How's Nike's Greater China Business Going?

$Nike(NKE)$ released its financial report for the fourth quarter of the 2023 fiscal year, ending on May 31, after the market closed on June 29.

Q4 Earnings Review

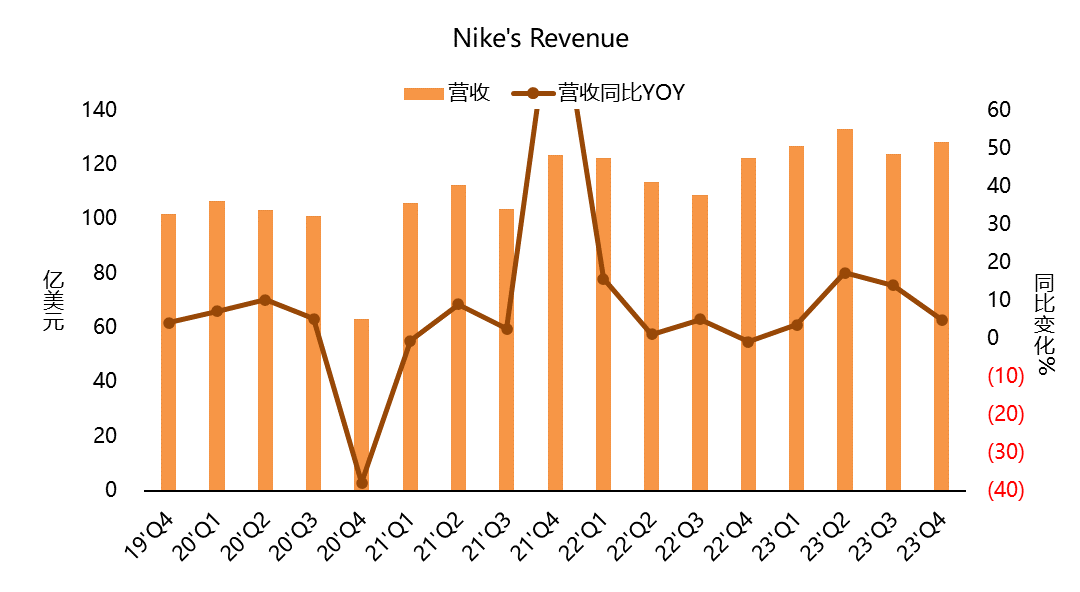

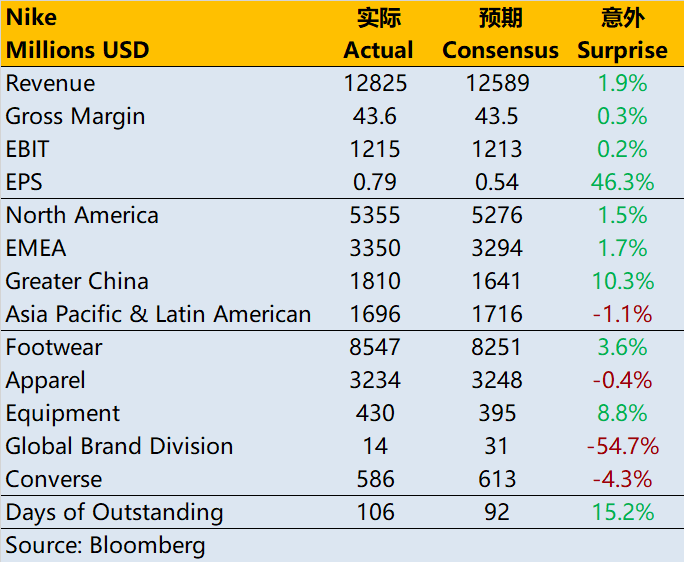

Q4 revenue increased by 5% year-on-year, reaching $12.8 billion, slightly higher than the market's expectation of $12.6 billion. Adjusted for currency-neutral calculations, the growth was 8%.

Nike brand revenue amounted to $12.2 billion, growing by 5% year-on-year and 8% on a currency-neutral basis. All brands, channels, and regions experienced growth.

