What Makes Sea The Most Disappointing Growth Stock?

Why did Sea collapse again? Who applied the pressure? Is there still hope for valuation?

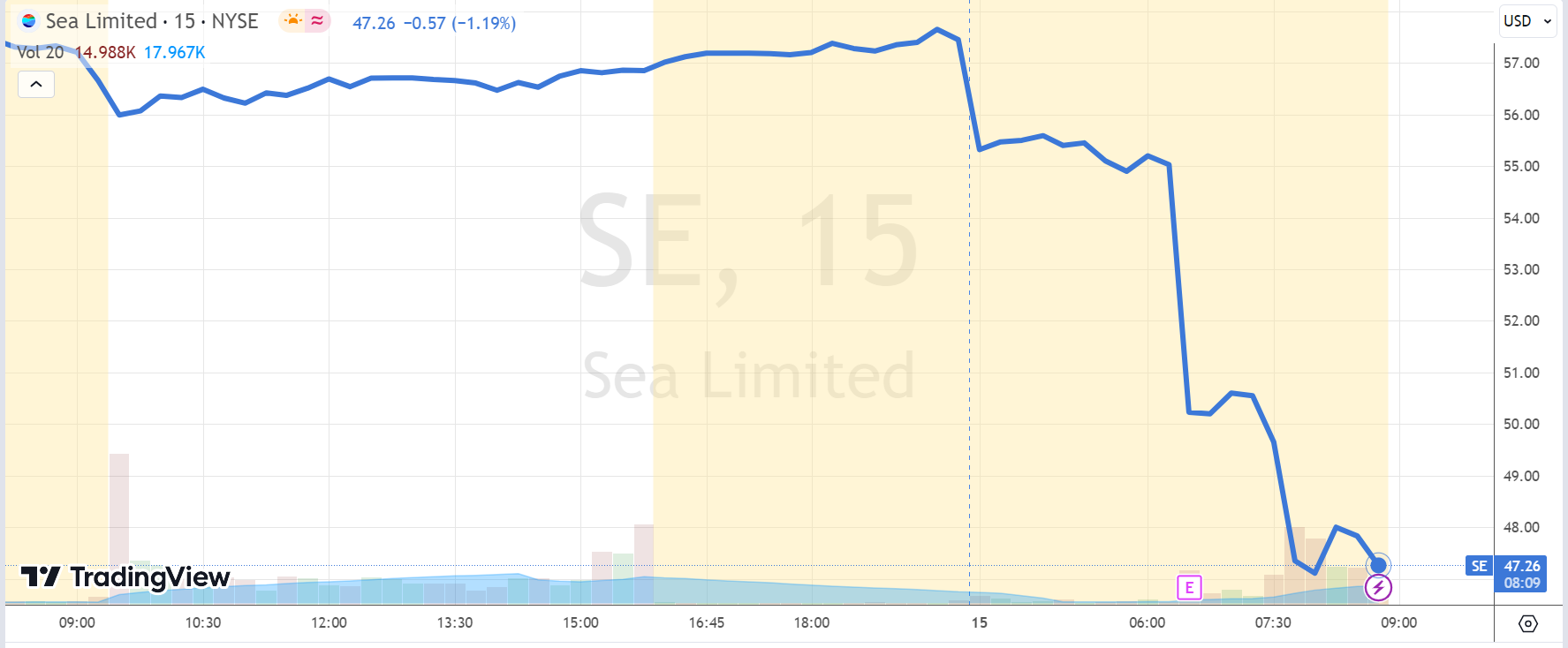

$Sea Ltd(SE)$ ‘s Q2 2023 earning made the stock plummeted 10% in pre-market trading.

Despite the profit indicators slightly exceeding market expectations, the main gaming and e-commerce revenue fell short, and there was no guidance for the next quarter, leading investors to doubt its business growth capabilities and the potential for profit margin improvement.

We believe

The company deliberately signaled "profit margin indicators" to the market. However, profit margin is merely a new expectation in the market, a promise for the company to improve the "burn money for scale" model in the era of high inflation, without giving up the expectation of "high growth" for the company. The previous "early profitability" was more about subtracting from self-operational aspects, reducing subsidies and promotions, but the consequences of sacrificing business growth have ultimately been manifested.

Garena with the highest margin continued to shrink due to a lack of quality products, while the recently improved operational efficiency of the e-commerce business stalled due to the contraction in the South American market, competition from Southeast Asian competitors, and a decline in overall consumption behavior. This also challenged the financial services business.

