How Big Banks React In Q2 Earnings?

Bank stocks may have set an example during the earnings season, as banks strive to demonstrate their recovery from the most challenging industry crisis since the 2008 financial crisis.

Of course, with various downward revisions in Q1 expectations, the market had already reached a consensus on the decline in Q2 performance (at least in terms of profits), so it was priced in early, and the banking sector index underperformed the overall market.

However, due to positive macroeconomic data and a continuous decline in the US dollar index, overall sentiment is gradually improving.

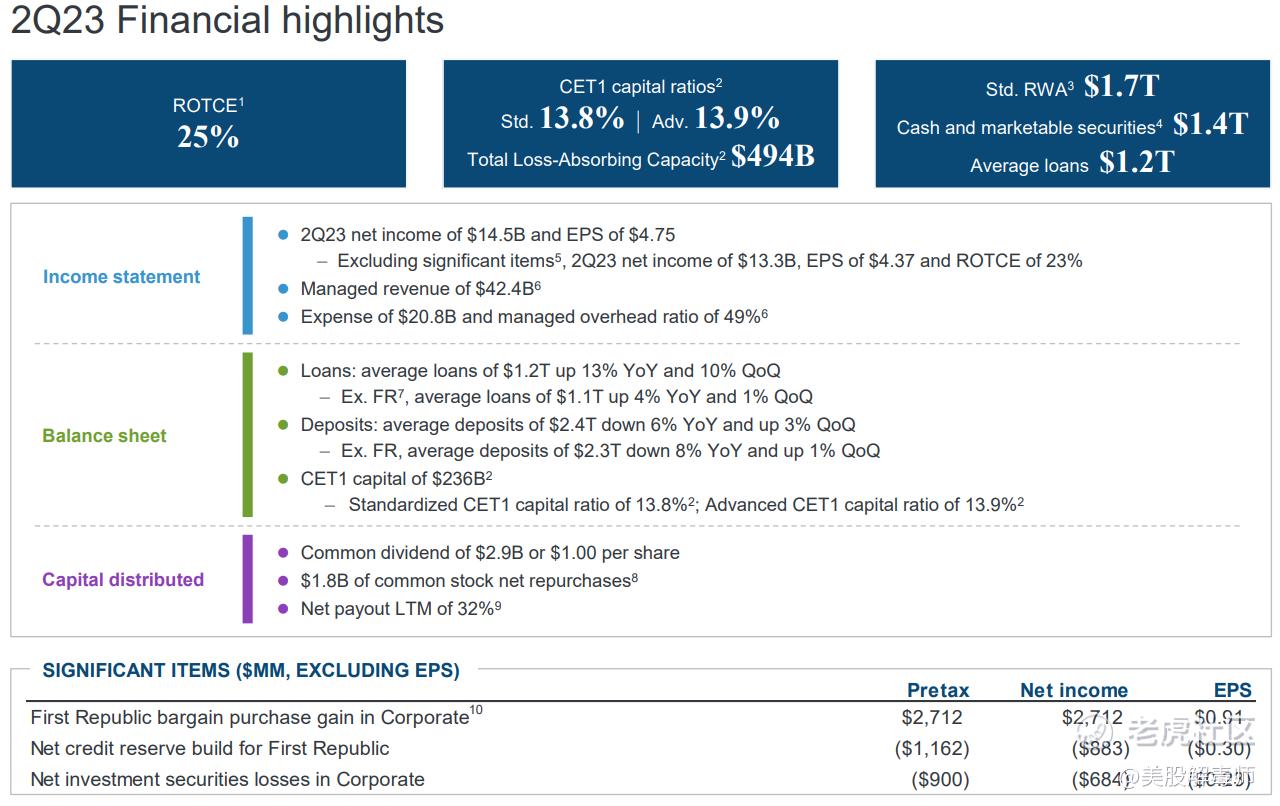

Adjusted revenue for JPMorgan Chase was $42.4 billion, exceeding the market's consensus of $38.9 billion. Net interest income was $21.8 billion, surpassing the market's expectation of $21 billion. The company's corporate and investment banking revenue was $12.5 billion, slightly higher than the $12 billion in the same period last year.

