Largest 618 Shopping Festival Ever, Makes Alibabas Different?

The largest "618" event in history has come to an end. Unlike previous years with frequent reports of remarkable results, this year, no company disclosed the GMV (Gross Merchandise Volume) data for the 618 event.

Based on the expectation in the e-commerce field that "no news is bad news," many investors believe that the implication of not disclosing performance results is "not good."

$JD.com(JD)$ , coinciding with its 20th anniversary, made the most investments and had the strongest initiatives, but it also did not disclose transaction data. On the 19th, JD.com vaguely announced that "JD.com's 2023 618 growth exceeded expectations, setting a new record," without specifying the details. However, it mentioned that the transaction volume for 3C digital products and home appliances increased by over 150% compared to the previous year.

$Alibaba(BABA)$ 's Tmall Group shifted its focus from previous fancy marketing to a low-price strategy. Interestingly, the number of short video users on Taobao increased by 113% year-on-year, and the page views and watch time also doubled, attracting a more diverse range of merchants to participate.

$Pinduoduo Inc.(PDD)$ known for being relatively indifferent to shopping festivals, silently participated as usual. While having differentiated advantages in certain product categories, it provided support for various categories, including the launch of several activities such as the "Digital Home Appliance Consumption Season," "Home Appliance Super Subsidies," "Computer Super Subsidies," and "Mobile Phone Subsidy Special." It focused on key categories such as smartphones and home appliances, essentially launching a disguised offensive.

The growth of short video platforms like Douyin and $KUAISHOU-W(01024)$ was even more significant, although their user base was relatively small. With the establishment of the new e-commerce era, the price of traffic continues to rise. Due to the frequent use of slogans like "618 every day, Double 11 every day," the significance of shopping festivals is not as significant for short video platforms compared to platforms like Pinduoduo, which handles transactions worth billions.

The quick reports of A-share listed company $Chongqing Baiya Sanitary Products Co.,Ltd.(003006)$ we can observe the overall trend.

