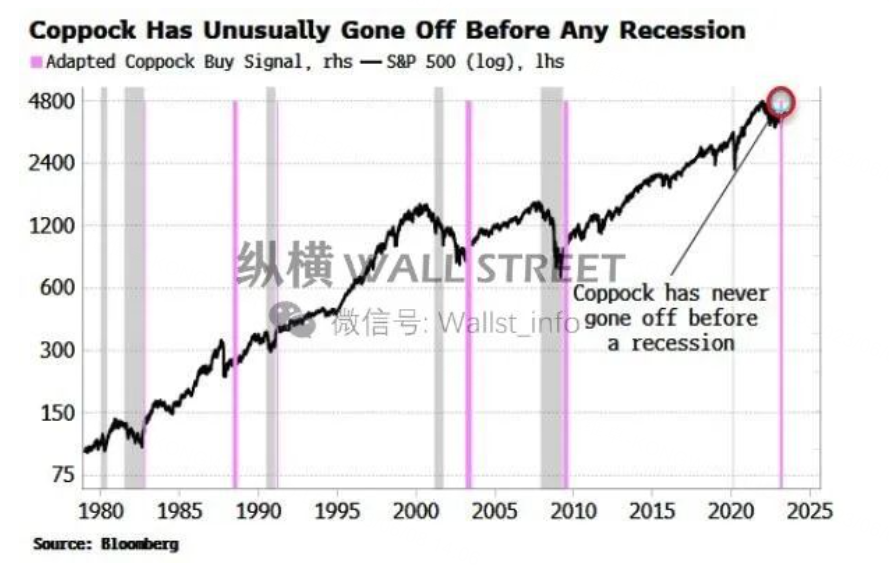

Secondly, the broad price trend is very constructive.Simon White pointed out in April that a very reliable long-term return signal, the Coppocket index, triggered in March. Normally, this signal flashes after a recession, or occasionally triggers in the middle of the cycle (such as after the stock market crash in 1987). It never disappears immediately before the recession (assuming that we will soon have a recession, as predicted by the recession indicators mentioned above)

For equities, the biggest long-term risk may not be a recession, but a rebound in inflation(Treasury Bond's increased circulation after the debt ceiling is eased may cause short-term weakness).

Long-term industries, such as technology, are leading the market and are most sensitive to inflation. However, considering the decline of inflation in China, the overall low inflation trend in the next 3-6 months will not be disturbed.

Therefore, it is suggested to adopt a cognitive dissonance attitude, and even if the economy falls into the terrible situation of recession, the stock market may still be supported in the medium term.

$NQ100 Index Main Connection 2306 (NQmain) $$Dow Jones Main Link 2306 (YMmain) $$SP500 Index Main Connection 2306 (ESmain) $$SP500 Index Main Connection 2306 (ESmain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Nine out of fourteen sub-indicators agree: recession is lurking! But hey, let's keep those stock losses entertaining, shall we

Recession gauge flashing red lights? Time to break out the popcorn and watch the economic drama unfold

Risk of recession? Don't worry, it's just a tiny, minuscule, itsy-bitsy increase... maybe

Buckle up, folks! We're in for a roller coaster ride of recession-induced stock market shenanigans

😅 Oh, who needs severe selling pressure when we can have a recession party in the stock market

这篇文章不错,转发给大家看看

Reposting...

Reposting...

last train !!