Unusual Options talks?(7.10) Big-Tech Surge Over?

There were significant changes in the market on July 10th, mainly due to a shift in trading styles. The focus switched from large technology stocks to second-tier technology stocks leading the gains, while the big tech companies experienced a correction.

On the news front, index providers expressed concerns about the excessive weight of large tech companies, with the top six companies accounting for over 50% of the total weight. There might be a need to adjust this to 40%. Sentiment-wise, the market was also influenced by overbought pressure.

Currently, we are in a period of relative calm before the upcoming Federal Reserve meeting and the release of earnings reports from major weighted companies. There is no significant news to stimulate the market, so it can only further digest previous information, such as the upward adjustment of expectations for July holiday travel.

This week, airline companies will be releasing their financial reports. Since airline stocks are currently at recent highs, there is not much downward pressure as expectations are quite high. As for unusual movements, they are quite diverse.

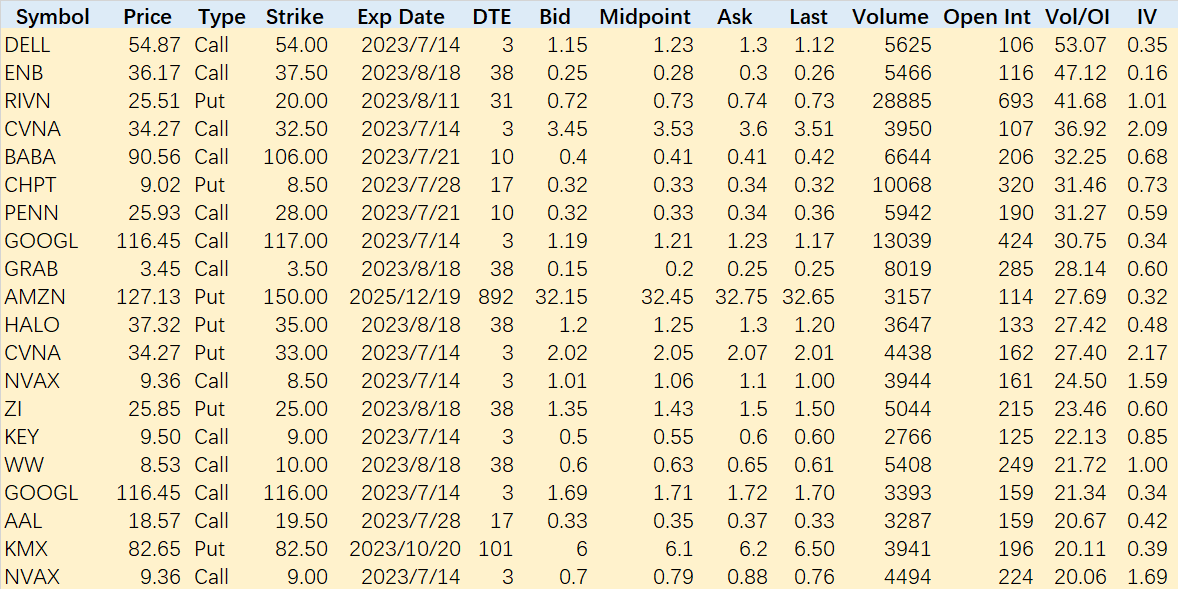

One noteworthy company that has experienced strong short-covering recently is $Carvana Co.(CVNA)$ It has also shown strong upward momentum. However, after a month of covering shorts, there are signs that long positions are being considered.

The short interest on Chinese concept stock $Alibaba(BABA)$ has reached a level of 106, indicating high expectations for the next two weeks.

$Rivian Automotive, Inc.(RIVN)$ continues to maintain upward momentum (demand for short covering has been significant). However, the selling of put options is currently only happening at the 20 level, suggesting that investors believe there is potential for a significant downturn if it occurs.

A large put option order for $Amazon.com(AMZN)$ has appeared, which is notable because such orders are usually initiated by buyers. From the seller's perspective, the return is too low and the risk-reward ratio is disproportionate. It is possible that this type of order is placed by investors who hold AMZN options or the underlying stock.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Hedge funds are counting on the average investor to believe AMZN will go up after earnings. Who cares? don’t trade AMZN let the hedge funds be the bag holders for a change.

Will AMZNever get back to all-time highs?? Has done nothing for 5 years and counting...Its so easy to raise share price by cutting costs dramatically.

RIVN goes up and down along with Nasdaq.. will cross $25 soon

BABA is gaining traction… big institutions upping their holdings after last weeks news….

My life is perfect buddy…. BABA is moving up strong…. very justified….