Earnings Review

Revenue side

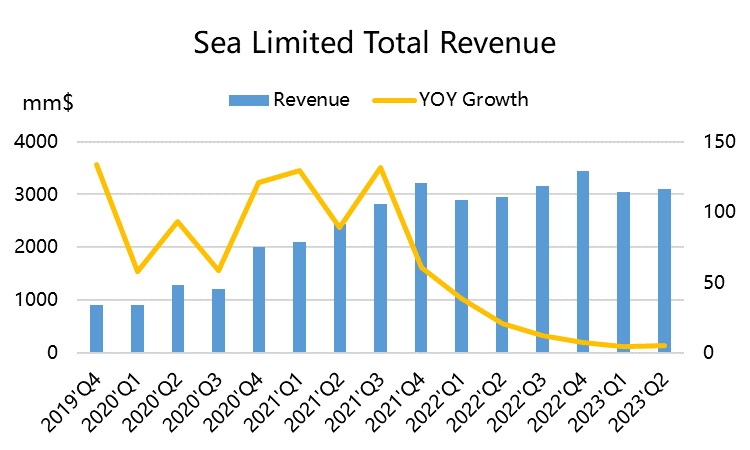

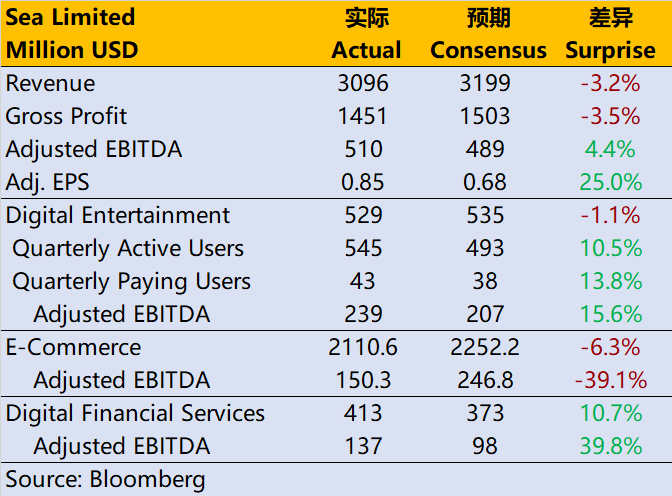

Total revenue was $3.096 billion, a year-on-year growth rate of 5.2%, hovering in the mid-single digits for three consecutive quarters and falling short of the market's expected $3.199 billion by a significant 3%.

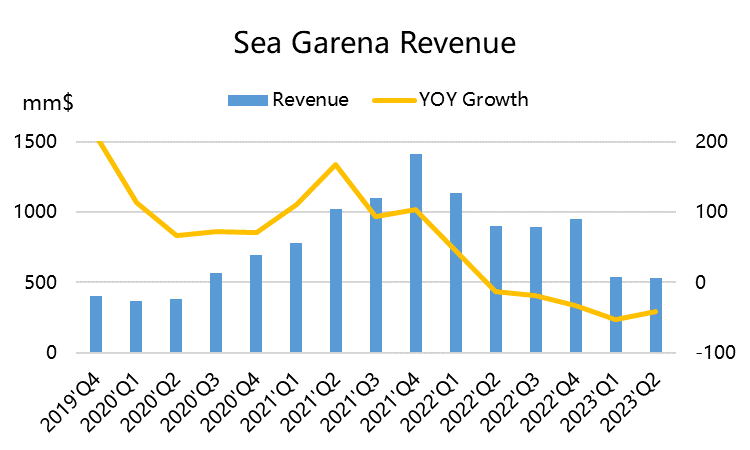

Among them, electronic entertainment business revenue was $540 million, a year-on-year decrease of 52.5%, returning to the level of Q3 2020, and below the market's expected $535 million.

