Why Market Underestimate Uber's Profit Potential?

$Uber(UBER)$ Q2 earning made the stock plummeted nearly 6%, surprisingly falling short of market expectations in terms of revenue, which caused some concerns as the CFO is stepping down without a successor in place.

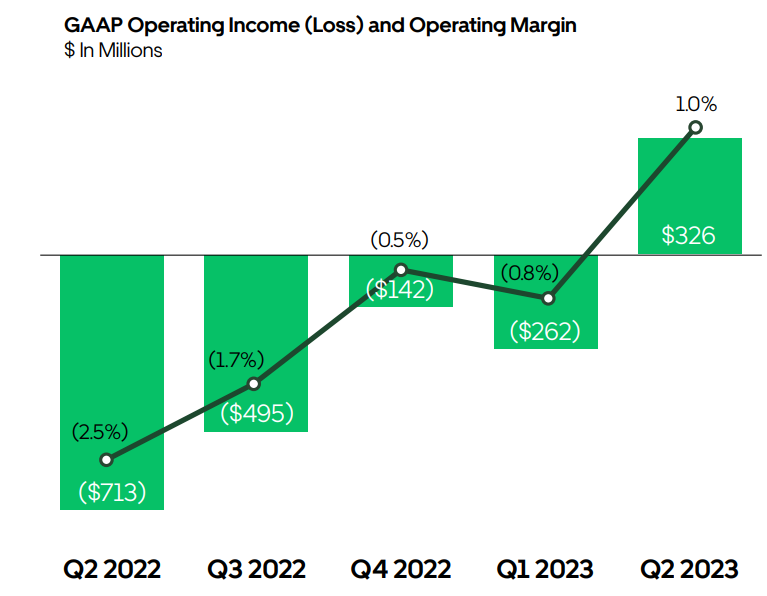

However, the ride-hailing and delivery still showed robust performance, with profit margins exceeding expectations and recording operating profit under GAAP for the first time. Additionally, the company raised its Q3 guidance, becoming an unexpected bright spot.

Furthermore, advertising revenue is expected to play a crucial role in boosting the company's profitability and increasing its valuation.