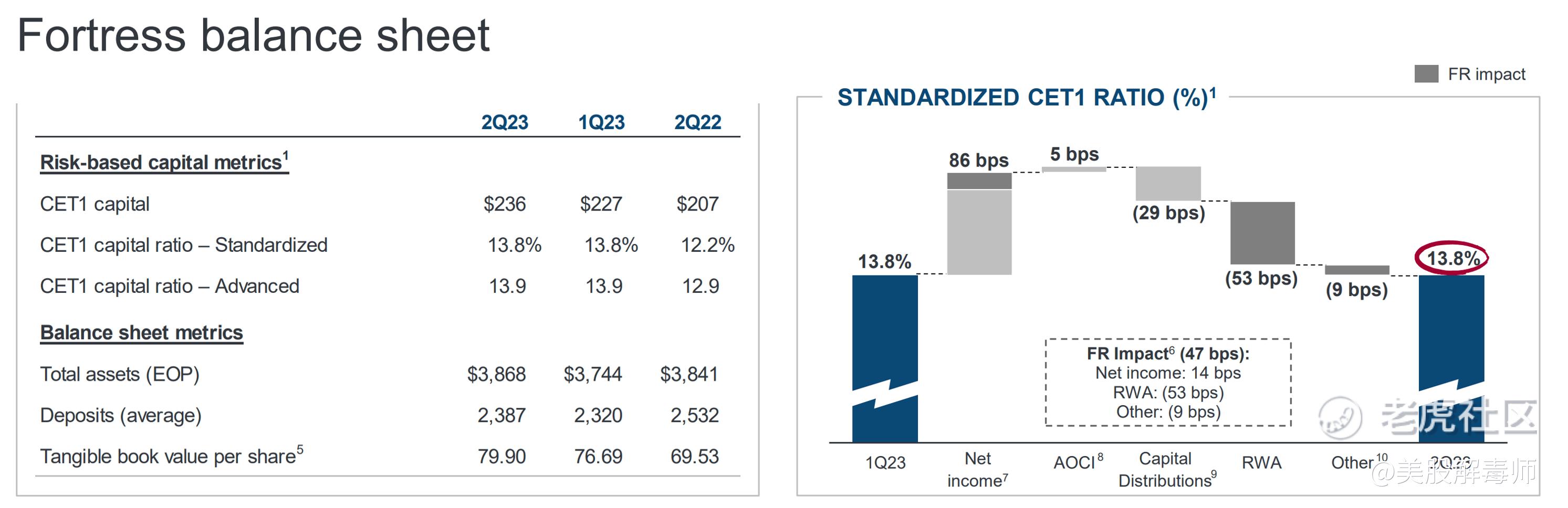

Loan loss provisions were $29 billion, exceeding the market's consensus of $26.8 billion and increasing from the previous quarter's $22.8 billion. EPS was $4.37, higher than the market estimate of $3.80. Total loans increased to $1.3 trillion from $1.13 trillion as of March 31, 2023, and deposits increased to $2.4 trillion from $2.38 trillion at the end of Q1. CET1 capital adequacy ratio was 13.8%.

Summary

Q2 performance exceeded expectations and raised guidance for full-year net interest income. The negative impact of the acquisition of First Republic Bank was relatively small.

Most businesses contributed to the growth of Q2 profits, with particularly strong performance in consumer and community banking as well as commercial banking. This indicates that the banking pressures that emerged in March have been largely relieved, and the balance sheet remains healthy.

Despite the downward trend in CPI in Q2, consumer spending continued to grow, albeit at a slower pace, while labor market growth slowed but remained robust.