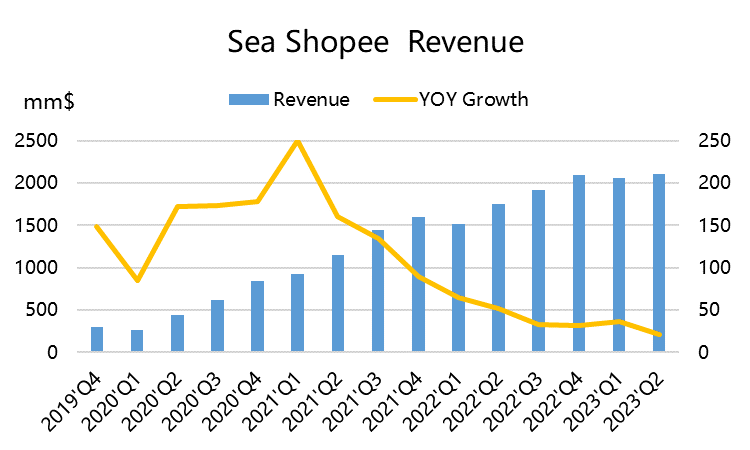

E-commerce business revenue was $2.11 billion, a year-on-year growth of 20.7%, below the market's expected $2.25 billion by more than 6%.

Financial services business revenue was $413 million, a year-on-year growth of 53.4%, roughly in line with market expectations.

Profit side

Gross margin 46.8%, slightly higher than the market's expected 46.3%, mainly contributed by the gaming and financial services businesses.

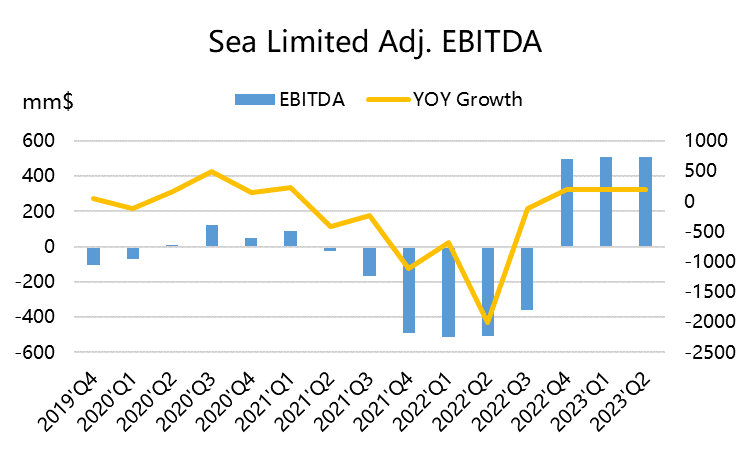

Adjusted EBITDA was $510 million, higher than the market's expected $490 million. Adjusted EPS was $0.85, surpassing the market's expected $0.68.

The EBITDA of the electronic entertainment segment amounted to $239 million, surpassing the market's anticipated $207 million.

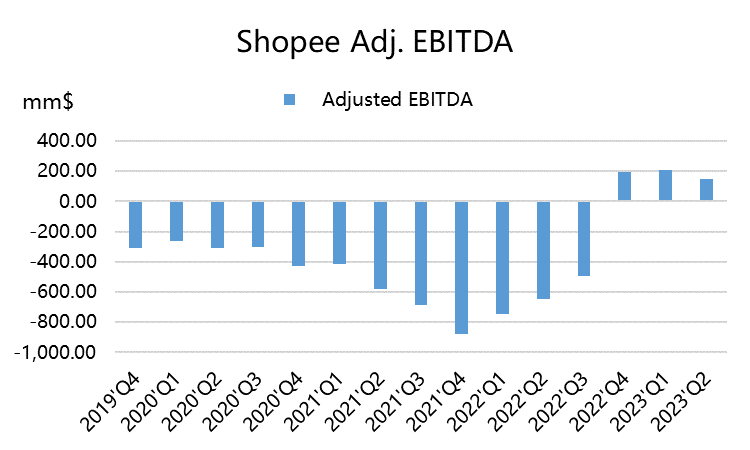

For the e-commerce division, the EBITDA stood at $150 million, falling short of the market's projected $246 million.

In the financial services sector, the EBITDA reached $140 million, exceeding the market's expected $98 million.

Investment Highlight

The gaming business continues to experience a "collapse," but there is hope for stabilization.