Direct sales revenue reached $5.5 billion, surpassing the expected $5.12 billion and growing by 15% year-on-year. Adjusted for currency-neutral calculations, the growth was 18%. Nike-owned store sales increased by 24%, and Nike brand digital sales grew by 14%.

Converse brand revenue was $586 million, slightly lower than the market expectation of $612 million. On a reported basis, it declined by 1%, but on a currency-neutral basis, it increased by 1%. The brand achieved double-digit growth in the Asia region but declined in the European region.

By category, footwear revenue reached $8.55 billion, growing by 7%, surpassing the expected $8.25 billion. Apparel revenue was $3.24 billion, remaining flat year-on-year and meeting expectations. Equipment product revenue reached $430 million, growing by 11%, higher than the market expectation of $390 million.

In terms of regions, revenue in North America reached $5.35 billion, growing by 4.7%, higher than the market expectation of $5.28 billion. Operating profit was $1.39 billion, surpassing the expected $1.31 billion.

Revenue in the EMEA region was $3.35 billion, growing by 3.05%, slightly better than the expected $3.30 billion. Operating profit was $781 million, lower than the expected $797 million.

Greater China's revenue was $1.81 billion, growing by 16%, higher than the market expectation of $1.64 billion. Operating profit was $529 million, surpassing the market expectation of $444 million.

Revenue in the Asia Pacific and Latin America region was $1.70 billion, growing by 0.8%, lower than the market expectation of $1.70 billion. Operating profit was $462 million, lower than the market expectation of $494 million.

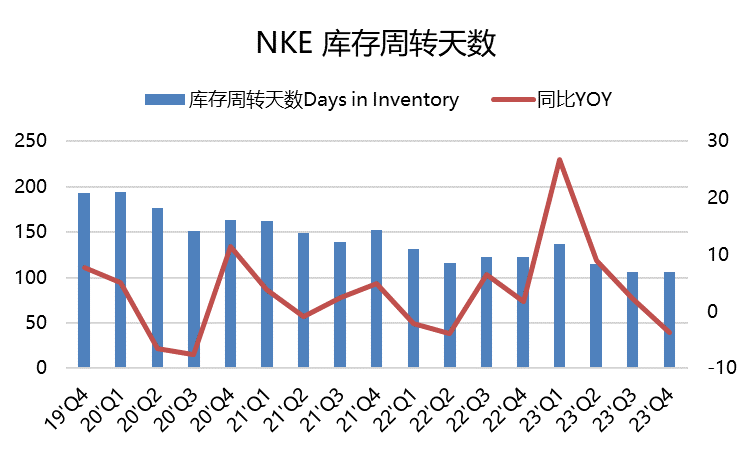

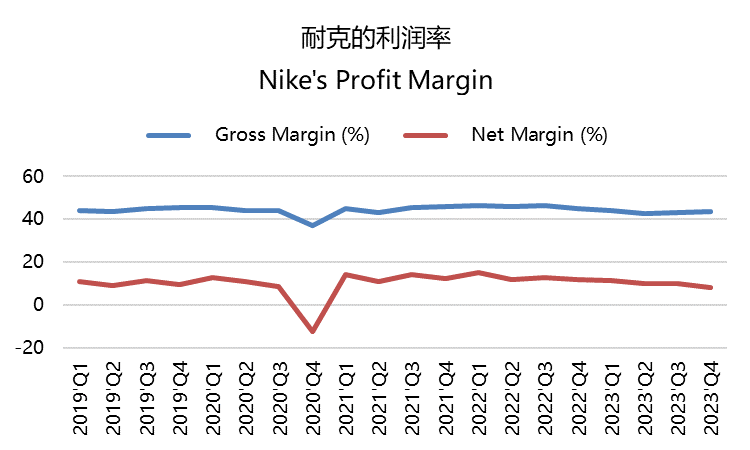

In terms of profitability, the gross margin declined by 250 basis points to 43.6%, slightly higher than the market expectation of 43.5%. This was mainly due to rising product costs, increased freight and logistics costs, higher discounts, and unfavorable net foreign exchange rates, which partially offset the impact of strategic pricing measures. Inventory increased by 0.4%, performing better than the expected increase of 8.37%. The company performed well in inventory reduction this quarter.