Performance overview

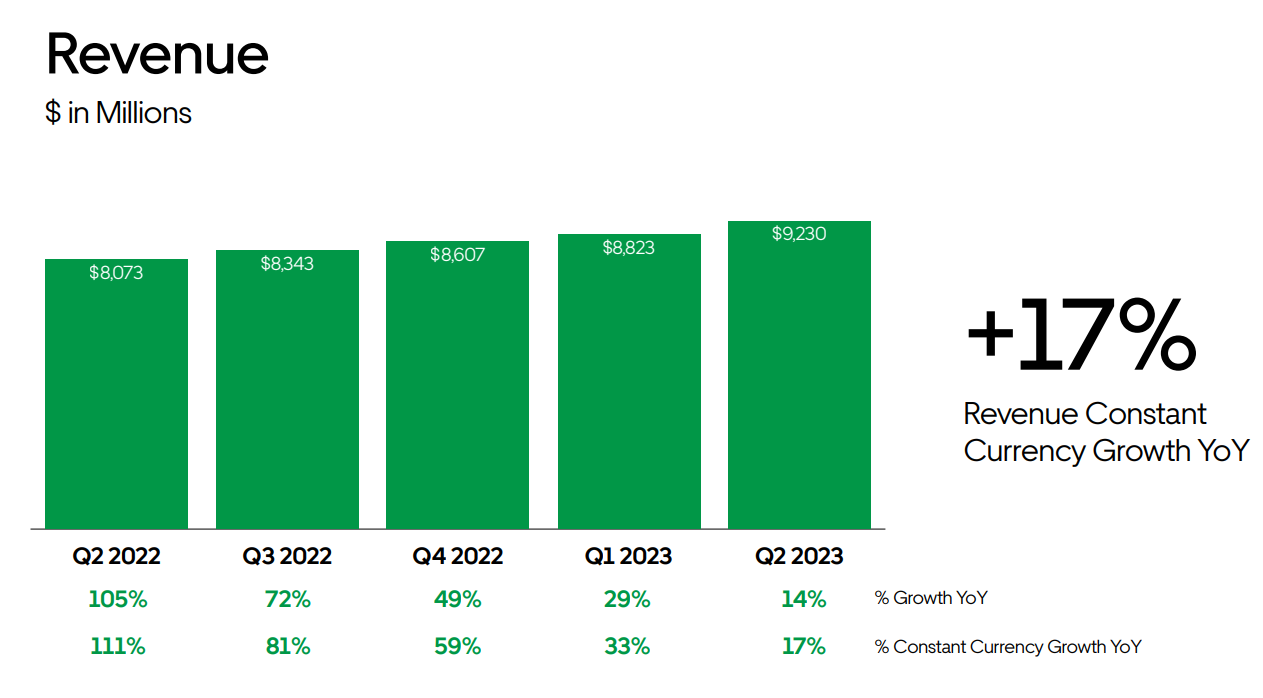

Revenue reaching $9.23 billion, a YoY growth of 14.0%, slightly below the expected $9.34 billion.

total bookings amounted to $33.6 billion, a YoY increase of 16% (or 18% on a currency-neutral basis), exceeding the market's expected $22.49 billion.

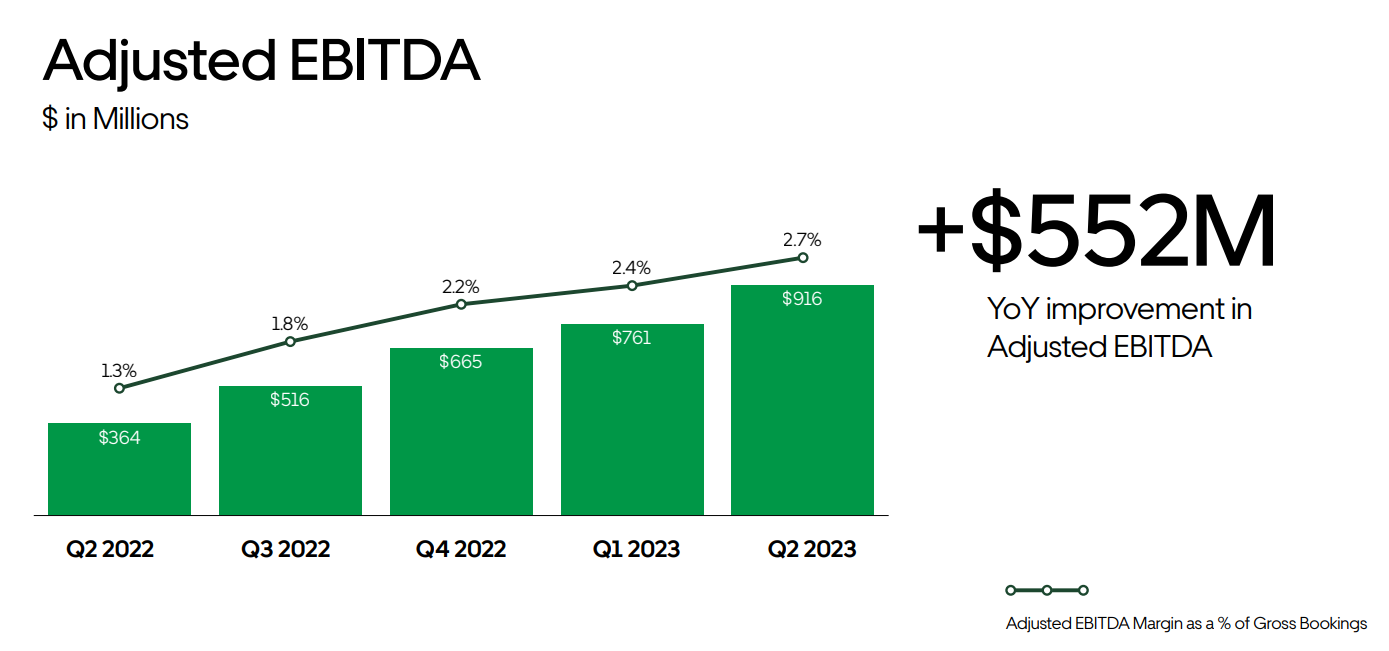

Adjusted EBITDA reached $916 million, a $552 million increase from the same period last year and higher than the market's expected $845 million. The adjusted EBITDA profit margin was 2.7%, an improvement from 1.3% in Q2 2022.

The GAAP EPS was $0.18, surpassing the market's expected -$0.01. Operating cash flow was $1.2 billion, with a record-breaking free cash flow of $1.1 billion, surpassing the market's expected $670 million.

