Biden's Health Back in Focus As The Double Top Of S&P 500 Patterns Defined

The first half of the year has passed, and the second half of the year is about to If inflation expectations and the end of rate hike cycle dominate market expectations in the first half of the year, then whether the economy is in recession and interest rate cut expectations will dominate market sentiment in the second half of the year. Even if the Federal Reserve's interest rate meeting in July and September goes back to rate hike, this year will be almost the same. After all, the core inflation data began to slow down, and there are fewer and fewer reasons for rate hike. The rest depends on whether the economic data is affected by rate hike and there is a recession. After all, recession is the real reason for cutting interest rates.

Since the debt ceiling was raised, the printing press in the United States has made sufficient preparations. Even without the QE of the Federal Reserve, the US Treasury Department can print money to save the economy by increasing bond issuance and raising fiscal expenditure, as long as the interest rate is cheap enough. Therefore, printing money is not a problem at present, but what is the reason.

An inconspicuous news at the weekend thought that everyone needed to pay attention to Biden's physical condition. Biden is 80 years old, and it is a question mark whether his physical condition is enough to seek re-election as president. The "Biden Economics" (green infrastructure + various fiscal expenditures) advocated by Biden is being implemented hard. Once the physical problems appear and lead to the failure of re-election, it can trigger the market to reassess the overall economic policy, which will bring impact.

Will American stock indexes have an impact?

The U.S. stock index definitely has little impact in the short term. At present, the three major U.S. stock indexes are still running above the 20-day moving average, and even the adjustment last week has not fallen below, which proves its strong characteristics. Therefore, we should observe the short-term trend according to the moving average. As for the growth rate, there may be rotation between indexes. For example, the Nasdaq was slightly weaker last week, while the S&P Dow was relatively strong, but the direction is still based on the 20-day moving average as an important benchmark. When a variety has a trend, the moving average is the best tracking method, which is simple and efficient, and the rest is to judge the impact of current or future events on the market.

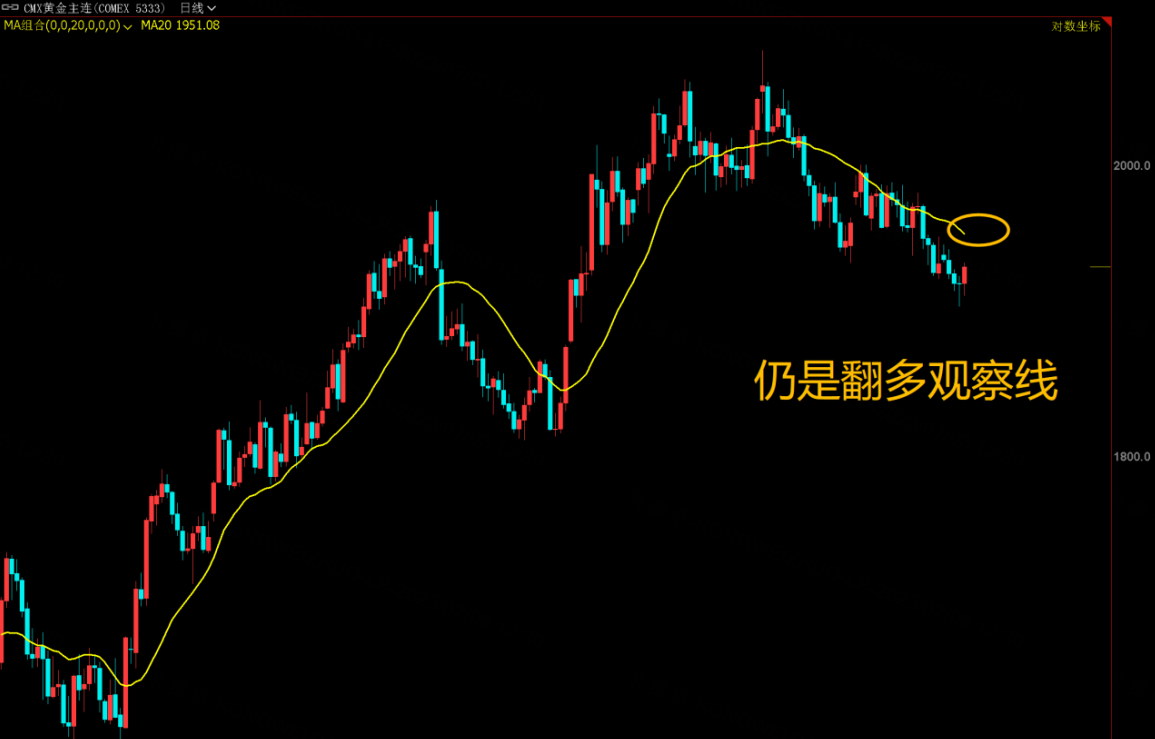

Pay attention to the rebound after gold fell

Next week's non-agricultural data will lay a rate hike for the Federal Reserve this month. If the data is bad for gold prices, gold prices may bottom out after falling. Below 1900 is an important support point for gold price in the medium and long term, so it is easy to rebound. As for the increase, it needs extra news to cooperate, but at present, I really can't think of any bad news for gold price, so I can only wait for it to turn.

Brief comment on agricultural products

The USDA report on planting area and end-of-season inventory of agricultural products on June 30th can be described as ice and fire. U.S. beans rose sharply while U.S. corn and wheat fell sharply, which was in line with the characteristics of agricultural products taking advantage of the topic in June. Soybean prices imported by China for a long time were firm, while wheat and corn, important export agricultural products of Russia, were weak. I'm afraid this situation is difficult to change in the short term, so whether corn and wheat should be weak or weak, super rebound can be considered, but bargain-hunting is still cautious in the short term. At present, the price of US beans is also in a volatile market. If you look directly at the rise of soybean oil, the pioneer of inflation, you can control your position and pay attention to the fluctuation rhythm.

$NQ100 Index Main Connection 2309 (NQmain) $$Dow Jones Main Link 2309 (YMmain) $$SP500 Index Main Connection 2309 (ESmain) $$Gold Main Link 2308 (GCmain) $$WTI Crude Oil Main Link 2308 (CLmain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

The specific provisions of Biden's Health Back will also affect the impact of the American stock indexes on it.

The American stock indexes can have an impact on Biden's Health Back, but the extent of the impact is uncertain.

I think the impact is very tiny for the US market.