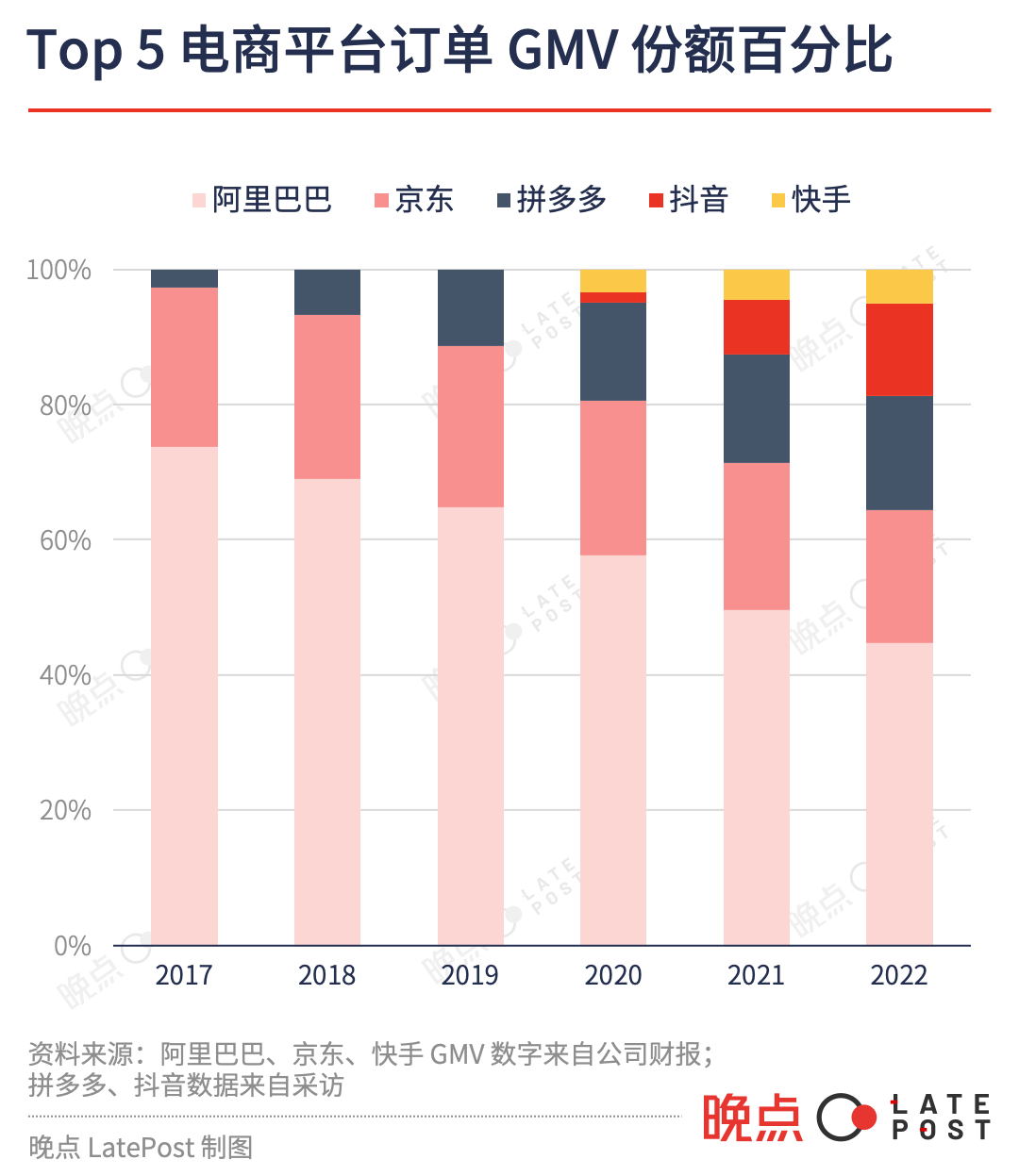

Furthermore, comparing it with the previously published GMV market share data from the e-commerce industry by "LatePost," we can see that traditional e-commerce is gradually relinquishing market share.

How should we interpret the results of the 618 event?

One perspective is that traditional e-commerce platforms like JD.com and Alibaba may not meet investors' expectations, while short video e-commerce platforms like Pinduoduo and Douyin/Kuaishou may show relatively strong performance.

However, we believe that without concrete data, any conclusion is mere speculation. By adjusting statistical methods internally or managing expectations effectively, e-commerce platforms can ensure that their performance exceeds expectations every year. Investors can naturally observe the overall consumption situation of shopping festivals based on indicators such as the shopping habits of people around them, the busyness of courier services, and the average order prices, and draw conclusions that may not meet expectations.

However, it is more objective to look at data from the broader retail sector. Compared to previous years, the most significant changes in this year's 618 event are the overall low-price strategy adopted by e-commerce platforms and the rising prominence of newcomers like live-streaming e-commerce platforms, which have had an impact on the sales landscape. Is it "consumption upgrading" or "consumption downgrading"?

We believe that the overall e-commerce market is still in a trend of development and expansion, but the macro environment in recent years has also changed the habits of businesses and consumers.

1. The overall growth in e-commerce retail sales is still as expected. Most categories have experienced some price increases (inflation), so as long as the sales volume remains the same, the overall sales revenue is bound to exceed expectations. Moreover, compared to the consumption during the pandemic period, there may be additional offline consumption as a result. Therefore, even if e-commerce platforms do not disclose their performance reports, we should not assume that their performance is necessarily poor; it may just not be able to match the growth seen between 2012 and 2018.

2. Different interpretations of "consumption upgrading" have led to varying performances. In the flourishing year of 2017, Alibaba believed that consumption upgrading involved introducing more new and high-end product categories, which could come from various regions around the world. As a result, Alibaba placed more emphasis on globalization. Tmall incorporated more international brands and heavily invested in Hema, an offline retail chain. However, at that time, Huang Zheng's understanding of "consumption upgrading" did not involve Shanghai residents living like Parisians but rather focused on providing kitchen paper and good fruits for people outside Beijing's Fifth Ring Road. This is also why Pinduoduo and similar platforms were able to become rising stars.

Founders "on board" again?

Essentially, it's returning to the original aspiration. In May, JD.com's former CEO, Xu Lei, retired, and CFO Xu Ran was promoted to CEO. In June, Alibaba's Zhang Yong announced that he would step down from the position of Chairman and CEO on September 10th, and Executive Vice Chairman Cai Chongxin would assume the role of Chairman. Wu Yongming was appointed CEO of Alibaba Group Holding and continued to serve as Chairman of Taotian Group. Major personnel changes in management have occurred across many large companies.