Regarding expenses, sales and administrative expenses increased by 11% to $16.4 billion. Demand creation expense was $4.1 billion, growing by 5% compared to the same period last year, primarily due to increased advertising, marketing, and sports marketing expenses.

In terms of expenses, sales and administrative costs increased by 11%, reaching $16.4 billion. Demand creation expenses amounted to $4.1 billion, a 5% increase compared to the same period last year, primarily due to increased advertising and marketing expenses, as well as sports marketing costs. Administrative costs increased by 12% to reach $12.3 billion, mainly driven by salary-related expenses, variable costs in direct sales, and higher investments in strategic technological enterprises. Operating profit was $1.22 billion, a 17% year-on-year decrease; net profit was $5.1 billion, a 16% decrease; adjusted diluted EPS was $0.66, slightly lower than the expected $0.67, a 14% decrease compared to the same period last year.

Outlook for FY2024

The company expects mid-single-digit revenue growth driven by direct sales for the fiscal year 2024. Exchange rates are not expected to have any significant impact. Gross margin is projected to expand by 140 to 160 basis points, with a long-term gross profit target of nearly 50%. Operating profit is expected to increase by 200 basis points.

Investment highlights

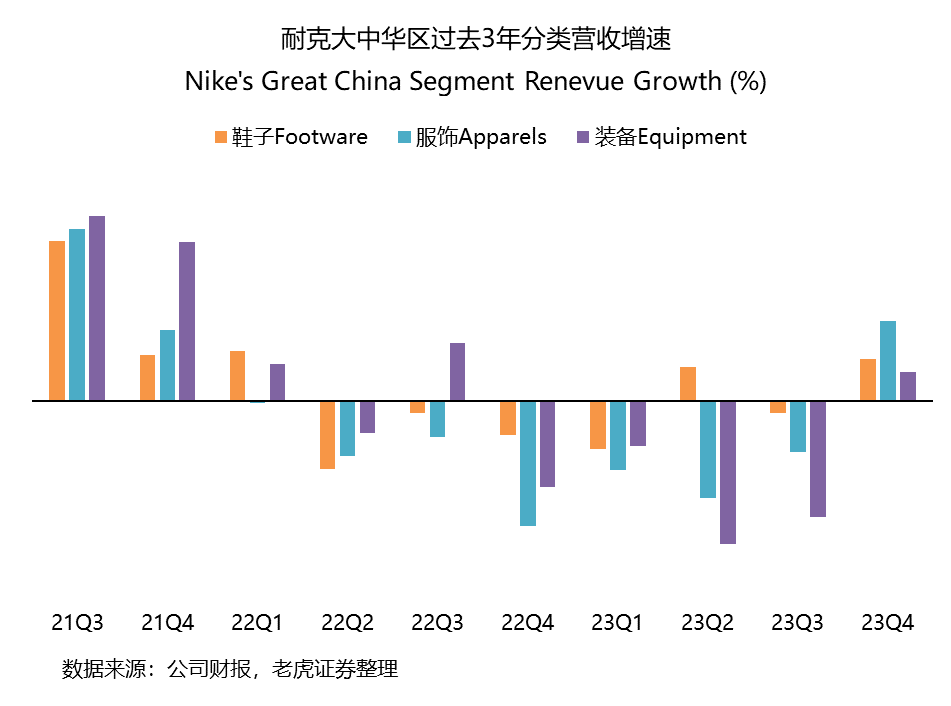

1. The Greater China region drives overall performance, recording positive growth for the first time in a year and a half. The growth in footwear is particularly evident, with footwear revenue for the quarter reaching $1.34 billion, higher than the $1.32 billion in 2021, exceeding the same period of the previous fiscal year for two consecutive quarters. However, the apparel category has not recovered to its previous level, mainly due to a significant 39% year-on-year decline in the fiscal year 2022, with a 25% year-on-year rebound this year, which cannot be considered a particularly good performance. Apparel revenue for Q4 of fiscal year 2021 was $570 million.