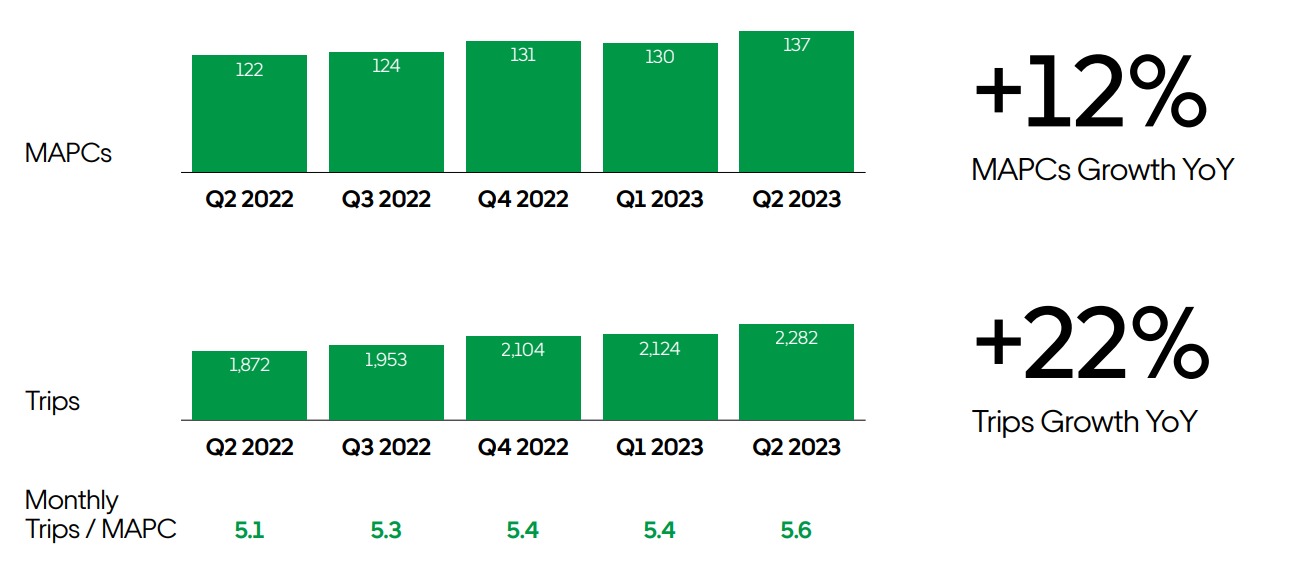

In terms of operational data, Uber's monthly active platform consumers reached 137 million, a 12% YoY increase and 5% increase from the previous quarter.

The total number of trips on the platform reached 2.3 billion, a 22% YoY increase and 7% increase from the previous quarter. The average monthly consumer trips increased by 9% YoY, reaching 5.6 trips.

Moreover, the company raised its Q3 guidance, anticipating total bookings of $9.75-10.3 billion, higher than the market's expected $9.19 billion. The expected Q3 total bookings will be $34-35 billion, and adjusted EBITDA is expected to be $975-1,025 million.

Investment highlights

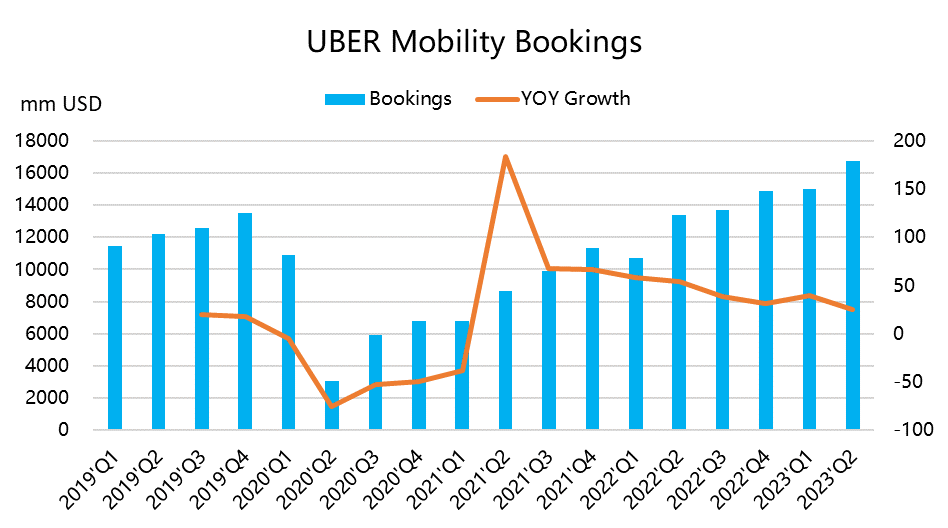

include the continued rapid growth of the ride-hailing business, reaching new heights despite disruptions during the pandemic. The mobility service has consistently achieved record-high demand each quarter, leading to a 25% YoY increase in gross revenue to $4.89 billion and a 38% YoY increase in ride revenue.