All of these changes happened after the founders' internal rallying cry. Liu Qiangdong believed that the team had lost its direction, with executives talking too much about fancy stories but too little about costs, efficiency, and customer experience. Jack Ma stated that the future lies with Taobao, not Tmall, and that Alibaba's e-commerce should "return to Taobao." This essentially means returning to the original aspiration of entrepreneurship, emphasizing consumers and experiences rather than just focusing on achievements.

Investors may see it more as the founder's "return," as such situations have been seen in the history of large American companies as well. Starbucks' CEO, for example, has even returned three times, each time when the company faced challenges or needed transformation.

Has the stock price shown improvement?

At the beginning of the year, there were high expectations for Chinese concept stocks, betting on a rebound after the pandemic, with consumer spending being the key driver. However, recent economic data suggests that the "rebound" is slightly below market expectations, putting pressure on the entire Chinese concept stock market.

Going forward, whether it's changes in the external economic environment, expectations regarding household income, or shifts in consumer behavior, e-commerce should face them with a fresh perspective. Simplifying and focusing on essentials will better showcase its resilience.

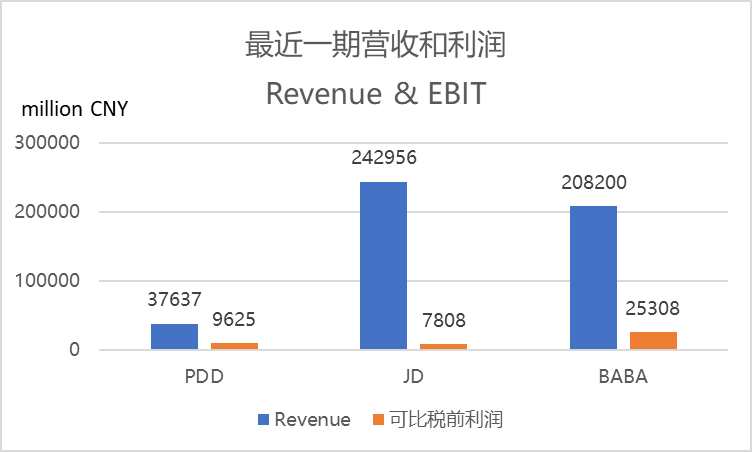

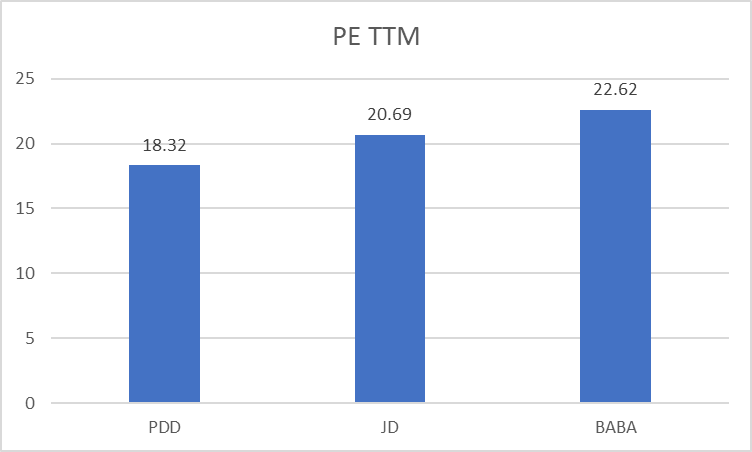

Looking at the latest quarterly financial reports, Alibaba, JD.com, and Pinduoduo have all shown profits, and their dynamic price-to-earnings ratios are 22 times, 20 times, and 19 times, respectively. These ratios are not high compared to the entire market and are even lower compared to other historical periods.

Therefore, from a long-term investment perspective, the current situation can be considered a favorable position.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Changes in leadership may signal a return to the original aspirations of entrepreneurship and emphasize consumers.

Short video e-commerce platforms like Pinduoduo and Douyin/Kuaishou may have outperformed traditional players.

Disappointed that no e-commerce platform disclosed GMV data for 618, indicating poor performance

E-commerce market still expanding; focus on overall retail sales growth.