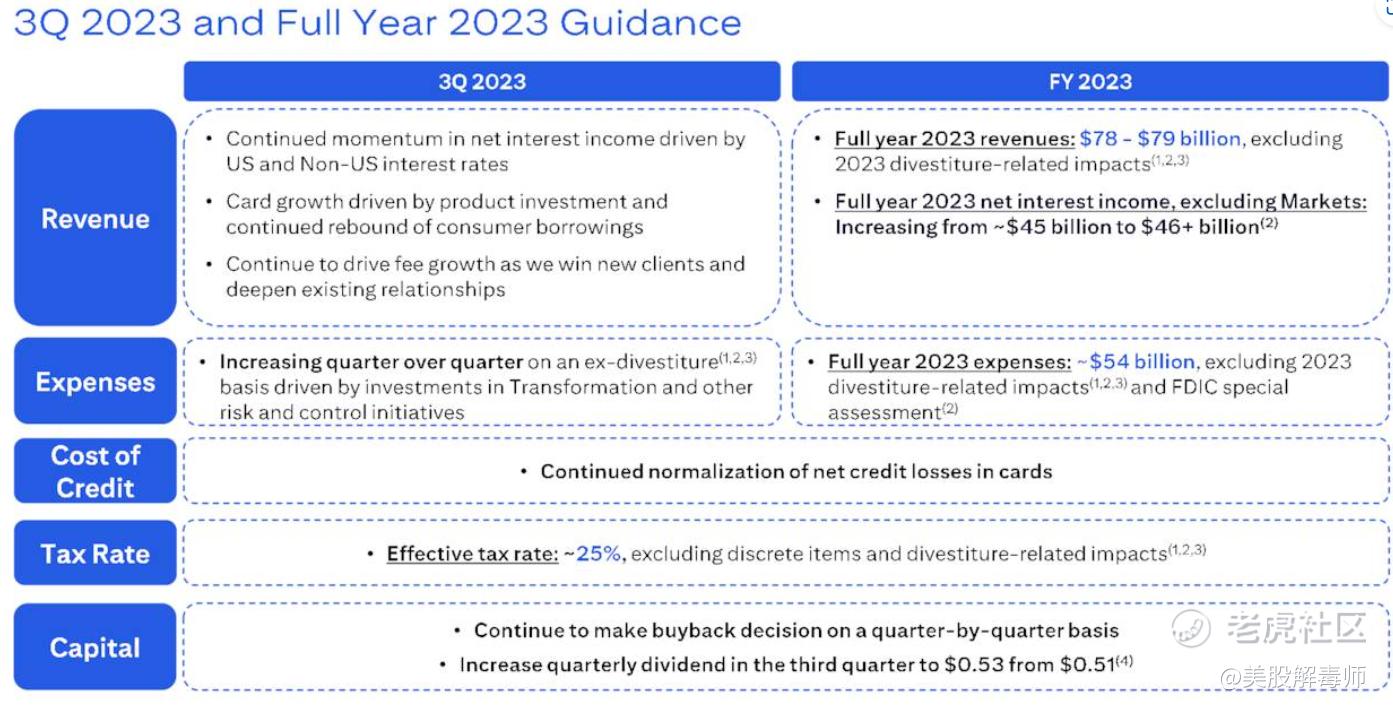

In terms of guidance, the estimated net interest income for the 2023 fiscal year is approximately $87 billion, an increase of $6 billion compared to the Q1 expectation of $81 billion.

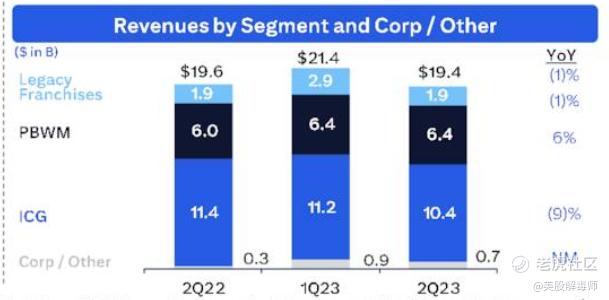

Citigroup reported revenue of $19.44 billion, slightly higher than the market consensus of $19.34 billion but a decrease from $19.6 billion compared to the previous year. Institutional clients group revenue was $10.4 billion, down 7% QoQ and 9% YoY. Consumer banking and wealth management revenue was $6.4 billion, down 1% QoQ but up 6% YoY. Traditional franchise revenue was $1.92 billion, down 33% QoQ and 1% YoY. Net profit significantly declined from $4.5 billion in the same period last year to $2.9 billion, a decrease of 36%.

Earnings per share were $1.33, slightly exceeding the expected $1.31. Net credit reserve build was $161 million, compared to $241 million in Q1 and $375 million in Q2 2022. The total cost of credit was $1.82 billion, a decrease from $1.98 billion in Q1.

Total loans increased to $661 billion from $652 billion as of March 31, while deposits decreased to $1.32 trillion from $1.33 trillion at the end of Q1. Common equity tier 1 capital ratio was 13.3%, slightly lower than Q1's 13.4%.

Summary

Due to the significant slowdown in market trading during Q2, revenue from institutional clients declined. However, the business targeting large clients still managed to achieve some YoY growth, albeit at a slower pace compared to last year, supporting the overall performance of the company.

The decline in investment banking revenue was not surprising, while strong consumer spending supported Citigroup's performance this quarter, with a 27% growth in revenue from retail credit card business. In terms of costs, the company implemented layoffs and continued strategic contraction in Q2, and the increase in expenses may be one-time compensation costs.

In terms of performance, Citigroup performed slightly worse than JPMorgan Chase, which is why the situation of opening high and closing low was more apparent.

Wells Fargo reported an EPS of $1.25 for Q2, exceeding the average analyst estimate of $1.14 and an increase from $1.23 in Q1 and $0.75 in the same period last year. Revenue was $20.5 billion, surpassing the expected consensus of $20.1 billion, an increase from $17 billion in Q2 2022, but a decrease from $20.7 billion in Q1.

Net interest income was $13.2 billion, exceeding the consensus estimate of $12.8 billion, a decrease from the previous quarter's $13.3 billion but an increase compared to $10.2 billion in the same period last year. Non-interest income was $7.37 billion, a decrease from $7.39 billion in Q1 but an increase compared to $6.84 billion in the same period last year.

Loan balance as of June 30, 2023, was $945.9 billion, a decrease from $948.7 billion as of March 31, 2022, while deposit balance was $1.35 trillion, a decrease from $1.36 trillion at the end of the first quarter. Loan loss provisions were $1.71 billion, $1.21 billion in Q1, and $580 million in the same period last year.

Additionally, Wells Fargo raised its full-year net interest income expectation to approximately 14% YoY growth, compared to the previous guidance of +10%. Non-interest expenses (excluding operating losses) for the full year are expected to increase to approximately $51 billion, higher than the previous guidance of around $50.2 billion.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

我喜欢WFC...WFC的一个主要优势是其强大的资本地位。它是少数几家恢复股息并再次大量回购股票的银行之一。

JPM是一只价值超过200美元的股票,拥有强大的品牌和每个人的信任。如此比例的净利息收入增长表明,它正在产生大量自由现金,并可能在未来几年继续增长。

I don't think investors should focus too much on quarterly earnigns, especially for a institution like JPM

WFC-PA I see most Wells Fargo preferred stocks are crashing don't know why?

I need to buy the deep on great dividend stock!!! C is on super sale