This growth is partly attributed to an increase in mobile ride-hailing fares from 26.5% a year ago to 29.3% in the last quarter. Additionally, higher driver participation has contributed to Uber's ability to maintain competitive pricing compared to Lyft, narrowing the price difference between the two. A

ctive drivers in the mobile ride-hailing segment increased by 33% YoY, with a 7% rise in driver participation, indicating their increased engagement with the Uber platform, which is crucial for sustained growth.

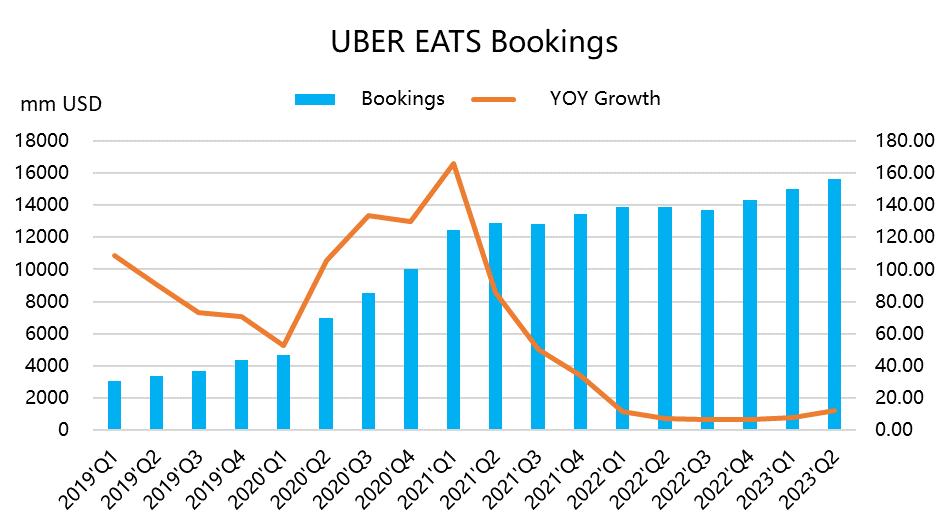

The food delivery business has also improved its profitability, with growth accelerating from 8% in Q1 to 12%. The introduction of Uber One has helped build a private domain flow, increase customer retention, and lower customer acquisition costs.

In the past quarter, Uber expanded its Uber One service to an additional 15 countries, and Uber One members accounted for 27% of total gross revenue. The decline in revenues for many other competitors allowed Uber to gain market share in all major markets and increase business profitability. The Take Rate also increased from 19.4% last year to 19.6% this year, while accelerated growth in travel also contributed to upward momentum, along with easing inflation.

Uber further increased its EBITDA profit margin in the food delivery business from 21.7% a year ago to 25%.

The potential for incremental growth should not be overlooked, given the rising EBITDA profit margin and the progress in the advertising business.

Currently, the company has generated over $650 million in advertising revenue, with more CTV advertisements to be featured in the Uber app. The number of advertising partners on the Uber platform increased by 70% YoY, reaching 345,000 businesses. While most of the revenue currently comes from Uber Eats, there is a significant opportunity for advertising in the ride-hailing segment as it continues to grow. Advertising is a high-profit business, and importantly, it can provide additional income to drivers, increasing their engagement and loyalty.

Valuation

Uber's current market cap of $95 billion and EV of $101 billion represent an EV/EBITDA multiple of 102x.

Although the forward P/E ratios for 2023 and 2024, at the current profit levels, are 81x and 36x, respectively, higher than the industry average,

EV/EBITDA for the 2023 fiscal year is expected to decrease to 27.3x, which is comparable to $MEITUAN-W(03690)$ 28x. At the current price, the expected EV/EBITDA multiple for 2024 is 18x, indicating potential for further upside.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- 火天大有火天大有·2023-08-03AwesomeLikeReport