Oracle sets a new high, Q4 earnings indicates AI opportunities.

$Oracle(ORCL)$ stock reached a new all-time high after the Q4 financial report released on June 12th. It is evident that the recent AI concepts have made the company a highly sought-after target.

The outstanding performance of the cloud business has greatly surpassed expectations in terms of revenue and profit. The development of AI is also reliant on software services, which will continue to contribute to the company's growth, generating high expectations among investors.

Over the past 20 days, the company's stock has already risen by over 30%. On June 12th, it performed exceptionally well during trading hours (+6.0%), and remained optimistic after the post-report announcement (+3.9%), although there was no double-digit increase.

Q4 Performance Overview

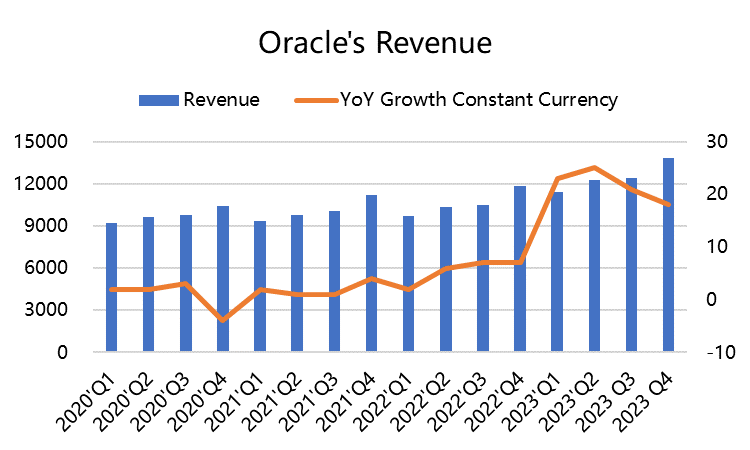

Revenue reached $13.84 billion, showing an 18% year-on-year growth at a fixed exchange rate, surpassing the market's expected $13.72 billion.

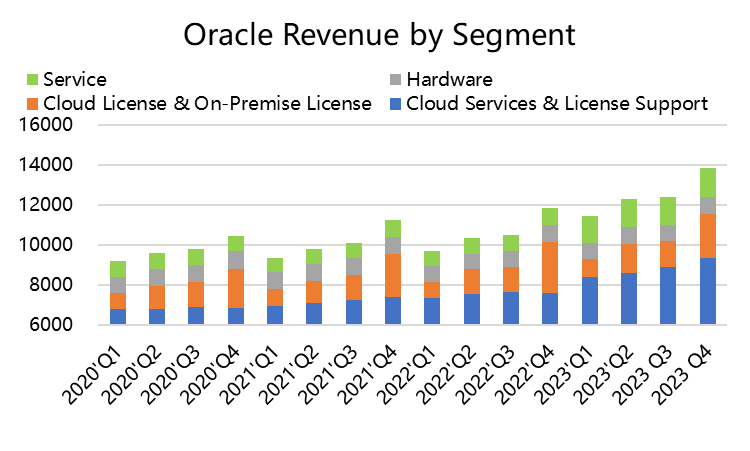

Among them, revenue supported by cloud services and licensing reached $9.37 billion, with a year-on-year growth of 25%, surpassing the market's expected $9.11 billion. The cloud business revenue from IaaS and PaaS was $4.39 billion, growing by 55% at a fixed exchange rate, exceeding the market's expected $4.04 billion. Strategic back-end SaaS application revenue increased by 4%, with Fusion ERP growing by 17% and NetSuite ERP growing by [missing value]. Hardware services amounted to $850 million, showing a 1% year-on-year growth, which is consistent with the market's $840 million. Software revenue reached $1.46 billion, surpassing the market's expected $1.45 billion and showing a 78% year-on-year growth.

Gross profit amounted to $10.11 billion, slightly below the market's expected $10.39 billion.

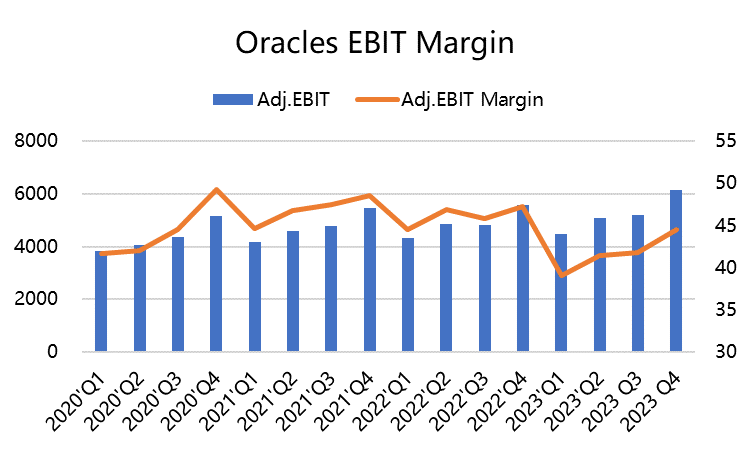

Comparable earnings before interest and taxes (EBIT) reached $6.16 billion, surpassing the market's expected $6.12 billion, with an EBIT profit margin of 44.49%. Adjusted earnings per share (EPS) were $1.68, higher than the market's expected $1.53.

The company's free cash flow was $3.73 billion, surpassing the market's expected $2.46 billion.

Investment Highlights

AI presents significant opportunities for the cloud business. Both strategic cloud businesses of the company are growing, with cloud applications and infrastructure business experiencing noticeable growth. Oracle has also stated that its Gen2 Cloud possesses the world's highest-performance, lowest-cost GPU cluster technology, which is also being used by NVIDIA. The company is collaborating with NVIDIA to build the world's largest high-performance computer.

With the growth of cloud business revenue, the company's profit margin is expected to continue improving. Meanwhile, the company has been expanding its data center capabilities. As these new cloud regions continue to be filled, the profit margin is also expected to increase. On the other hand, following the integration of the acquired healthcare IT giant Cerner, the company's operating profit has increased to 44%. Oracle will continue its efforts to enhance Cerner's profitability to meet Oracle's standards and further benefit from economies of scale in cloud computing.

While cash flow growth is optimistic, attention should also be paid to the impact of repaying substantial net debt (from acquisitions) in a high-interest environment.

Valuation

The company currently has a 12-month trailing price-to-earnings (P/E) ratio of 36 times, which is naturally not high compared to SaaS companies and on par with Microsoft (MSFT) at 35 times. Additionally, due to growth expectations, the forward P/E ratio for the expected 2023 fiscal year is around 21 times, lower than the software industry average

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

How is Oracle collaborating with NVIDIA to build the world's largest high-performance computer?

What has been driving Oracle's stock prices up lately?

Why is the market so interested in Oracle's AI concepts?