Nike's apparel in the Greater China region faces competition from similar sports brands on one hand and the influence of live-streaming e-commerce on the other. As we have mentioned many times before, the brand influence of these overseas sports brands has declined sharply after the "Xinjiang cotton" incident, coupled with the rise of domestic trend brands and the undifferentiated promotion of live-streaming e-commerce, the advantages of Nike's apparel category have been largely exhausted.

2. Destocking is nearing completion, and the focus for fiscal year 2024 is on improving profit margins. The value of inventory in Q4 remained flat year-on-year, with a slight decrease in quantity compared to 12 months ago. Among them, the inventory of apparel decreased by more than 20% compared to the same period last year. In both North America and the Greater China region, inventory amounts decreased by high single-digit percentages compared to last year, with a double-digit decrease in inventory quantity. The company has taken measures in the past few quarters to achieve higher profit margins in the future.

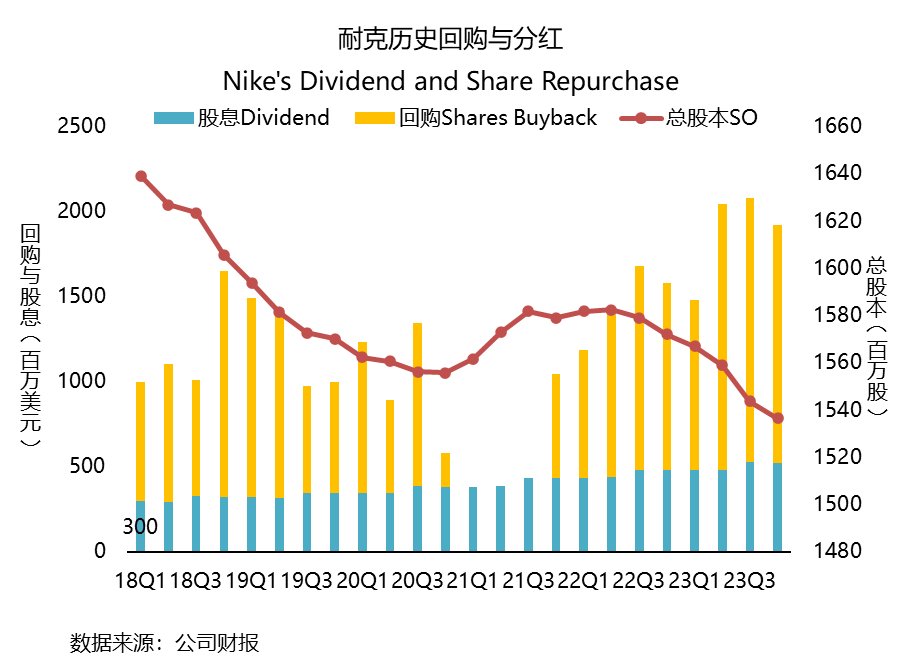

3.continue to carry out share buybacks to support the stock price. Although the company's stock price in the secondary market has fallen by 2.5% since the beginning of the year, the overall XLY sector has risen by over 30% since the beginning of the year (with the majority contributed by major companies such as TSLA and AMZN). As a player in the apparel sector, Nike did not have the opportunity to increase prices significantly during this period of inflation, which is a major reason why investors have been less optimistic about the company's prospects over the past year and a half. However, the company still repurchased over $1.4 billion in Q4 and paid out $500 million in dividends starting from Q3.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Nike get what they deserve closing all small stores that made them big... Several times in my career talked with sales reps of Nike, they never ever talked with any respect about small retailers. Shorting it till 80...

Have not bought anything this company makes since they turned against normal, decent human behavior and sided with circus freaks.

Nike brand revenue exceeds expectations, driven by strong direct sales and digital growth

NKE sells junk stuff. I stopped buying 4-5 yrs ago. No more NKE or Adidas. Totally insane.