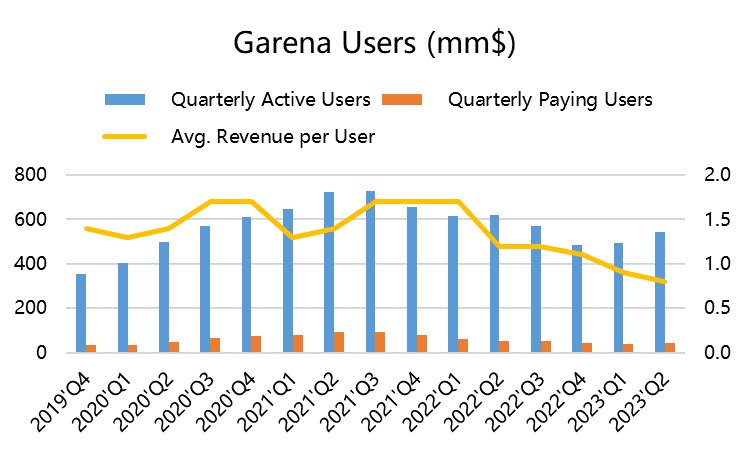

In fact, since the lifecycle of "Free Fire" entered a downward trend, Garena has been struggling to come up with a successful product. Currently, relying on the representation of more games can ensure channel advantages, but it falls far short of filling the gap left by the lack of successful products and cannot achieve the goal of recovery.

From another perspective, due to the increasing number of represented games, the trends of active users and paying users from the previous quarter continue, with active users at 544 million, a year-on-year decrease of 12%, but an increase compared to the previous quarter. Paying users are recovering at a slower pace, reaching 43 million, the same level as Q4 of last year. At the same time, the revenue generated per individual paying user continues to decline.

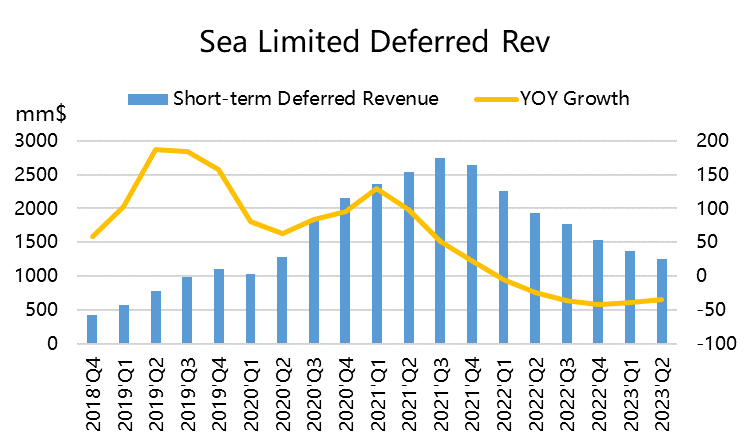

Looking at the level of deferred revenue, the rate of decline is also on the rise. Therefore, in the short term, the gaming business should be able to maintain a revenue level of over 500 million for a single quarter. The company's efforts in cost reduction and efficiency improvement have been most effective, as Q2's EBITDA profit exceeded expectations, reaching 239 million.

E-commerce business faces stronger competition.

Shopee's revenue performance this quarter is the weakest, which is partly related to the contraction of the Brazil business and competition in the Southeast Asian market. As the company has not disclosed GMV and order volume data separately since the previous quarter, there is a lack of a comparative dimension. The monetization rate within the Southeast Asian market should have also increased to a higher level. Additionally, $Alibaba(BABA)$ Lazada performance in this quarter has been impressive, suggesting a certain degree of market share transfer.

The EBITDA for this quarter did not meet the market's strong expectations. This is also because Shopee's strong turnaround from losses to profits in the previous two quarters had set overly high expectations for investors. In reality, there are still challenges to face in terms of maintaining growth. It may take a few more quarters for the management to strike a balance between profit and scale.

However, it can be said that the handling of investor expectations has not been very successful, resulting in Shopee's overall business falling short of market expectations.

Digital financial On the right way

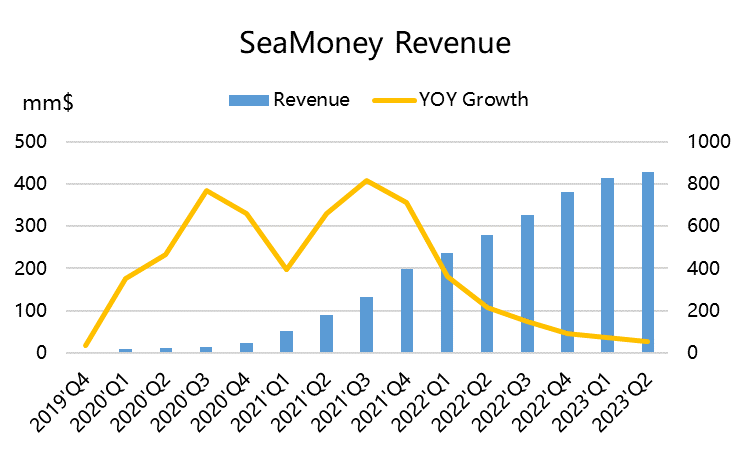

The best-performing business this quarter is SeaMoney, with revenue maintaining a growth rate of 53%, reaching 428 million, and an astonishing EBITDA profit growth rate of 223%, resulting in a remarkable profit margin of 32%.

Meanwhile, the total amount of loans to be recovered remains steady at $2 billion, without expansion. The provision for bad debt losses has risen to $279 million, slightly lower than the previous quarter's $281 million. The proportion of non-performing loans overdue for more than 90 days to the total gross loans also maintains stability, at around 2%.

However, drawing from the lessons of Shopee's declining profit margins, the market's outlook on SeaMoney's future profit margin levels is expected to be somewhat cautious.

Effectioncy Goes First?

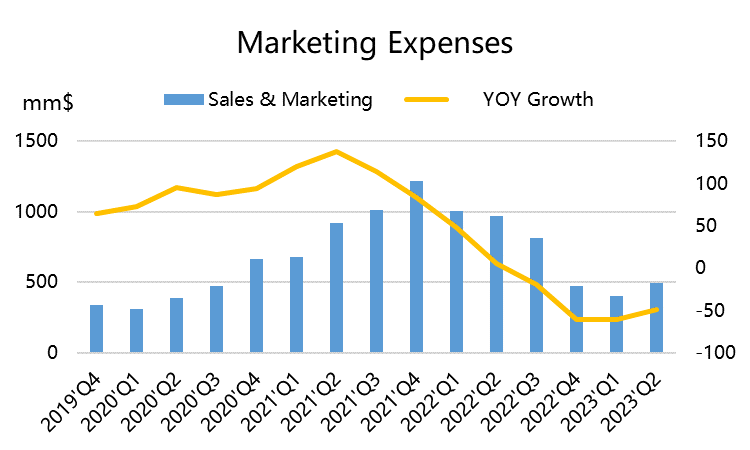

From the perspective of expense ratios, the company's marketing expenses for this quarter amount to $493 million, a 49% decrease year-on-year. However, this reduction is less significant compared to the over 60% declines in the previous two quarters, possibly due to pressures from the Shopee division.

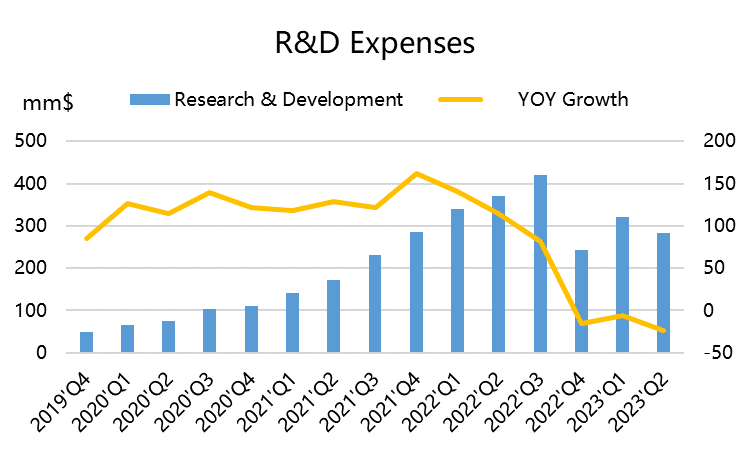

On the other hand, research and development expenses have decreased by 23.6% year-on-year, reflecting the company's significant workforce reduction efforts this year.

Valuation Down?

Due to anticipated poor management by the company, the market is unlikely to evaluate the company in an overly optimistic manner for the foreseeable future.

Valuation of the three business segments, assuming a very pessimistic outlook:

With Garena a multiple of 8 times EBITDA for 2023, Shopee a multiple of 5 times Gross Profit for 2023, and SeaMoney a multiple of 3.5 times Revenue.

Based on the 2023 market consensus, the overall valuation of Sea would be $60 per share, one-third lower than Bloomberg's target price of $92.

It appears that aside from enhancing operational efficiency, the management should also pay more attention to the company's valuation management.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

SEA PLUMMENTED DUE DISAPPOINTED EARNING

[Miser] [Cry] [Cry] [Cry] [Cry] [Cry] [Cry] [Cry] [Miser] [Miser] [Miser]

这篇文章不错,转发给大家看看

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

.